Key takeaways

- Six funding deals were recorded for Thai financial technology (FinTech) firms as of the third quarter of 2021 (3Q2021). Thai startup Ascend Money raised US$150 million, while InsurTech (insurance technology) startup Sunday raised US$45 million in a Series B round.

- COVID-19's effects on society have led to a growth in digital payments, compelling incumbent banks to speed up their digitalisation plans while creating opportunities for FinTech firms to innovate.

- Thailand has yet to flesh out its digital banking roadmap and proposed licensing regimen, but its central bank digital currency (CBDC) pilot project, Project Inthanon, is in advanced stages of development, while its e-payment system (PromptPay) is widely used.

- While Thailand does not yet consider cryptocurrencies as legal tender, there are signs this may change. The Tourism Authority of Thailand (TAT) recently announced that it is working with regulators and leading crypto exchange Bitkub to enable the acceptance of cryptocurrencies from travellers, in a bid to draw in newly minted crypto millionaires.

Overview of FinTech funding in Thailand

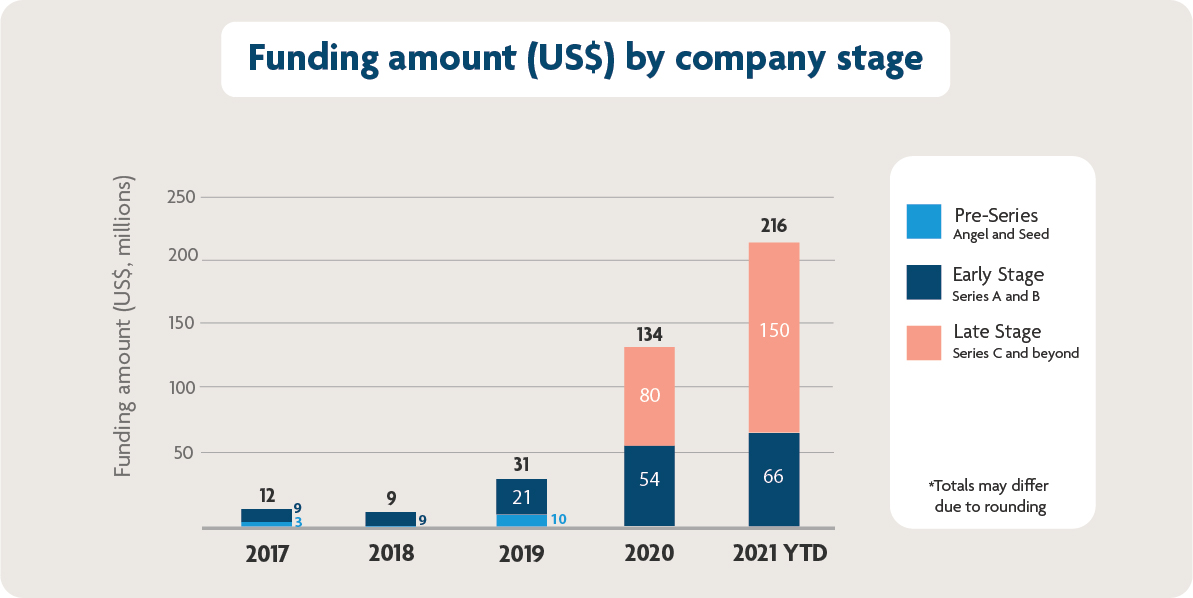

While Thailand's FinTech industry saw subdued investor activity relative to the rest of the region, six deals up until 3Q2021 signalled some growth in the InsurTech and wealth management categories.

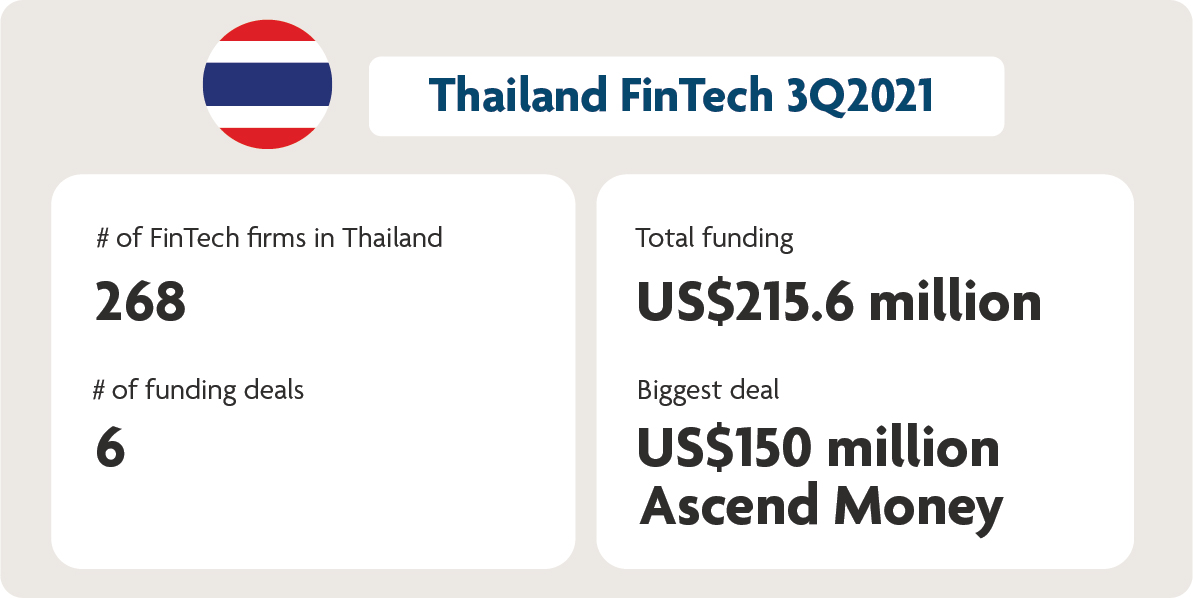

Figure 1: A summary of funding activity in Thailand, 3Q2021. Source: Tracxn (last accessed 5 Oct 2021)

Six deals for Thai FinTech firms as of 3Q2021

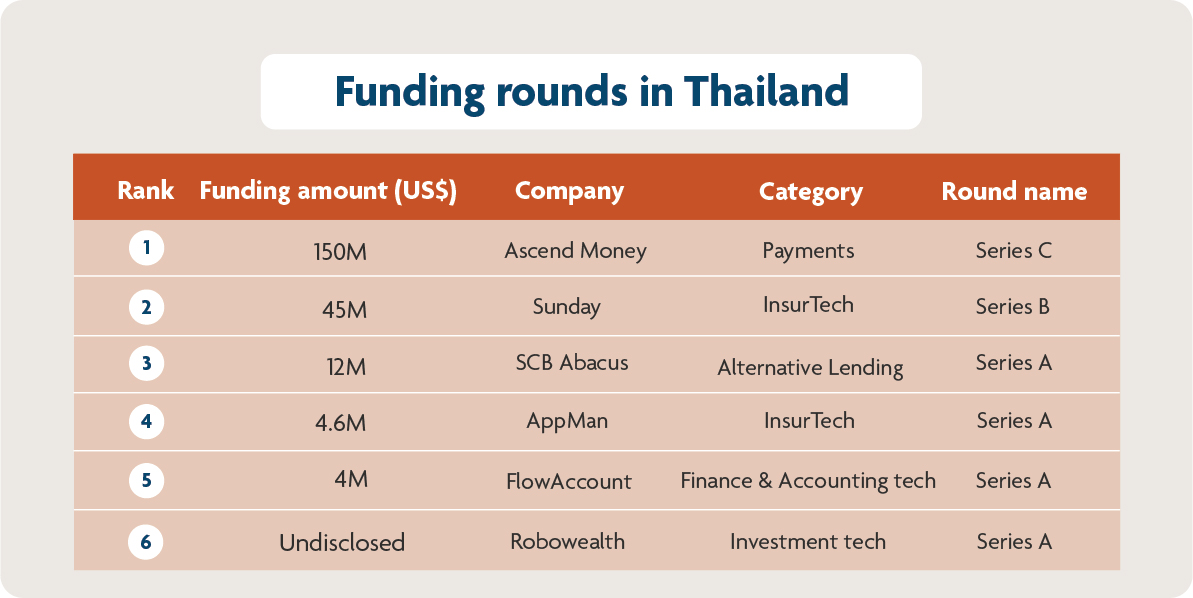

2021 saw six deals finalised in Thailand as of 3Q2021. These are the three biggest fundraising rounds in the first nine months of the year:

- Ascend Money, the FinTech startup behind e-wallet service TrueMoney, raised US$150 million in a Series C round at a valuation of US$1.5 billion.

- InsurTech startup Sunday raised US$45 million in an oversubscribed Series B round. The deal comes on the heels of a steadily growing insurance market in Thailand, with annual gross written premiums expected to reach THB 285.5 billion (US$8.7 billion) by 2023.

- Alternative digital lending platform SCB Abacus raised US$12 million in an oversubscribed Series A funding round led by Openspace Ventures.

The year's total funding for Thai FinTech firms as of 3Q2021 reached US$215.6 million – a significant improvement over 2020's US$134 million take.

Access to institutional support influencing Thai FinTech growth

Major banks in Thailand have embraced the FinTech industry, to the point of dominating the sector completely.

The country's established commercial banks have "either developed their own digital financial services capabilities in-house or acquired those capabilities from other firms, [potentially crowding out] independent FinTech firms," the World Bank's Thailand Economic Monitor puts it. "Collaboration between banks and FinTech firms is largely limited to firms that are bank subsidiaries or in which banks have an equity stake."

For example, Siam Commercial Bank–the nation's oldest bank–took a 51 per cent stake1 in leading crypto exchange Bitkub Online in November. The deal values Bitkub at 35 billion baht (US$1.05 billion), making it a unicorn. According to Bitkub Capital Group founder and CEO Jirayut Srupsrisopa, the company is "no longer just a startup and is now becoming a necessary part of the infrastructure critical for Thailand's financial industry".

Many Thailand FinTech firms are being funded by venture capital firms that are extensions of long-established local banks. Photo: David Egon/Pexels

FinTech trends and opportunities in Thailand

COVID-19's impact on FinTech firms

The economic turmoil brought about by the impact of COVID-19 rocked all sectors of society in Thailand, as a drastic reduction in tourism revenue from US$117.5 billion in 2019 to US$24.5 billion in 2020 caused a contraction of the economy by five per cent in 2020.

Yet the crisis has also introduced new opportunities for FinTech firms. Social distancing, lockdowns, and temporary bank branch closures have changed consumer behaviour, spurring FinTech firms to innovate. According to the e-Conomy SEA 2021 report, nine out of 10 internet users in Thailand have made at least one purchase online. The country's internet economy is now worth US$30 billion, up 51 per cent from 2020. To encourage people to go digital, pandemic relief programmes were paid out through online payments platforms like e-wallet Pao Tang.

Thailand's leading digital payment method is TrueMoney, an e-wallet backed by the True Digital group which provides a broad range of financial services. A 2020 Rapyd study found that 66 per cent of respondents reported using it regularly, with seven per cent choosing it over other payment methods.

Roadmap required for digital banks

Work needs to be done on Thailand's nascent landscape for digital banks, as the country's central bank, Bank of Thailand (BOT), has yet to outline a concrete digital banking roadmap and a proposed licensing regimen. In early 2020, Ronadol Numnonda, BOT deputy governor said that "digital banks are an option," and promised "a comprehensive study" of the way forward for licensing2.

At the moment, no neobanks have announced an intention to launch in Thailand. Incumbent banks, on the other hand, have proceeded with launching their own digital banking services.

UOB launched its TMRW digital bank in Thailand in 2019, tripling its customer base in just six months. TMRW considers customer engagement as its key measure of success. Customer engagement quadrupled in TMRW's first year of operations, with more than two-thirds of new users referred by satisfied customers.

UOB launched its digital bank, TMRW, in Thailand in 2019. Image: TMRW

Meanwhile, Kasikornbank and messaging platform LINE have collaborated to form LINE BK, a "social banking service" that accumulated over two million users within four months of its Thailand debut in October 2020. The service is also pioneering 'nano loans' that provides credit access for borrowers with a minimum income of 5,000 baht per month, addressing concerns about financial inclusion.

Project Inthanon – Thailand's CBDC

CBDCs represent one area where Thailand has advanced further relative to the regional status quo.

Project Inthanon, Bank of Thailand's CBDC project, is intended as a proof-of-concept for digital currency-based fund transfers using distributed ledger technology. Having passed two phases testing basic payment functionality, Project Inthanon is presently at phase three, which tests joint payment systems with commercial banks and businesses. Phase four will expand payments to retailers by the second quarter of 2022.

Cross-border transfer prototypes have also been initiated, first in collaboration with the Hong Kong Monetary Authority and expanding in scope to include the Central Bank of the United Arab Emirates (UAE) and the Digital Currency Institute of People's Bank of China in February 2021. Future Thai FinTech firms may benefit from widespread adoption of CBDCs in Thailand, with their concomitant speed, security, and traceability enhancing FinTech firms' service delivery.

Evolving views on digital assets

In July 2021, BOT published guidelines covering blockchain technology in the financial sector. Citing blockchain's "robust potential in providing increased efficiency, transparency and interoperability across industries" and the need to "increase people's confidence" in using "blockchain-backed financial services," the BOT proposed the guidelines to help regulate blockchain technology adoption by FinTech firms and other financial services providers.

Most recently, the Tourism Authority of Thailand (TAT) announced that it is working with regulators and leading crypto exchange Bitkub to enable the acceptance of cryptocurrencies for inbound travellers, in a bid to draw in newly minted crypto millionaires. This is expected to be ready "by the time global travel returns to normal", according to TAT's Governor Yuthasak Supasorn.

Despite these positive moves, the crypto sector experienced a few setbacks. Thai regulators still do not treat digital assets as legitimate means for payments for goods and services.

In May 2021, Thailand's Anti-Money Laundering Office began requiring face-to-face Know Your Customer procedures to open new crypto accounts3. The Thai Securities and Exchange Commission (SEC) also announced it would transfer oversight of initial coin offerings for investment and utility tokens to the Securities Act4. This move aligns Thailand's regulations on digital assets trading with international standards and offers an added degree of supervision over assets being increasingly traded by young, inexperienced investors.

The SEC also issued a criminal complaint against crypto exchange Binance in July, for operating a digital asset business without a licence.

National PromptPay e-payment system

Uptake of Thailand's e-payment system PromptPay has accelerated as a result of the present disruption – its facilitation of cashless, contactless transactions has eased financial interactions hampered by social distancing measures.

"Amid the COVID-19 pandemic, PromptPay has enabled online business and personal transactions to thrive," said BOT Governor Sethaput Suthiwartnarueput. "The number of PromptPay users has grown rapidly to 56 million. Government agencies have also utilised the system to provide social transfers directly to Thai citizens during the crisis."

As of May 2021, the number of transactions over PromptPay averaged 23 million per day, up from 13 million daily in the same month in 2020, according to BOT statistics; the figure has risen to 28 million daily transactions as of October 20215.

In April 2021, PromptPay and Singapore's PayNow real-time retail payment systems announced a linkage that would allow cross-border transactions with the same level of ease as domestic ones. (UOB is one of three pioneering Singapore banks participating in this scheme.)

PromptPay access is open only to established banks, or mediated through them. While the service is technically open to both banks and non-banks, a BoT spokesperson specified that "[entities] joining PromptPay [are] required to meet the high technical/security and regulatory requirements," noting that non-banks (including independent FinTechs) may partner with a sponsoring bank to join the service.

Well on the way to Thailand 4.0

The nationwide shift to a digital economy requires solid government support. Since 2016, government sponsorship of the digital economy in Thailand has been guided by Thailand 4.0, its 20-year roadmap towards a "value-based and innovation-driven economy". Digital businesses (including FinTech firms) are part of the 10 industries being targeted by Thailand 4.0.

To help attract investment in these future industries, the Thai Government has also been building a legal framework for Thailand 4.0. The latest building block in this framework, the Personal Data Protection Act (PDPA), was gazetted on 27 May 2019 and slated for full effect by June 2021, but enforcement has been delayed a full year to ensure wider compliance. Without the full implementation of the PDPA, FinTechs will lack clear direction on compliance measures and collection and use of personal data.

Thailand's FinTech industry is expected to make further inroads in the immediate future, with digital payments leading the growth; FinTechs gaining broader acceptance as consumer behaviour changes; and Thailand 4.0 guiding the nation to a cashless, digitalised new status quo. These portents of financial change may create more fertile ground for Thai FinTech activity in the near future.

For more insights on ASEAN's growing FinTech industry, check out UOB's FinTech in ASEAN 2021: Digital takes flight report.

You can also get up to speed on the FinTech landscape by reading our previous reports, FinTech in ASEAN: Get Up, Reset, Go! (2020) and FinTech in ASEAN: From Start-up to Scale-up (2019).

1Thailand's oldest bank takes 51% stake in crypto exchange, Nikkei Asia article, 5 November 2021.

2Bank of Thailand considering licences for digital-only banks, Bangkok Post article, 27 January 2020

3ID check required for new crypto accounts, Bangkok Post article, 3 May 2021

4Regulator to shift oversight of ICOs to Securities Act, Bangkok Post article, 9 February 2021

5Digital payments surge from pre-coronavirus level, Bangkok Post article, 11 October 2021