Key takeaways

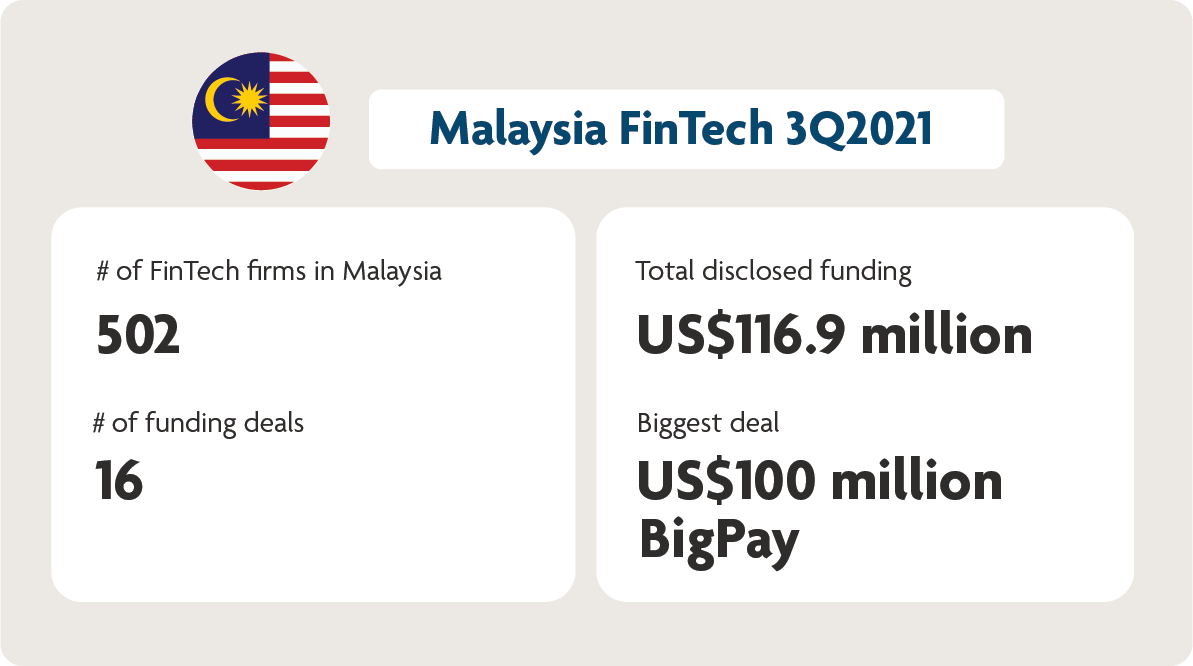

- Malaysian financial technology (FinTech) startups raised US$116.9 million across 16 funding rounds1 up until the third quarter of 2021 (3Q2021).

- Payments FinTechs raised five of the 16 rounds, including BigPay’s US$100 million raise, one of the largest for a Malaysian startup to date.

- The growth of FinTech is expected to help meet the needs of underserved Malaysian consumers, particularly in the lending and insurance sectors.

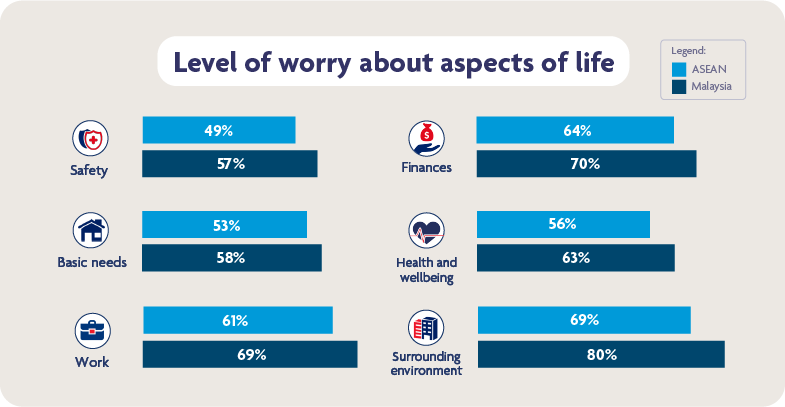

- A UOB survey found that within ASEAN, Malaysians are the most anxious about work, finances, health and their environment; earning and maintaining their trust is important for businesses to succeed.

- Malaysian regulators are eager to work with FinTechs, and have announced development funds, stimulus packages and regulations to support young businesses.

Overview of FinTech funding in Malaysia

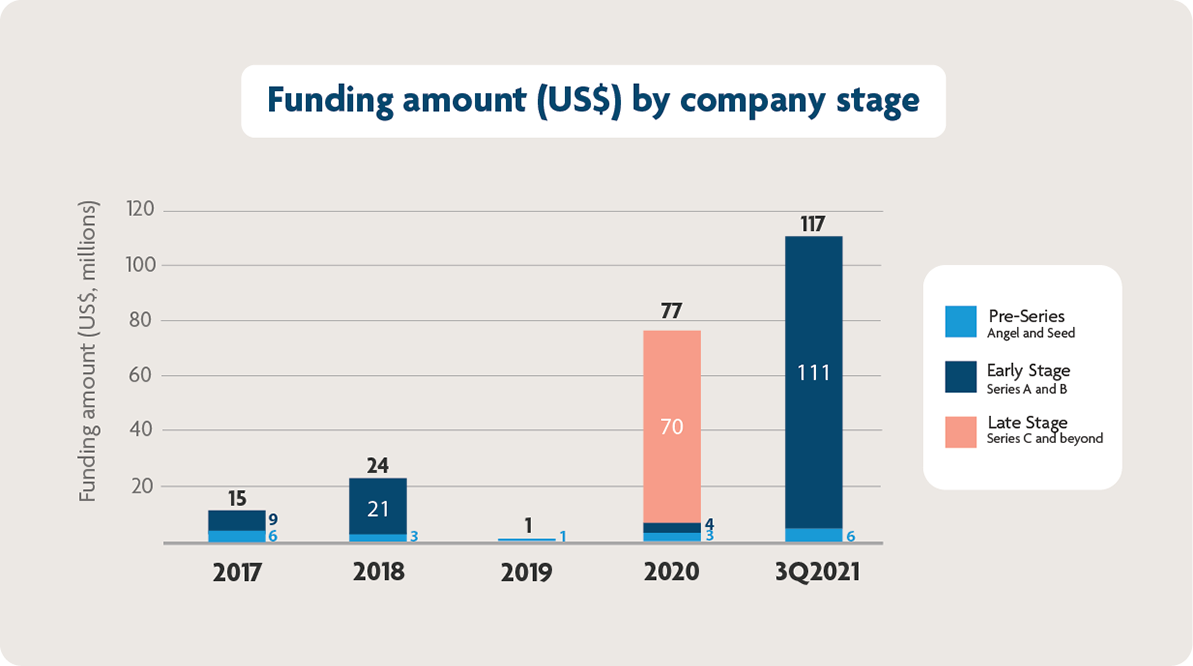

Malaysia’s FinTech industry saw sustained consumer interest and investor activity up to 3Q2021. Here is a summary of Malaysia’s FinTech funding scene for the first three quarters of 2021:

Figure 1: A summary of funding activity in Malaysia, up to 3Q2021. Source: Tracxn (last accessed 6 Oct 2021)

Renewed interest in payments startups

Digital banking app BigPay raised a significant US$100 million Series A round in August 2021. This raise was not only the largest in Malaysia, but the 11th largest round (of over 100) across Southeast Asia. Aside from BigPay’s large Series A round, payments startups MoneyMatch, Tranglo, and TNG Digital also raised undisclosed funding amounts in 20212.

Alternative lending firms are seeing greater momentum

Alternative lending firms saw consistent interest in 2021. The largest round in this category was a US$3 million raise by peer-to-peer business loan platform Microleap, whereas Islamic equity crowdfunding platform Ethis raised US$1.6 million. They were joined by two startups, pitchIN and Finology, that raised smaller pre-series rounds.

Bank Negara Malaysia (BNM), Malaysia’s central bank, credits the expansion of alternative finance to changing demand drivers and a shift towards a more comprehensive, knowledge-based and tech-led approach to lending. Many stand to benefit from alternative lending innovation from FinTechs; Malaysian SMEs, micro-SMEs, and significant amounts of the population lack access to traditional financing options. Alternative lending FinTechs use different sources of data (such as e-commerce purchase activity, supply chain contracts and invoices, or online Gig performance) to offer affordable loans, effectively broadening the financial sector and reducing the proportion of underserved borrowers.

InsurTech firms enjoy sustained growth

InsurTech company PolicyStreet raised Malaysia’s second-largest disclosed round this year with fresh funding of US$6 million. InsurTech firms in Malaysia can benefit through the application of nascent technology such as artificial intelligence (AI) matching and big data analytics. Such data-driven innovations enable InsurTech firms to provide customers with intelligent recommendations tailored to their lifestyle and habits. They can also help companies develop and deliver smarter microinsurance options at critical times, benefiting lower-income communities who cannot afford annual policies3.

Another strategy for growth by InsurTech startups is to partner with industry incumbents, rather than competing directly with them. Karen Puah, President at FinTech Association of Malaysia, explains, “While FinTech startups may have top-notch technology, people and products, their journey typically starts with a trust deficit. In such a situation, you’d need to spend heavily on branding and marketing to get attention. But by going the collaborative route with bigger companies that are already trusted by consumers, it’s easier to drive adoption.”

Such partnerships allow each party to focus on what they do best and, together, democratise access to insurance.

FinTech trends and opportunities

Malaysian regulators are eager to build a more connected ecosystem

The Malaysian Government has demonstrated clear efforts to transition to a digital economy. The eTunai and ePenjana programmes, which started in 2020 during the pandemic, saw the Government distributing digital cash (MYR30–50 each) to users via e-wallets such as Boost, Touch ’n Go and Grab, driving the adoption of digital payments.

The three e-wallets featured in the Malaysian Government’s eTunai and ePenjana digital cash disbursement programmes, as captured on a smartphone screen. Photo: Lennie Chan

The InvestKL initiative, founded in 2011, has recently ramped up efforts to present Malaysia as an attractive hub for multinational corporations (MNCs), highlighting the common use of English, wealth of tech talent, and long history of cooperation with large tech companies like Dell, HP and Motorola.

Puah believes that, as Malaysian regulators sharpen their branding and outreach, FinTech startups will begin to consider basing their operations in Malaysia rather than another ASEAN country.

Digital banks can be a solution for underserved populations

The unbanked population is relatively small in Malaysia, explains Puah, and regulators see digital banks as a solution to more adequately serve certain segments that cannot access traditional banking products and services. One of BNM’s requirements for the digital banking licence was the submission of the applicant’s market study of underserved and unserved segments like the bottom 40 per cent in society (B40 segment). BNM ultimately received 29 applications for five digital banking licenses4 in 1H2021.

Challenger digital-only banks have a unique opportunity to serve SMEs, micro-SMEs and their employees. For example: Gig workers may have issues receiving financing from a traditional bank, but a challenger digital bank could leverage the insights of ride-sharing service providers, which would have their own libraries of data on drivers that include information such as individual earnings and performance. Newer digital banks can use these insights to create relevant services, such as alternative funding and credit scoring or micro-investments.

Malaysian consumers are driven by a need for trust

Figure 2: Compared with the rest of ASEAN, Malaysians are the most worried about various aspects of life. Source: UOB ASEAN Consumer Sentiment Survey 2021

According to UOB’s ASEAN Consumer Sentiment Survey from August 20215, Malaysians are the most anxious about work, finances, health and wellbeing, and the surrounding environment among five ASEAN populaces. The country also has a history of consumer apprehension about financial instruments; Malaysian trust in financial instruments suffered6 for many years after the 1997/98 stock market crash, and it is only recently that the stock market has regained popularity7.

Additionally, according to KPMG’s Consumer Loss Barometer, 49 per cent of Malaysian consumers have had their financial information compromised, higher than the global average of 37 per cent.

Malaysian regulators have come up with various policies to address the security of end users’ financial transactions. Photo: Eduardo Soares/Unsplash

Stronger e-KYC guidelines were published in June 2020 to further regulate and support FinTechs as they manage growing amounts of consumer data; the Malaysian Government forced Binance to cease operations in 1H2021 due to its lack of authorisation to operate a digital derivatives/assets exchange. The closure came with a warning to the public against joining “unlicensed platforms offering investment advice and opportunities, especially those that claim to offer high returns without informing users of the risks”.

BNM also launched the Risk Management in Technology (RMiT) policy in 2020 to help businesses manage their cybersecurity risks and better protect consumers. The RMiT policy enforces organisations to properly manage their cyber-risk exposure and governs the creation of risk assessments, governance structures, policies and procedures. To operate in Malaysia, FinTechs will need to maintain open dialogue with regulators and clearly demonstrate how they protect consumers.

FinTech’s rise in Malaysia depends on ability to build trust, accessibility and regulation

The rise of FinTech is important in Malaysia, where many segments continue to lack access to traditional financial services such as investments and loans. Besides gaining trust, another major challenge that FinTechs will need to solve is that of accessibility: Not all consumers are familiar with tech lingo or know how to interact efficiently with mobile devices if they have one at all. Users in cash-heavy rural areas may not be able to integrate certain FinTech solutions into their day-to-day lives because local merchants have yet to accept digital payments.

FinTechs will need to carefully consider which segments they want to serve. They will be at least partially guided by regulators, who have high expectations about FinTech’s potential to shrink social divides. .

To increase digital adoption, Malaysia released a digital blueprint at the end of 20208 that comprises 22 strategies, 48 national initiatives and 28 sectoral initiatives designed to help the country become a regional tech leader. The blueprint also includes initiatives to strengthen Malaysia’s FinTech ecosystem.

With regulators and FinTechs coming together to solve the infrastructure gap and share data more openly with one another, there is hope for Malaysia’s FinTech ecosystem to rise above its current challenges, beckoning more investments into the industry.

To learn more about ASEAN’s bustling FinTech landscape, please download the FinTech in ASEAN 2021 report.

You can also read our previous reports, FinTech in ASEAN: Get Up, Reset, Go! (2020) and FinTech in ASEAN: From Start-up to Scale-up (2019).

1Includes five deals with undisclosed funding amounts.

2Funding activity in Malaysia, up to 3Q2021. Source: Tracxn (last accessed 6 Oct 2021)

3Insurtech: Raising insurtech’s game in Malaysia, The Edge Malaysia article, 9 August 2021

4BNM receives 29 applications for digital banking licences, The Asian Banker article, 6 July 2021

5UOB’s ASEAN Consumer Sentiment Survey - Question B1: COVID-19 has had a major impact on many aspects of our lives. Listed below are some key areas that people talk about. Please indicate how much you still worry about each of them. Base: Total respondents (3,466)

6Alternative Views: Robinhood listing a grim reminder for millennial investors, The Edge Malaysia article, 2 August 2021

7Malaysia still at an early stage of open-banking adoption,The Edge Malaysia article, 18 August 2021

8Malaysia Digital Economy Blueprint, Economic Planning Unit, Prime Minister's Department, February 2021