Key takeaways

- Total funding for financial technology (FinTech) firms in the Philippines for the first half of 2021 (1H2021) reached US$342 million, more than double 2020’s total of US$137 million.

- Total funding in 1H2021 came from three deals in the payments category, two of which made the top three deals in ASEAN-61.

- FinTech firms are tapping an unaddressed opportunity by incumbent banks and financial institutions to help increase financial inclusion in the Philippines.

- Philippines’ central bank Bangko Sentral ng Pilipinas (BSP) is exploring the possibility of a central bank digital currency (CBDC), but are not planning to rush its development.

Overview of FinTech funding in the Philippines

The Philippines’ FinTech industry saw encouraging growth in consumer interest and investor activity in 1H2021. In particular, the payments category performed strongly due to several drivers, such as the pandemic-led shift to digital and government initiatives to improve financial inclusion.

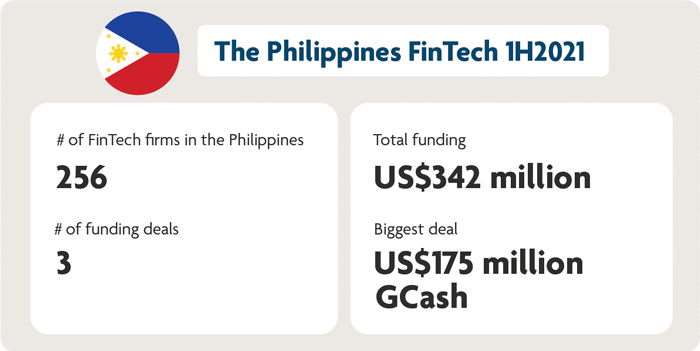

Here is a summary of the first half of 2021 for the Philippines’ FinTech industry:

Figure 1: A summary of funding activity in the Philippines, 1H2021. Source: Tracxn (last accessed 2 July 2021)

2021: Three funding rounds beat 2020’s total

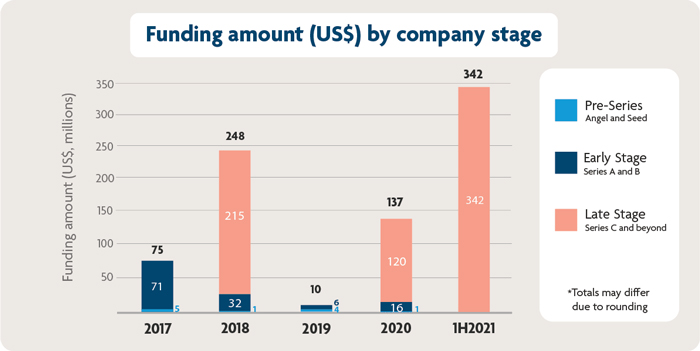

Total funding for Philippine FinTech firms in 1H2021 hit US$342 million—all in the digital payments category, achieving more than double of 2020’s six funding rounds of US$137 million. The Philippines ranks third in ASEAN-6 FinTech funding, below Indonesia and Singapore, and contributes to what is already the biggest-funded year for FinTech firms in the region.

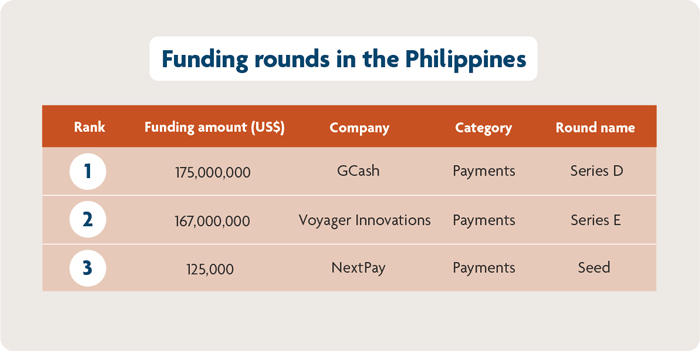

Only three companies made up the total funding activity for Philippine FinTech firms in 1H2021. Rivals GCash and Voyager Innovations raised US$175 million in a Series D funding round and US$167 million in a series E round, respectively. Each company represents one-half of the Philippines’ dominant telecommunications duopoly: Globe Telecoms for GCash, and PLDT Inc. for Voyager Innovations. NextPay places a distant third in the funding list, having secured US$125,000 in pre-seed funding from seed accelerator Y Combinator.

GCash and Voyager Innovations’ fundraising in 1H2021 made the top three FinTech deals in ASEAN-6 countries. Their respective funding amounts were only exceeded by the US$300 million Series A funding round of Grab Financial Group, a subsidiary of ride-hailing and delivery conglomerate Grab.

Why payments dominates Philippine FinTech funding activity

Payments’ dominance in the Philippines’ FinTech funding activities is a continuation of the funding trend seen in 2020, where five out of six deals for the year were in the payments category.

A contributing factor to this growth could be due to the country’s digital savviness. Internet penetration in the Philippines stood at 67 per cent as of January 2021. The Philippines also has one of the highest levels of internet usage in Asia, with an average of 10 hours and 56 minutes a day spent online.

Filipinos are also accustomed to receiving money via remittance services from overseas worker relatives. Around 10 million Filipinos live and work overseas, making the country Asia’s third largest recipient of remittances, after India and China. Remittances have grown steadily since the turn of the millennium, from US$7 billion in 2000 to US$35 billion in 2019, with a slight dip in 2020 as overseas workers who lost jobs in the pandemic returned home.

While Filipinos are digitally savvy and accustomed to payments, financial inclusion in the Philippines continues to remain low, as more than 70 per cent of the Philippines’ adult population remain unbanked as of 2019. A recent Moody’s report2 suggests that FinTech firms in payments are using these conditions to reach the country’s unbanked, while established financial institutions focus “mostly on the corporate segment and to some extent, the more affluent retail segment.”

Philippines FinTech trends and opportunities

COVID-19 catalysing payment services and outreach to unbanked

As COVID-19 precipitated a series of lockdowns throughout the Philippines, FinTech firms have stepped up to address payment transactions that could not be done in person.

The use of digital-only transactions grew as more Filipinos were forced to adapt. Payments provider GCash reported an eightfold increase3 in 2020’s transaction value compared with the same period in 2019, processing PHP1 trillion (US$19.8 billion) in transactions throughout the year. The surge in adoption and usage of GCash’s solution led it to increase wallet limits4 to PHP500,000 (US$9,920). A 2020 Visa study reported that the majority of first-time digital payments in the Philippines were made for food and groceries, bill payments and pharmaceutical products.

The unbanked population have been a particular focus of GCash and Voyager Innovations’ payments platform, PayMaya, both of which lead the Philippine mobile wallet market with 40 million5 and 38 million6 users respectively.

According to Voyager Innovations, its most recent influx of funds will go to expanding services for the unbanked through PayMaya, its remittance service Smart Padala, and its nascent digital bank Maya Bank. PayMaya reports that its 250,000 access touchpoints already outnumber the country’s ATMs and bank branches seven to one, catering to the unbanked even in remote parts of the country that lack any banking presence.

As of January 2021, PayMaya expanded from payments to lending and insurance, with ‘sachet’ loans for micro-, small- and medium-sized enterprises, and PayMaya Protect that covers COVID-19, personal accidents, and even mobile device coverage for less than PHP1 (US$0.02).

Government-sponsored efforts to promote digital payments have likewise increased significantly during the numerous community quarantines of 2020 and 2021.

Official COVID-19 relief programs have helped boost awareness and use of digital payments among unbanked Filipinos. The second tranche of the Government’s Social Amelioration Program was disbursed primarily through almost 10 million newly created bank accounts, significantly boosting financial inclusion in 2020.

Government-sanctioned electronic payment channels also saw a phenomenal increase in uptake.

QR PH, the national QR code standard that governs transfers between banks and e-wallets in the Philippines, saw the value of QR payments between individuals increase to PHP974.2 million7 (US$19.3 million) as of May 2021 from only PHP1.04 million (US$20,654) in November 2019.

PESONet and InstaPay, the BSP’s automated clearinghouse frameworks, also reported rapid growth in the wake of the pandemic.

According to BSP Governor Diokno, PESONet’s volume of transfers surged 376 per cent to 15.3 million transactions, with transaction values reaching PHP951.6 billion (US$18.9 billion). InstaPay’s transfer volume surged 459 per cent to 86.7 million transactions, with transaction values of PHP463.4 billion (US$9.2 billion).

Demand for coins in 2020 subsequently dropped by 57 per cent in volume and 60 per cent in value compared with 2019. “More accessible and more convenient e-payment options may have partly contributed to the decline, aside from softer economic activities during the said period,” explained Diokno.

Filipino FinTech firms are catering to the country’s unbanked population. Photo: Brian Evans (CC BY-ND 2.0)/Flickr

Filipino FinTech firms are catering to the country’s unbanked population. Photo: Brian Evans (CC BY-ND 2.0)/Flickr

Arrival of digital banks

In the BSP’s latest financial inclusion study, in 2019, 31 per cent of cities and municipalities in the Philippines lacked both banks and micro-banking offices. These structural obstacles to financial inclusion, which perpetuate the country’s persistently low financial inclusion levels, may finally be addressed with the advent of digital banks in the Philippines.

“Digital banks can help reduce the barriers that hinder financial access, such as the small and irregular income of clients, high transaction costs, geographical distance, and lack of proper documentation,” explained the BSP’s Deputy Governor Chuchi Fonacier.

"The BSP sees digital banks as future partners in advancing financial inclusion in the country by leveraging on digital technology to offer financial products and services that bridge the market gaps in the unserved and underserved segments," Fonacier added.

As of September 2021, six digital banks have been approved by the BSP—the Overseas Filipino Bank (OFB) in March 2021, a subsidiary of the government-owned Land Bank of the Philippines; Tonik Digital Bank and UNObank in June 2021; Union Digital Bank in July 2021; GoTyme in August 2021; and Voyager Innovations’ Maya Bank in September 2021.

However, the BSP stopped accepting new applications for digital banking licenses from 1 September 2021, beginning a three-year moratorium that will allow the central bank to monitor the nascent industry’s performance.

Digital assets and tokens making steady gains

While cryptocurrency is arguably far from mainstream in the Philippines, test cases by FinTech firms have increased its visibility and encouraged greater adoption by a wider range of users.

Virtual currency exchanges (VCEs) must be officially registered as remittance and transfer companies. As at March 2021, there were 17 BSP-registered VCEs8; their recorded transaction value amounted to PHP101.6 billion (US$2 billion) in 2020, up from PHP20.9 billion (US$415.6 million) in 20199. Transaction volumes doubled to 12.2 million in 2020, up from 6.6 million in 2019.

The BSP itself has completed a study exploring the creation of a central bank digital currency (CBDC), but BSP Governor, Benjamin Diokno expressed a preference for not rushing its actual development, foreseeing its introduction happening beyond his current term, which expires in 2023.

BSP’s study instead recommended continuing research, capacity-building and building networks with like-minded central banks and institutions. “The initiative is aimed at enabling the BSP to keep pace with, and to enhance its readiness to adjust and evolve amid rapid technological developments,” Diokno said.

BSP Governor Benjamin Diokno. Photo: World Bank Photo Collection/Flickr

BSP Governor Benjamin Diokno. Photo: World Bank Photo Collection/Flickr

Strong government support

Government support for Philippines FinTechs

BSP Governor Diokno foresees the Philippines’ economy “transitioning from cash-heavy to a cash-light environment by 2025—eventually to a coin-less and cashless society.” To that end, the BSP has championed the ‘Digital Payments Transformation Roadmap Roadmap to 2023’, a regulatory framework for digital payments in the Philippines.

The Roadmap’s goals include the conversion of 50 per cent of retail payments’ total volume into digital form and the creation of more innovative FinTech solutions that meet the Filipino market’s unique needs.

To serve the unbanked population, the Roadmap plans to lower barriers to the formal financial system, raising financial inclusion levels to 70 per cent of the Filipino population. (Digital banks and e-wallets can serve as onboarding mechanisms.)

The BSP has complemented the Roadmap with regulatory initiatives on FinTechs, including the following in 1H2021:

- A Memorandum of Agreement on FinTech Oversight signed with the Philippines’ Securities and Exchange Commission, Insurance Commission, and Philippine Deposit Insurance Corporation. This may serve as the basis for a new inter-agency body overseeing FinTech firms.

- Guidelines for virtual asset service providers that cover new business models and activities, including cryptocurrency. The new rules are seen to help increase consumer confidence in the local cryptocurrency market, spurring growth.

The acceleration of FinTech in the Philippines is already under way, with digital solutions for the unbanked providing key opportunities for expansion. With the rise of online payment channels, cryptocurrency and digital banks, and a clear roadmap to a cashless society ahead, the Philippines looks set to improve its financial inclusion standings.

For more insights on ASEAN’s growing FinTech industry, check out UOB’s FinTech in ASEAN 2021: Digital takes flight report.

You can also get up to speed on the FinTech landscape by reading our previous reports, FinTech in ASEAN: Get Up, Reset, Go! (2020) and FinTech in ASEAN: From Start-up to Scale-up (2019).

1The ASEAN-6 consists of Indonesia, Malaysia, Singapore, Thailand, the Philippines, and Vietnam.

2Research Announcement: Moody’s – Fintech companies can overtake incumbent Philippine banks in retail services, Moody’s Investors Service, 15 July 2021.

3Digital payment grows in Philippines amid COVID-19 fears, Nikkei Asia article, 19 July 2021.

4GCash hikes wallet limit, The Philippine Star article, 27 June 2021.

5GCash doubles user base to 40 million in one year, Manila Bulletin article, 28 May 2021.

6Smart partners with PayMaya for ‘seamless payments’ on telco’s app, ABS-CBN News article, 21 July 2021.

7QR code transactions near P1 billion, The Philippine Star article, 27 June 2021.

8BSP sees further rise in cryptocurrency transactions, The Philippine Star article, 1 March 2021.

9Virtual currency transactions hit P100 billion in 2020, The Philippine Star article, 24 May 2021.