Key takeaways

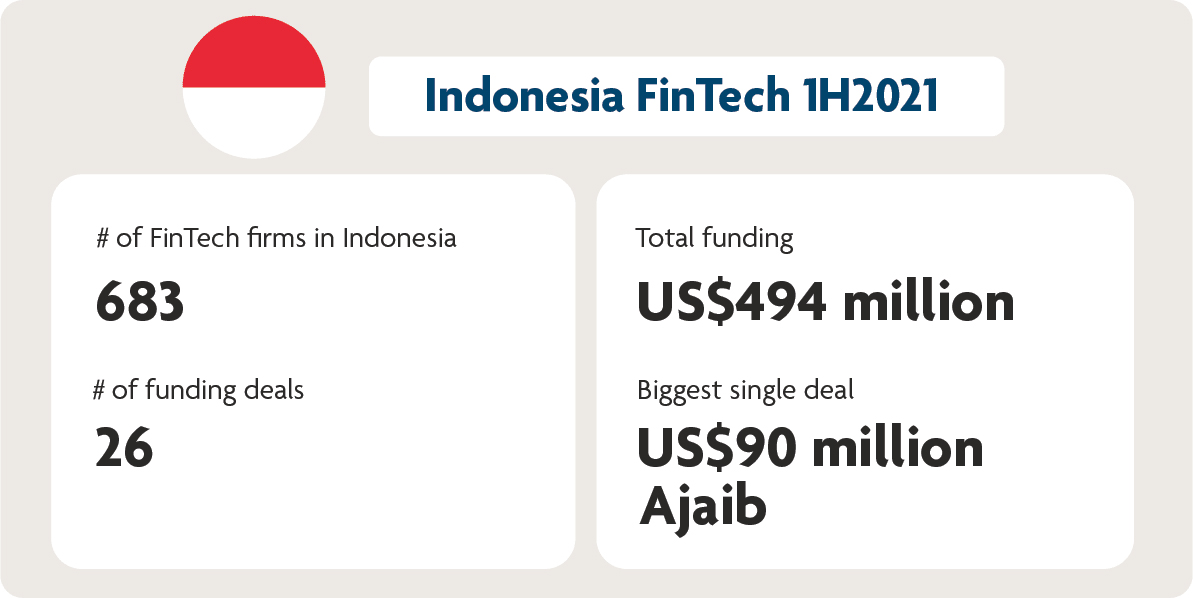

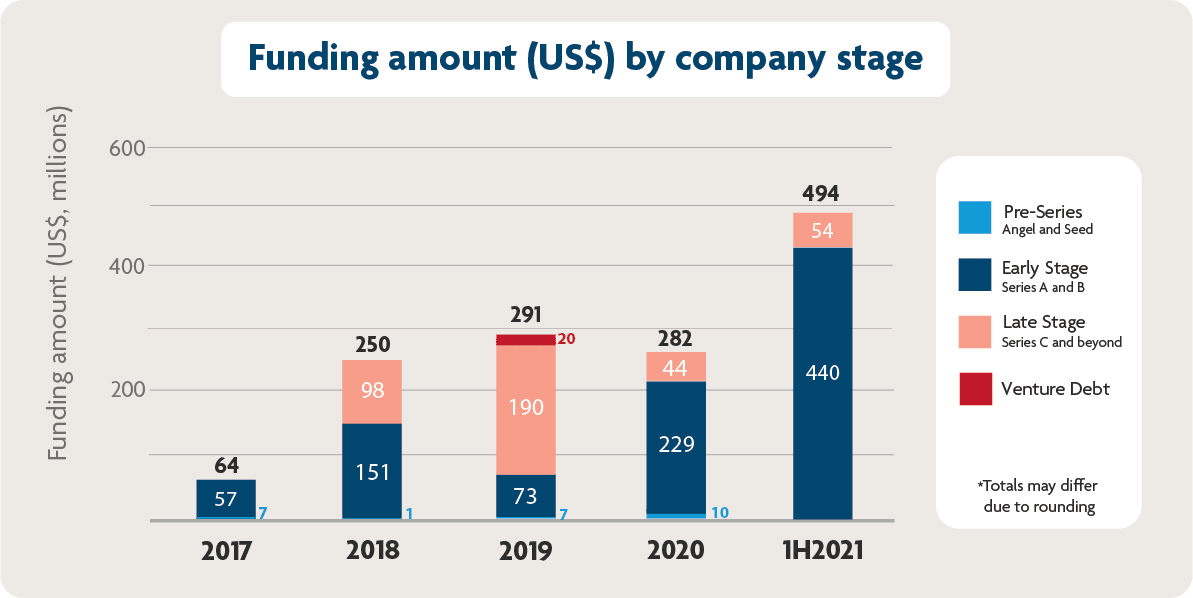

- Indonesian financial technology (FinTech) firms raised a total of US$494 million in funding in the first half of 2021 (1H2021), surpassing total funding for Indonesian FinTech firms in 2020 by 75 per cent.

- Early stage startups (Series A and B) raised the largest rounds in 1H2021.

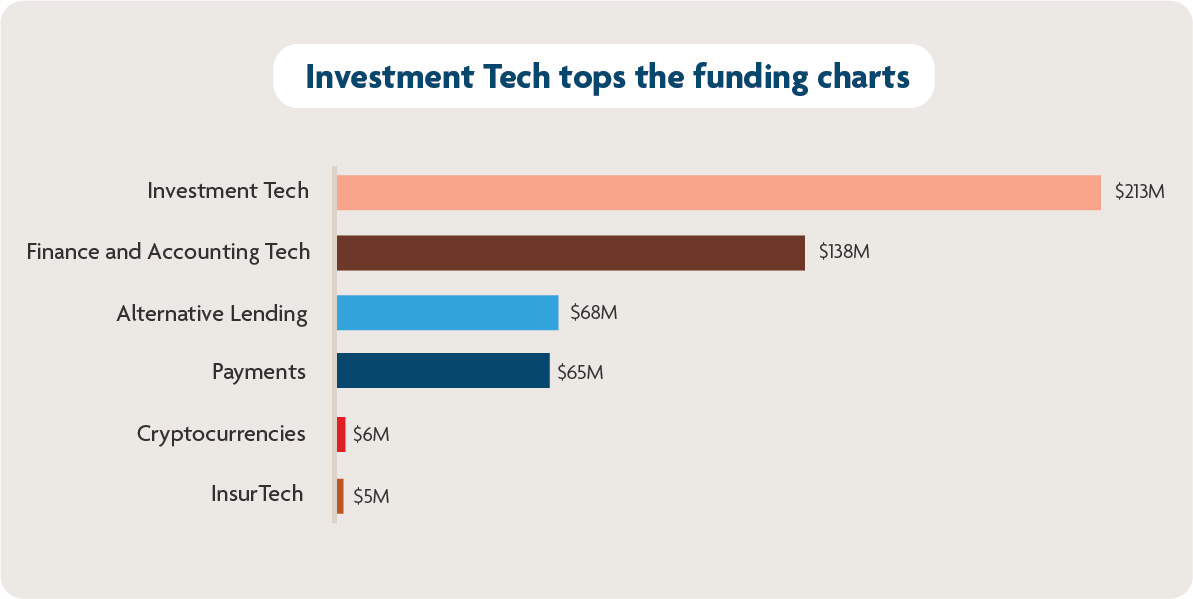

- Investment tech firms and finance and accounting FinTech firms attracted major investor interest, garnering 43 per cent and 28 per cent of all funds raised in 1H2021, respectively.

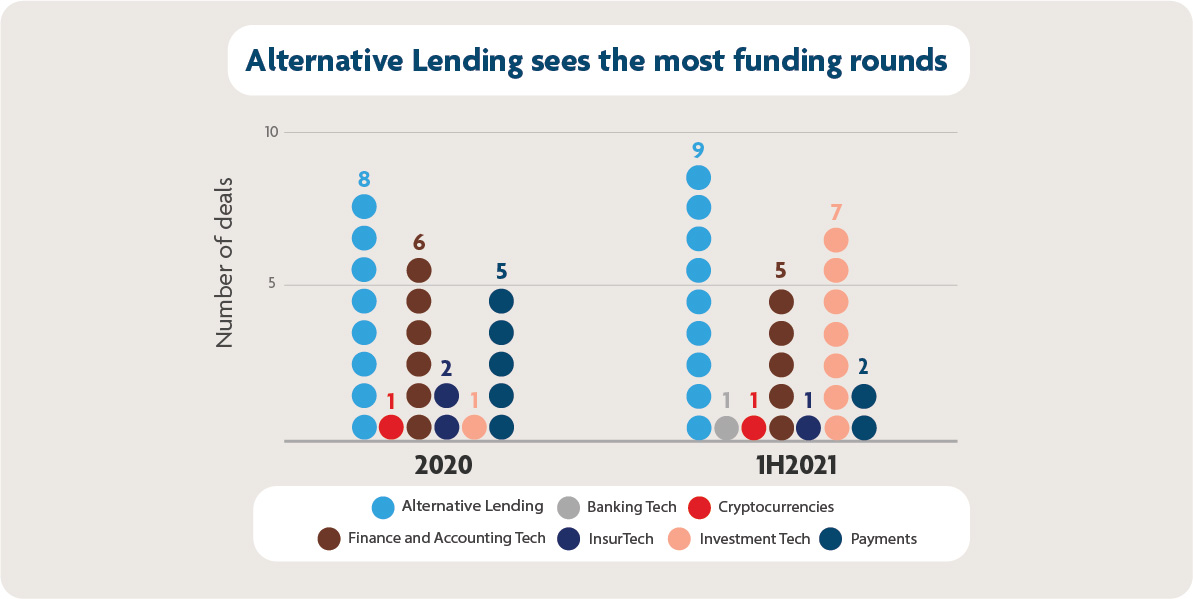

- Alternative lending platforms struck the most deals with nine out of 26 deals in 1H2021.

- New government regulations and digitalisation efforts by micro-, small- and medium-sized enterprises (MSMEs) and incumbent banks are creating a faster and more modern FinTech ecosystem for Indonesia.

2021 is turning out to be the biggest year for Indonesian FinTech startups

In the first half of 2021, 26 Indonesian FinTech firms received funding totalling US$494 million. This figure is the highest in Indonesia's history, nearly doubling the total FinTech funding in 2020 (US$282 million), and making up almost 33 per cent of total FinTech funding across the ASEAN-6 markets (the rest being Malaysia, Singapore, Thailand, the Philippines, and Vietnam).

Figure 1: A summary of funding activity in Indonesia, 1H2021. Source: Tracxn (last accessed 2 July 2021)

While Ajaib secured the largest amount per single funding round, the top-funded FinTech in 1H2021 is Bibit, a mutual fund robo-advisory app which raised a total of US$95 million over two Series A rounds. Notably, it is the first Southeast Asian startup investment by California-based venture capital Ribbit Capital, signalling increased interest in the Indonesian FinTech industry from global venture capital (VC) firms.

Most funded FinTech categories in Indonesia as of 1H2021

Figure 2: Funding raised (US$) per FinTech category in Indonesia, 1H2021. Source: Tracxn (last accessed 2 July 2021)

Investment tech firms received the greatest portion of funding in 1H2021, attracting US$213 million or about 41 per cent of total FinTech funding during this period.

Together, mutual fund robo-advisory Bibit and online stock trading platform Ajaib attracted 87 per cent of the total funding into investment tech. Both apps draw reference from American investing app Robinhood in hopes that a user-friendly design will entice a new generation of retail investors in Indonesia.

The sizable growth of Indonesia's retail investor market—nearly 500 per cent in less than five years—coincides with the increased use of technology for financial services and government-led educational initiatives focusing on stocks and bonds.

B2B FinTech firms help businesses tackle Indonesia's vast geography

Connectivity and infrastructure pose a challenge for many Indonesian businesses. Photo: Fikri Rasyid/Unsplash

Connectivity and infrastructure pose a challenge for many Indonesian businesses. Photo: Fikri Rasyid/Unsplash

In Indonesia, MSMEs make up 99 per cent of existing businesses and contribute over 60 per cent of the national GDP1. The B2B payments and finance and accounting tech startups seeking to help MSMEs digitalise have generated 40 per cent of total funding raised in 1H2021.

These cloud-based startups function as a bridge to help MSMEs in Indonesia tackle the country's vast landscape. By helping such MSMEs go digital, these ‘middlemen' startups can establish and strengthen their own positions in the nation's growing economy. Payment gateway startup Xendit facilitates payments for businesses, helping them accept a variety of digital payments. BukuWarung, BukuKas, and Mekari, on the other hand, provide digital accounting services for MSMEs.

Alternative lending records the most funding rounds

Figure 3: Number of funding deals by category in Indonesia, 1H2021. Source: Tracxn (last accessed 2 July 2021)

Figure 3: Number of funding deals by category in Indonesia, 1H2021. Source: Tracxn (last accessed 2 July 2021)

FinTech firms offering alternative lending continue to be most attractive to investors in 1H2021, an ongoing trend since 2017. The constant flow of investments in this category can be attributed to the large financing gap for MSMEs in Indonesia. In 2019, the World Bank and International Finance Corporation estimated that Indonesian MSMEs had access to just US$57 billion in credit, leaving a huge financing gap of US$165 billion.

The growing popularity of alternative lending can be attributed to the lack of credit history for both Indonesian individuals and MSMEs. Alternative lending platforms present a new option for these "credit invisible" entities by using other methods to assess creditworthiness, giving them access to otherwise hard-to-reach loans. On the supply side, alternative lending platforms are sometimes perceived by investors as providing more competitive returns compared with traditional instruments like mutual funds.

Peer-to-peer (P2P) FinTech startups such as Amartha and Alami Sharia raised two of the largest funding rounds in 1H2021; they each target their own highly specific markets. Amartha, which targets socially conscious millennials, specialises in micro-loans for women-led micro-enterprises. The number of Amartha's borrowers increased by 11.7 per cent throughout 2020 and financial disbursements increased by 21 per cent.

Alami, on the other hand, is positioned as a syariah P2P platform—one guided by Islamic laws and customs (Indonesia's population is 87 per cent Muslim). The company's CEO claims that the platform grew threefold in 2020.

FinTech trends, opportunities and threats

COVID-19 a wake-up call for personal finance

Financial management became a major concern as Indonesians lost jobs, experienced pay cuts and found themselves purchasing more online as a result of lockdowns. To grow their wealth, new Indonesian retail investors explored online investment platforms serving high-return P2P loans, mutual funds, government bonds and stocks. According to Bibit, 90 per cent of its users are millennials and first-time investors.

In households where money was tight, some also turned to micro-loan services to make ends meet. But while signing up for such services might be fast, acquiring enough financial knowledge to understand the implications of each action takes time.

The low financial literacy has presented an opportunity for illegal P2P FinTechs to abound—to date, OJK has identified and banned 3,198 illegal P2P platforms, apps, and companies.

In response to the growth of illegal FinTech activity in the country, OJK has released several updates in 2021, such as requiring micro-loan debt collectors to carry an official identity card and authorisation letter from the credit company, and creating a new category of business registration for crowdfunding FinTechs, with more changes expected.

OJK's changes are designed to protect the nation's new retail investors and to prevent exploitation and predatory behaviour. FinTechs that wish to succeed will need to keep up with these changes and do their part in educating new users about what each online financial service is about, and how it works.

Digital banks and FinTechs are transitioning into lifestyle partners

Though Indonesia's citizens are digitally savvy and frequently shop online, millions still lack access to formal financial services. Both incumbent banks and new FinTech firms are driven by a desire to close this gap: the country's digital banking transaction volume is forecast to rise by 19 per cent throughout 20212.

Filianingsih Hendarta, Assistant Governor Head of Bank Indonesia's System Policy Department, attributes this growth to the pandemic, saying, "The movement restrictions forced people to adopt online banking. Once you experience the comfort of digital transactions for the first time, you will support the digital financial economy."

Newer FinTech startups like LinkAja and DANA seek to integrate their own financial services within other ecosystems and environments – known as "embedded finance". At the same time, many incumbent banks are also developing digital-first subsidiaries and undergoing digital transformations.

Rather than simply serving as a financial intermediary, consumers are demanding for banks to better integrate with their lifestyle and life journey. For example: TMRW, UOB's digital-only bank, empowers the digital generation with banking solutions and insights that are personalised to their lifestyle. This has helped TMRW to become one of the leading digital-only banks in Indonesia.

The ecosystem is witnessing the rise of ‘superapps'

Indonesia is seeing a rise in superapps: ecosystems of services and offerings served in a single app. For example, many e-commerce platforms in Indonesia—like Bukalapak, Tokopedia, and Shopee—now provide retail investment instruments such as gold and mutual funds, and buy-now-pay-later services, in addition to online shopping. Online booking startup and unicorn Traveloka offers a buy-now-pay-later service for travel bookings and its partners' retail products—describing itself as "your lifestyle superapp".

Despite these developments, more is needed before Indonesia can emerge with its own version of WeChat or Baidu. These superapps offer online shopping, credit card payments, charity payments, travel booking, networking and messaging services, and more under a single umbrella. In contrast, Indonesian superapps like GoTo and Shopee have historically focused on financial and e-commerce services.

To get closer to the vision of a true superapp, FinTech firms will likely partner with other startups that provide services adjacent or complementary to their own. Some of the largest (like GoTo and Traveloka) may have the ability to develop their own built-in social feeds and friend network features. For other FinTechs and smaller startups, consolidation and integration will need to occur in order to achieve the vision of an integrated ecosystem.

FinTech's role in bringing a nation forward

FinTech plays a role in making Indonesia a more equitable country. Photo: Adismara Putri Pradiri/Unsplash

FinTech plays a role in making Indonesia a more equitable country. Photo: Adismara Putri Pradiri/Unsplash

Indonesia is the most populous ASEAN country, home to over 275 million people. The country is undergoing a digital revolution: mobile phone internet user penetration in Indonesia reached 67 per cent in 2020 and is expected to rise by another 20 per cent by 2025.

To facilitate this transition to a digital economy, OJK introduced a regulatory sandbox process in 2018. Indonesian finance startups such as Brankas, Brick, and Finantier are also trying to develop open banking protocols and Application Programming Interfaces (more commonly known as APIs) to foster more transparent banking and financial services.

With improving regulations and a growing middle class of digital natives, Indonesia's FinTech landscape holds extraordinary promise for investors and FinTech firms alike. With total funding in the first half of 2021 already surpassing 2020's total for Indonesian FinTech firms by 75 per cent, it is without doubt that investors will be watching this space closely.

For more insights on ASEAN's growing FinTech industry, check out UOB's FinTech in ASEAN 2021 report.

You can also get up to speed on the FinTech landscape by reading our previous reports, FinTech in ASEAN: Get Up, Reset, Go! (2020) and FinTech in ASEAN: From Start-up to Scale-up (2019).

1The new normal: Digitalization of MSMEs in Indonesia, Asia Pacific Foundation of Canada, 9 February 2021.

2BI proyeksi transaksi digital banking naik 19% jadi Rp 32.206 triliun sepanjang 2021, Kontan article, 7 July 2021.