Digitalisation has become a buzzword in the wake of COVID-19. But for many small and medium enterprises (SMEs), the journey towards digital transformation has not been smooth sailing.

This is not for lack of ambition. The UOB SME Outlook Study 2022 found that three in four SMEs in Singapore have leveraged digital technologies in at least one department1. At the same time, the results of digitalisation vary – while 85 per cent experienced some form of success with their digital adoption, only around 43 per cent reported having considerable or complete success.

Amongst businesses that adopted digitalisation, 67 per cent see business performance in 2022 to be somewhat or vastly improving. Digitalisation provides a brighter outlook for 2022, but the findings signal room for improvement in digitalising more effectively.

One common obstacle is that many businesses are not sure how to develop an effective digitalisation framework. An EY study of SMEs in Southeast Asia found that the majority of respondents were embarking on ad-hoc digital initiatives, rather than setting out a digital transformation strategy that could be embedded throughout the organisation2. Adding to the dilemma is the sheer number of digital solutions to choose from – so many that it becomes challenging to pinpoint the best options. Case in point: over 15,000 companies worldwide offer Software-as-a-Service solutions3. How do you know which might benefit your business most?

Once you do choose a tool, resource-strapped SMEs must then consider whether they can afford it. Half of Malaysian SMEs, for instance, cite financing as a key hindrance to digital transformation, with 60 per cent claiming a lack of awareness of possible financing methods4. This suggests a need for education on financing solutions for SME digitalisation.

It is crucial for SMEs to overcome this decision fatigue so they can reap the rewards of digitalisation and ensure business sustainability in a post-COVID world.

First things first: Decide what you wish to gain from digitalisation

Digital transformation requires business leaders to wear their visionary hats. At the same time, it calls for a close examination of business processes.

First, consider your operations and business areas. Which, if digitalised, would have the most business impact?

Make sure the impact is related to your near- and long-term business goals. For example, you might aim to increase your market share by a certain percentage each year, to become the market leader in your segment within 10 years. How will digitalisation help you reach these goals? The answer could involve several business areas, from manufacturing to marketing. By visualising the desired impact on your business, you can decide on your digitalisation priorities. Start by looking at some key areas of digitalisation that benefit firms of all sizes5, identified by the Malaysian Digital Economy Corporation and adapted by the London School of Economics:

| Key area | Definition and explanation |

| Procurement and inventory | Digital procurement software and inventory management systems reduce costs and streamline business operations as they reduce the manpower required to manually check and update inventory. For example, inventory restocking can be automated using analytical models that predict price fluctuations and customer demand. |

| Accounting and taxes | Digital accounting software record transactions accurately and instantly without human intervention, significantly reducing accounting errors that are commonly associated with manual bookkeeping. |

| Digital marketing | Digital marketing campaigns can reach a wider customer base more efficiently and cheaply than traditional advertising. For example, platforms such as Facebook, Instagram, or YouTube enable firms to promote their businesses via digital advertising with flexible pricing plans. |

| E-commerce | E-commerce (e.g. via platforms such as Lazada and Shopee) helps firms overcome geographical limitations and lowers the cost of entry for entrepreneurs and SMEs, allowing them to compete with established firms. |

| Electronic Point of Sale (ePOS) and contactless payment systems | ePOS is a system that records sales, manages payments, and monitors inventory, enabling accurate, up-to-date information on business operations. The system enables businesses to engage in data analytics (e.g. by generating reports on product popularity), thus optimising business performance. Contactless payment systems, such as digital wallets, can reduce transaction time, increase security, and improve customer experience. |

Source: London School of Economics

Once you have gained an understanding of the business areas to focus on, you can delve into the finer details. That means identifying routine, manual tasks that you can automate.

This one is easier to pinpoint. Ask each team within your organisation to list down their routine, manual tasks, the number of people doing those tasks, and the number of hours a week spent on each of task.

Now ask them: What could they be doing to add value to the business if they did not have to spend hours on such work?

If the potential value of automating these manual tasks outweighs the time and costs involved in performing them, this could be a potential area for digitalisation.

One helpful tool for you to achieve a clearer picture of your digital transformation needs is a Digital Needs Assessment (DNA) Test designed by UOB’s innovation accelerator, The FinLab. The FinLab runs a slew of support programmes tailored to SMEs in various Southeast Asian countries. SMEs can leverage this regional accelerator to get mentorship from venture capitalists and financial experts, and even access solutions to kickstart their digitalisation efforts. As part of The FinLab's proprietary business tools to support businesses on their transformation journey, this diagnostic test aims to help SMEs know their business requirements and prioritise their areas of digitalisation.

Malaysian SMEs can tap The FinLab’s Jom Transform Programme, which offers discounted rates on a curated bundle of easy-to-deploy digital tools. In Thailand, The FinLab runs the Smart Business Transformation Programme, which similarly aids SMEs in going digital with free diagnostics tests on their technology needs, digital solutions from tech partners like Microsoft and SAP, and expert-led workshops.

Another tool that SMEs can turn to includes UOB BizSmart, a ready suite of business management solutions. These curated digital solutions enable you to manage all your banking and business activities end-to-end via integrated web and mobile applications, from accounting and payroll to POS, digital marketing, and more. This helps you enhance your business efficiency across multiple areas, from getting real-time insights on your financial performance to enjoying simplified digital payments.

Instead of adopting digitalisation piecemeal, try an ecosystem approach

An ecosystem approach is key to digitalise your business. Photo: Tirachard Kumtanom/ Shutterstock

If digitalisation seems like a daunting task, take heart. From street food vendors to wet-market merchants, countless traditionally offline businesses across Southeast Asia have adopted online sales and payments6. They managed to do so with the help of government programmes as well as private firms.

SMEs can learn from this: Look beyond your own business towards the larger ecosystem. Tap on your local community and virtual groups to learn from other SMEs’ experiences.

Get in touch with your area’s chamber of commerce, invite other business leaders for a chat, and ask universities or training providers if they have any workshops to offer. If your area does not have enough resources, go online by joining business groups on messaging platforms or exploring online classes, such as The FinLab Online.

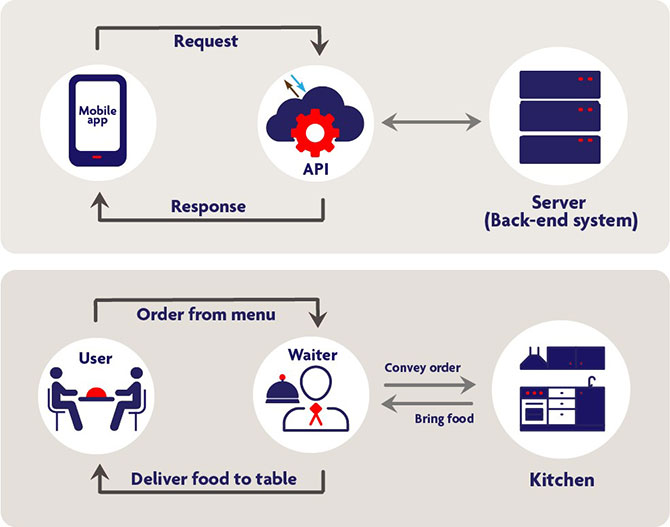

This ecosystem approach applies to digital solutions, too. Instead of adopting tools piecemeal, it is more efficient to use tools that work seamlessly together. For example, many cloud-based software come with application programming interfaces (APIs) that allow them to work with each other. This ensures that files and data can be shared and accessed across your business platforms, and reduces the steps needed to perform a function. It also helps you avoid redundancy and cost by not having two tools that fulfil the same function.

Take, for instance, the step of recording an e-commerce payment in your books. You can automate this process using an API between your e-commerce store and an accounting tool. That means you can acknowledge the customer’s payment promptly and keep your financial data updated.

Figure 1: An API works like a waiter in a restaurant to relate messages to back-end system (Source: Medium.com7)

While it sounds simple, this step contributes to improving customer service and giving business owners a real-time view of their finances.

For SMEs in Singapore, another starting point to tap into an ecosystem is the SME Digital Reboot programme. Led by NTUC LearningHub (NTUC LHUB) and supported by NTUC U SME, The FinLab, and Ngee Ann Polytechnic, the programme takes an end-to-end approach to helping businesses go digital.

What this means for SMEs is a holistic support scheme, starting from identifying your digital needs all the way to implementation. Businesses can leverage tools to develop their digital success strategy, before undergoing training programmes in key areas of digitalisation. Finally, workplace learning sessions will be conducted to guide implementation on-site.

According to the chairman of NTUC LHUB Eugene Wong, lack of support and expertise are the key barriers to digitalisation cited by SMEs8. “As the digital wave sweeps over Singapore, it is crucial for SMEs to effectively reboot their businesses to stay competitive,” he highlights. The SME Digital Reboot programme addresses this need by empowering businesses with the backing of a whole ecosystem.

Learn about your financing options

Southeast Asian countries have made their digitalisation ambitions clear, so you will likely find government-funded grants and programmes that help SMEs with digital transformation. Look for non-government organisations, such as accelerators and entrepreneur networks like The FinLab.

Another financing option that SMEs can consider is loans. Given that small businesses typically struggle to obtain loans due to a lack of financial records, the UOB BizMerchant programme fills this gap with lending support tailored to SMEs. Through collaborations with FinTech partners, the programme uses transaction data from partner platforms to assess SMEs’ credit behaviour. Qualifying SMEs can receive business loans of up to S$100,000.

No SME is an island

The bottom line is that you do not need to embark on your digitalisation journey by yourself. SMEs account for 89 per cent to 99 per cent of establishments across ASEAN9, which means you can learn from a rich ecosystem of businesses and digitalisation enablers in the region.

If your business needs help with going digital, UOB’s tech startup ecosystem offers support at every step of the journey, from mentorship and industry resources to digital solutions and financing options.

1UOB SME Outlook Study, 2022. The survey was conducted from late December 2021 to early January 2022 among 800 local SMEs with revenue less than S$100 million to understand the business outlook and key expectations among SMEs in Singapore.

2Redesigning for the digital economy: A study of SMEs in Southeast Asia, EY study, 2019.

3The Rise of Software as a Service (SaaS), CardConnect article, 16 June 2020.

4News: SMEs still not using digitalisation enablers, The Edge Malaysia article, 21 January 2019.

5The impact of COVID-19 on SME digitalisation in Malaysia, London School of Economics article, 20 October 2020.

6Grab CEO Anthony Tan: What Southeast Asia is teaching us about a post-pandemic world, Fortune article, 13 August 2020.

7What is an API? How does it work?, Medium.com, 14 Jun 2018.

8SME Digital Reboot programme to help SMEs in Singapore deepen digital capabilities, The Business Times article, 9 March 2021.

9SMEs as the Backbone of Southeast Asia’s Growing Economy, International Federation of Accountants article, 29 April 2019.