Key takeaways

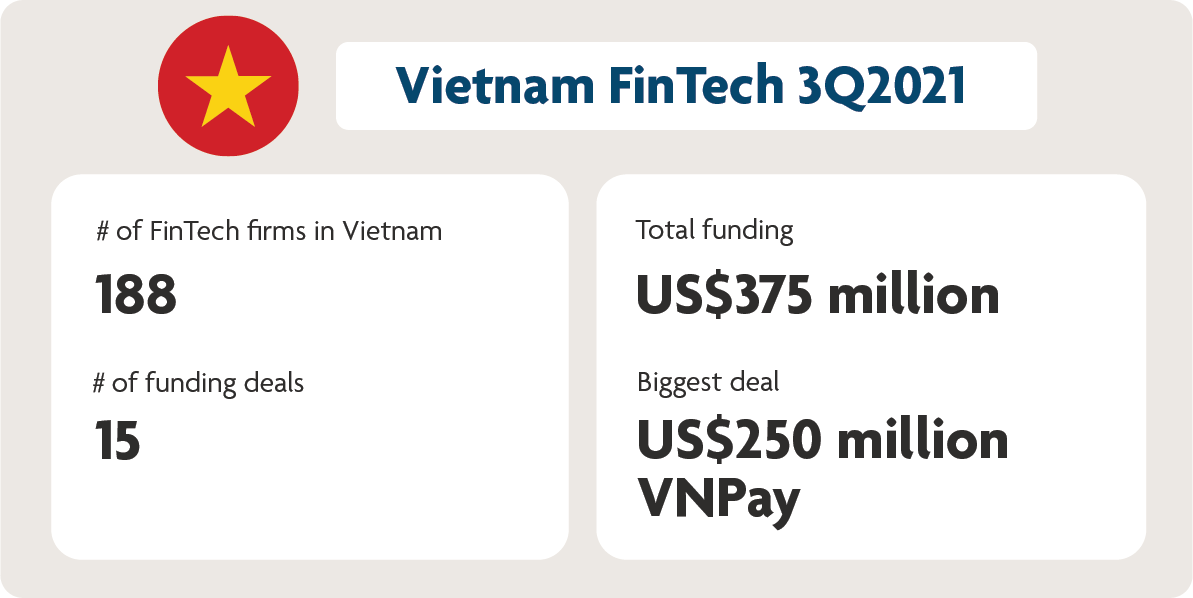

- In the first nine months of 2021 (3Q2021), Vietnam financial technology (FinTech) firms secured a total of US$375 million in funding across 15 deals1.

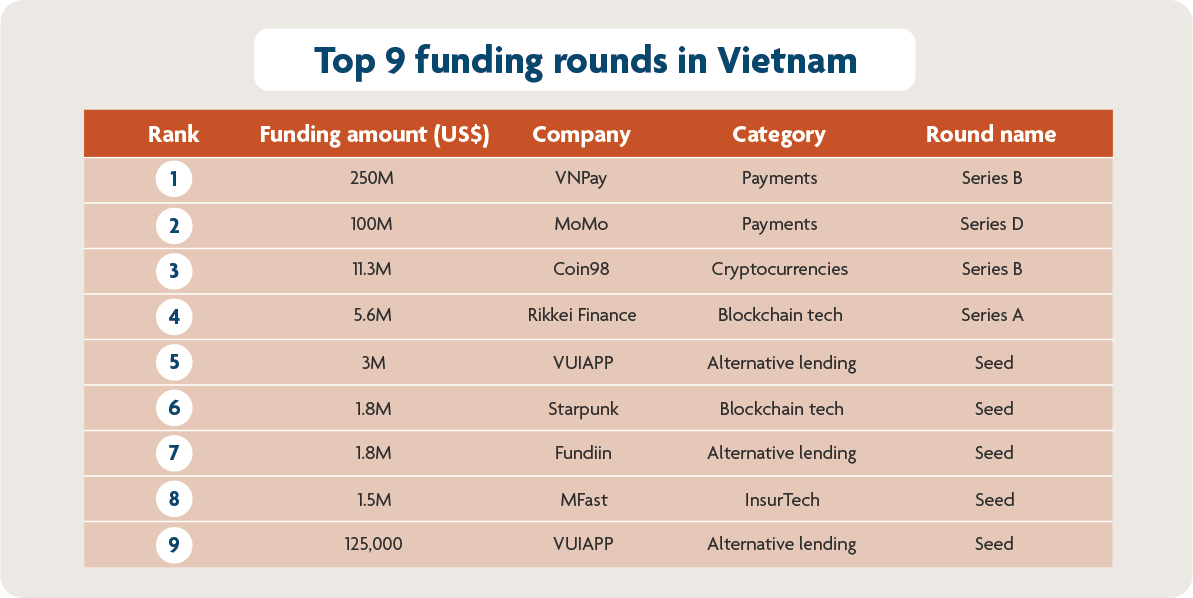

- The payments category took the lion’s share, led by VNPay and MoMo (US$250 million and US$100 million respectively). Cryptocurrencies, blockchain in financial services and alternative lending also enjoyed investor interest.

- Government regulation is becoming more supportive of FinTech, but overcrowding in the payments category may lead to consolidation.

Overview of FinTech funding in Vietnam

Vietnam’s FinTech industry is showing signs of recovery from the pandemic’s impacts, with payments firms leading the way. Here is a summary of funding activity up until the third quarter of 2021:

Figure 1: A summary of funding activity in Vietnam, 3Q2021. Source: Tracxn (last accessed 5 October 2021)

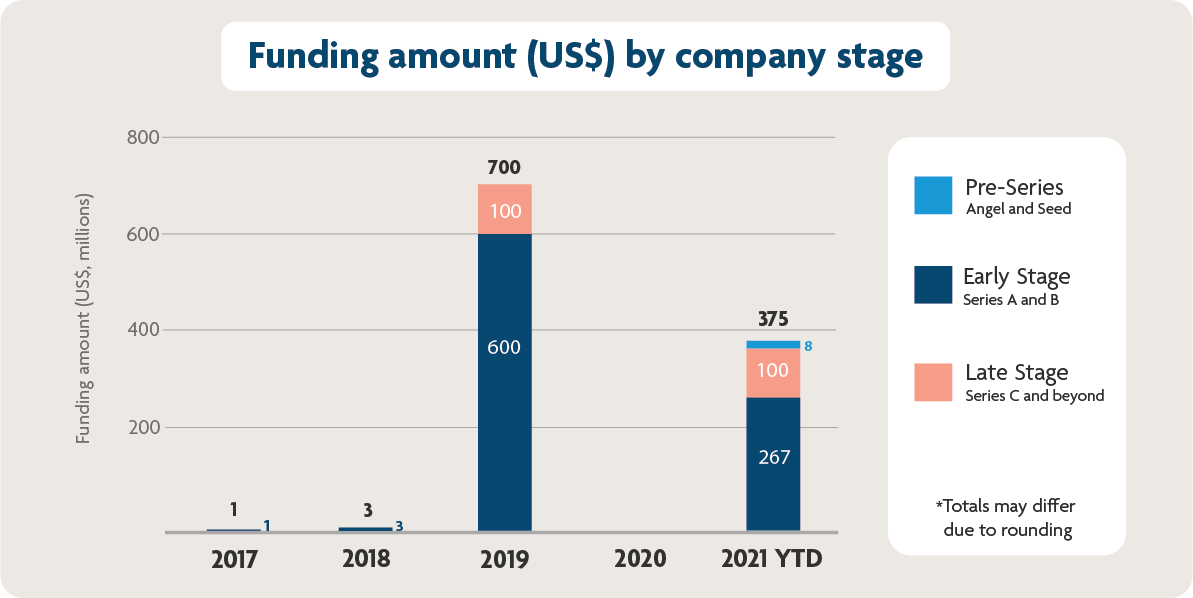

3Q2021 FinTech funding in Vietnam recovers from 2020 lows

In 3Q2021, Vietnam-based FinTech firms raised a total of US$375 million in funding through 15 deals—exceeding 2020’s total, but still below 2019’s US$402 million total.

With the exception of 2020, the number of deals in Vietnam has been increasing steadily since 2017.

Two-thirds of the rounds were in the Pre-Series stage, hinting at Vietnam’s still nascent FinTech scene. The biggest deal went to VNPay, with its Series B funding round representing more than half of total funds raised (in 2018, it raised another mammoth US$300 million round).

Payments firms get the lion’s share of FinTech funding

Apart from VNPay’s mega-round, e-wallet and digital payments firm MoMo closed a US$100 million Series D round. In 2019, MoMo raised a similarly sized Series C funding led by Warburg Pincus.

VNPay’s technology powers the mobile apps of 22 banks in Vietnam2 , including Vietcombank, Agribank, and VietinBank. It also runs QR code-based payment platform VNPay-QR, which serves 22 million users and more than 150,000 merchants.

Meanwhile, MoMo processes US$14 billion worth of transactions annually for more than 25 million users, and claims to cover 60 per cent of the country’s mobile payments market3.

Historically, the bulk of Vietnam FinTech investor dollars have gone to payments firms. The category raised US$3.3 million in 2017 and US$400 million in 2019—growth driven mainly by the country’s large tech-savvy user base, an increasingly inclusive regulatory environment, and an active investment and startup community4.

Vietnam also has the highest mobile penetration rate among the ASEAN-6 countries, with 158 per cent of the population5 having a mobile connection, increasing the potential market size for FinTech services.

Vietnam’s insurance scene gaining traction

Globally, the pandemic is expected to keep fostering insurtech solutions and other innovations in the industry.

3Q2021 saw insurtech raising its first-ever significant amount of funding in Vietnam. Founded in 2019, MFast has helped 600,000 customers to date—mostly from rural areas and remote provinces—access insurance and financial services through their mobile app.

The pandemic also accelerated the digitalisation of Vietnam’s insurance sector. Incumbents, local insurtech startups, and foreign insurtech firms are seizing growth opportunities online. Many offer services delivered via mobile apps, taking advantage of the country’s high mobile penetration.

Even established organisations, such as Post and Telecommunication Joint Stock Insurance Corporation (PTI), one of Vietnam’s top three non-life insurance companies, have ventured into mobile, forging partnerships with tech startups and developing new digital products.

FinTech trends and opportunities

COVID’s impact on Vietnam’s FinTech firms: a rapid shift to cashless

Before the pandemic, it had been difficult to convince consumers and merchants alike to go cashless. Small and microenterprises were unwilling to pay for transaction and mobile data fees, or invest in point-of-sale software, according to a 2019 Cimigo study. Additional barriers include a mature cash-on-delivery system that encourages people to keep using cash and the challenge of adopting new behaviours.

But 2020 saw a swift and substantial shift to cashless: according to the State Bank of Vietnam (SBV), the number and value of non-cash payments rose by 75 per cent and 30 per cent respectively compared to 2019, and a study by Visa conducted in August to September 2020 found that digital wallets, QR code payments, and mobile contactless methods led the growth of cashless payments.

Banks and the government are supporting this sprint towards digital. The National Payment Corporation of Vietnam (NAPAS) and 14 pioneering banks launched VietQR, a QR code-based payment and transfer service, in June 2021 to promote non-cash payments. Since 2020, NAPAS has been regularly cutting transaction fees to aid users affected by the pandemic and encourage non-cash payments. Many banks have followed suit because of a central bank directive requiring them to reduce fees by the same rate as NAPAS.

Cash remains king, however, and was still the most popular payment method in e-commerce and point-of-sale transactions in 2020, according to The Global Payments Report 2021.

Cashless transactions gained momentum in 2020, but cash remained the most popular e-commerce and point-of-sale payment method, the 2021 Global Payments Report found. Photo: Shutterstock

Cashless transactions gained momentum in 2020, but cash remained the most popular e-commerce and point-of-sale payment method, the 2021 Global Payments Report found. Photo: Shutterstock

Evolving, supportive regulatory environment

Vietnam’s FinTech regulation has historically been on the conservative side, but government aspirations to improve financial inclusion and create a cashless society spurred the development of a more inclusive regulatory framework in recent years.

In 2017, the State Bank of Vietnam (SBV) established the Steering Committee on Financial Technology to oversee all FinTech matters.

In February 2020, the Prime Minister ratified a five-year national financial inclusion strategy, which involves diversifying and widening the reach of financial services and products, reducing transaction fees, and upgrading financial infrastructures. Targets include having 80 per cent of adults have bank accounts by 2025 and increasing non-cash transactions by 20 to 25 per cent annually.

Currently, 70 per cent of adults in Vietnam have a bank account6, according to the SBV. Non-cash payments also continued to grow from 2020 to 20217, with online transactions growing 66 per cent in volume and 32 per cent in value; mobile payments rising by 86 per cent in volume and 123 per cent in value; and QR code payments going up by 96 per cent in volume and 182 per cent in value.

In September 2021, the Government approved a FinTech regulatory sandbox in the banking sector to help credit institutions, FinTech firms, and similar organisations test out products and services in a controlled environment. The Vietnam Investment Review reports that feedback from FinTechs has been positive, with some expecting the decree to give them a fair chance to develop their businesses.

Although these initiatives are steps in the right direction, the country’s overall regulatory framework needs further refinement and must expand to cover other FinTech categories. Currently, it still largely focuses on payments.

Crowded payments landscape could lead to consolidation

The rise of VNPay, MoMo, and other major players has toughened competition in the payments space. The Government’s Mobile Money pilot project, which lets telecommunications companies, such as Viettel and MobiFone, enter the e-payment category to serve the country’s unbanked, is likewise contributing to market saturation. To date, the SBV has granted a total of 46 licences to non-bank institutions providing payment intermediary services.

As a result, local firms will compete not just with homegrown and overseas FinTechs, such as Grab and Sea, but also with local banks and telcos that may roll out similar services.

Given the many competing players, consolidation is likely. Grab and Moca’s strategic partnership, announced in 2018, is indicative of this. Other players are coming together: payments startups Vimo Technology and Vietnam MPOS Technology merged to form NextPay in 2019; BC Card, South Korea’s biggest payment processing company, acquired Wirecard Vietnam in 2020.

“The market may eventually consolidate into two or three players… But the investors behind them have very deep pockets. As long as the money keeps flowing in, many companies can coexist," said Takahiro Suzuki, managing partner at Genesia Ventures, in an interview with Nikkei Asia.

Fertile ground for FinTech

A sizable mobile-first, unbanked population in a country with gradually maturing regulations are positive factors supporting the growth of FinTech firms in Vietnam. The pandemic-triggered rapid digitalisation of financial services may open up even more opportunities in this space.

Competition, however, is ramping up between local FinTech firms, companies from overseas, and local banks and telcos. As such, consolidation is likely.

To learn more about ASEAN’s bustling FinTech landscape, check out our FinTech in ASEAN 2021: Digital Takes Flight report.

You can also read our previous reports, FinTech in ASEAN: Get Up, Reset, Go! (2020) and FinTech in ASEAN: From Start-up to Scale-up (2019).

1Out of the 15 deals, the amounts raised for six deals—five of which were in the seed stage—were undisclosed.

2VNPay raises $250 mln in series B funding, VNExpress article, 5 August 2021

3Vietnam emerges as Southeast Asia's next fintech battleground, NikkeiAsia article, 6 August 2021

4Unlocking Vietnam's FinTech potential, YCP Solidiance whitepaper, June 2020

5Digital 2020: Vietnam report by We Are Social and Hootsuite, 11 February 2021

6Government wants every Vietnamese to have a bank account, Vietnam Economic News article, 23 October 2020

7Operating monetary policy proactively and flexibly, contributing to economic recovery, The State Bank of Vietnam website, 24 June 2021