When Wipavee Watcharakorn first took over as Managing Director of Thai fruit distributor Vachamon Food Co., Ltd ("Vachamon") just under a decade ago, the SME was faced with growing debt and declining sales. The company also had no clue or direction of how to move forward, she said.

What the company's 40 employees had, was a fighting spirit.

Vachamon sought ways to widen the company’s customer base and introduce new revenue streams. Aside from wholesale and retail channels, the company began expanding their operations and made strides towards their ambition to serve the larger international market. It also explored ways to extend the shelf-life of its products, creating ready-to-eat foods that appealed to the palettes of customers in Cambodia, Laos, Malaysia, and Vietnam.

Today, after 40 years in business, Vachamon is one of the biggest importers and distributors of premium-grade fruits in Thailand. It has worked with supermarkets and retailers both in Thailand and around the world, including Dairy Farm, Carrefour, BigC, Tops, Aeon and even McDonald’s. Over the last 9 years, with Wipavee at the helm first as Managing Director and subsequently as Group CEO, Vachamon’s annual sales have grown more than tenfold from THB 200 million (USD 7 million) to THB 2.5 billion (USD 90 million).

Pictured here is Wipavee Watcharakorn, Group CEO of Vachamon Food Co., Ltd at the company’s headquarters

With the influx of orders from different markets, Vachamon realised it needed to update its processes. The fruit distributor implemented basic digital solutions which enabled them to reduce the time it took to process orders and integrate it with existing on-the-ground operations. Shifting from a predominantly manual workflow to an automated one set the company on the path towards the level of operational efficiency it needed to realise its ambitions.

A case for digital empowerment

Wipavee knew that to grow Vachamon further, the company had to invest in technologies that could help it ramp up operational efficiencies and scale seamlessly. Yet the company struggled with prioritising pain points to address and deciding which technology solutions would be appropriate.

The challenges were multi-fold. Since digitalisation requires investment, there were concerns if the resources put in would lead to substantial returns. The breadth of solutions available made it difficult to tease out the pros and cons of each and determine which would deliver the most optimal results. There is also the risk of implementing an incompatible solution that could disrupt operations rather than help it.

It was then that Wipavee decided that Vachamon should join the Smart Business Transformation Programme (SBTP) conducted by The FinLab, an innovation accelerator powered by UOB.

The transformation process

The SBTP helps SMEs refine their business models and adopt digital solutions that are suited to their business needs. The FinLab started the programme in Singapore in 2018 and expanded it to Thailand and Malaysia in 2019. Since then, The FinLab has accelerated the digitalisation journey of more than 250 SMEs through expert guidance, one-on-one clinics and mentorship sessions, and tech solution matching and implementation, including Vachamon.

Through The FinLab’s SBTP, Vachamon identified an Enterprise Resource Planning (ERP) solution that addressed their most pressing pain point – managing the increasing volume of orders and fulfilling them in a timely manner. Vachamon chose to implement UOB BizSmart, a suite of integrated cloud-based solutions that offers ERP functionalities for SMEs.

This one move allowed Vachamon to reduce time spent on warehouse processing by over 90 per cent — from three hours a day to just 15 minutes per Purchase Order (PO). The solution also simplified the ordering process for its staff by standardising the order formats and shifting it onto the cloud. This reduced the rate of human errors and increased efficiency since orders could be placed from multiple locations and even on-the-go.

With The FinLab’s guidance, the company also implemented an AI-powered chatbot to augment its customer service capabilities to cope with the high volume of customer queries. This chatbot doubles up as a customer service assistant and a sales representative.

For its digitalisation efforts, Vachamon tapped on THB 450,000 (USD 15,000) of funding from the Innovation Technology Assistance Programme (iTAP) under Thailand’s National Science and Technology Development Agency, which is also one of UOB’s partners in the SBTP. The funding came amid calls by the Thai government for all sectors to leverage digital technologies in driving the country’s economy.

Digitalisation in times of crisis

Vachamon’s early investments in technology put it ahead when COVID-19 lockdowns hit worldwide in 2020. With movement restricted, the company’s usual physical distribution channels had a limited reach and it was compelled to shift much of its sales online.

This shift online was only possible because of Fresh Living, the online fruit ordering and delivery platform they had begun working on in late 2019. When the pandemic hit the country’s shores, Vachamon expedited the build and launched Fresh Living by July 2020, ahead of its original schedule. The platform enabled Vachamon to reach consumers directly, allowing them to reach a new market segment – consumers who had shifted to Work-from-Home (WFH) set ups.

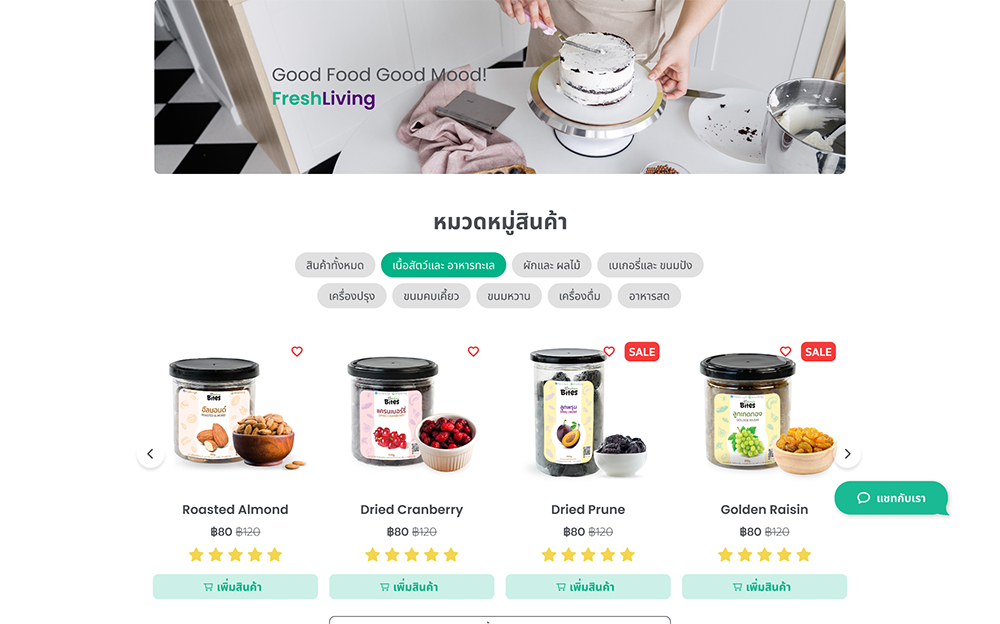

Screenshot of Vachamon's online fruit ordering and delivery platform, Fresh Living. The online distribution channel generates THB 2 million in monthly revenue.

Since adding Fresh Living to its distribution channels, the company has seen Fresh Living’s monthly revenue grow from around THB 100,000 to THB 2 million (USD 3,300 to USD 66,000) within a span of three months. The company projects that Fresh Living will bring THB 120 million in sales by the end of 2021.

Buoyed by the success of their early investment in technology, Vachamon set out its new ambition for Fresh Living. "The next goal for Fresh Living is to bring food suppliers to our platform so we can provide a variety of food products and create a community of food lovers", Wipavee said.

While Vachamon had a good delivery system in place before the launch of Fresh Living, that system was only able to support the fulfillment of its own orders. To become a platform that could support other companies, Vachamon needed to put in place a more complex solution – a Distributed Control System (DCS). A DCS integrates multiple applications via API and allows them to be controlled via a single software. With the implementation of the DCS, Vachamon would be able to automate all aspects of its delivery system and be able to monitor the movement of goods through their delivery chain in real time.

The FinLab worked with Vachamon on the implementation of their DCS for Fresh Living, which gave Vachamon the capability to offer a new platform to fruit and food distributors, who were hard pressed to expand their customer reach beyond retail outlets and sell to both businesses and end consumers.

The power of digitalisation

Before Wipavee took over as CEO, Vachamon’s situation was grim; but a few key moves have enabled it to ramp up its operational efficiency and agility to pivot in unexpected times.

The most critical factor is that Vachamon, through Wipavee, has maintained a razor-sharp focus on what it hopes to accomplish – introducing new revenue streams and ensuring operations are streamlined to support the resulting increase in demand.

By clearly defining the next stage of growth, like enabling other fruit and food distributors to deliver produce/products to its customers, it becomes easier to determine which tech solutions should be prioritised.

Once there is a distinct business case, there needs to be a corresponding willingness to invest in new technology, even if it begins with a small pilot to test out the solution. That’s when an innovation accelerator like The FinLab comes in to play. The FinLab, with its expertise in SME tech solutions, has a good grasp of the available solutions, their capabilities and keen understanding of whether it will suit the needs of the SME.

Like Vachamon, many Thai SMEs find digitalisation daunting. They see digitalisation as an expensive and optional investment, or they embrace it but find their digital transformation process fragmented. One of the common challenges SMEs face with their digital transformation journeys is the lack of digital skills and knowledge. This is what The FinLab wants to address.

The FinLab runs an online community that educates SME founders on technology trends and the latest innovations in the market through workshops. The FinLab team also runs digitalisation programmes where they work with SMEs to assess their needs and match it with the appropriate tech solution(s), and then assist the founders with implementation. In so doing, The FinLab helps SMEs leverage digital solutions to improve efficiency, increase sales and scale across ASEAN, to ultimately enable long term success.

This article is jointly written by The FinLab and UOB. This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and The FinLab and their employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.