This is the final article in a six-part series exploring findings from the FinTech in ASEAN 2021 research. It looks at consumers’ digital financial adoption in Vietnam.

Download FinTech in ASEAN 2021

Key takeaways

- FinTech companies can take advantage of digital services to leapfrog the lack of banking infrastructure throughout Vietnam, and better reach Vietnam’s unbanked and underbanked majority.

- Vietnamese are fond of conventional financial products like credit cards and brokerages but are not averse to trying out new FinTech services.

- Digital banking and buy now, pay later (BNPL) providers may expect greater uptake, particularly once the Government adjusts the regulatory environment in their favour.

- FinTech companies can overcome resistance by providing new services, offering attractive promotions and building legitimacy to bolster consumer trust.

A walk through the bustling Saigon Centre in Ho Chi Minh City reveals how Vietnam’s digital adoption has come of age. Where cash used to be the primary mode of settlement between merchants and customers, digital payments are now the norm, as users flash out their smartphones to pay via contactless credit cards, e-wallets and QR code-based payment services like VietQR.

According to the e-Conomy SEA 2021 report by Google, Temasek and Bain & Company, there were over eight million new digital consumers in Vietnam since the start of the pandemic (up until H1 2021), with 55 per cent hailing from non-metropolitan areas. Driven by these newcomers, the country’s overall internet economy is expected to reach US$57 billion in value by 2025.

Vietnam’s lockdowns during the COVID-19 pandemic, and the resulting need for internet-based retail, may have helped erase any latent scepticism about online transactions.

In UOB’s FinTech in ASEAN 2021 report, produced in collaboration with PwC Singapore and the Singapore FinTech Association, we looked at the adoption of digital financial services1 in ASEAN-6 (namely Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam). In this article, we dive into Vietnam’s consumer insights, against a backdrop of developments within Vietnam’s FinTech ecosystem.

Thirty-six million more consumers will join Vietnam’s consuming class over the next decade, according to consultancy firm McKinsey. Photo: Piqsels/Public domain

Thirty-six million more consumers will join Vietnam’s consuming class over the next decade, according to consultancy firm McKinsey. Photo: Piqsels/Public domain

Growing preference for digital payments, but cash still king

Our survey shows that cash is still the overall preferred payment method for Vietnamese consumers, with 41 per cent claiming to use it most often to pay2. E-wallets take second place at 23 per cent, slightly higher than the ASEAN-6 average of 20 per cent.

Thinking about your shopping habits, which of the following payment methods have you used most often?

| Payment method | Vietnam | ASEAN-6 |

| Cash | 41% | 38% |

| E-wallets | 23% | 20% |

| Mobile banking apps | 15% | 12% |

| Debit cards/Credit cards | 11% | 20% |

| Mobile payment app (e.g. Apple Pay, Samsung Pay, Google Pay) | 1% | 2% |

| E-commerce payment platforms (e.g. ShopeePay, Q-money, Lazada wallet) | 7% | 6% |

Table 1: Payment methods used most often for both in-store and online payments in Vietnam, compared with the ASEAN average. Source: FinTech in ASEAN 2021 research

FinTech fundraising activity in 2021 reflects investors’ interest in the potential growth of e-wallets in Vietnam. The payments category led fundraising for the first nine months of 2021, with VNPay and MoMo raising US$250 million and US$100 million respectively3.

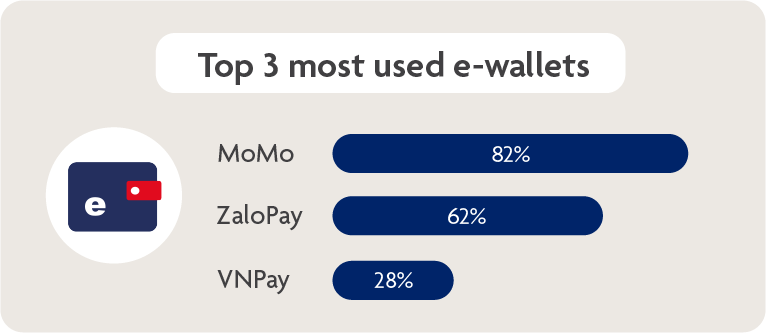

Figure 1: Top three most used e-wallets in Vietnam, according to respondents on which e-wallet(s) they use most regularly. Source: FinTech in ASEAN 2021 research

Figure 1: Top three most used e-wallets in Vietnam, according to respondents on which e-wallet(s) they use most regularly. Source: FinTech in ASEAN 2021 research

MoMo is a major Vietnamese “super app”, with 82 per cent of surveyed consumers claiming to use it regularly4. The company’s one-touch online payment solutions cover a wide variety of transactions, including bill payments, phone top-ups, online game vouchers and airline tickets.

ZaloPay, on the other hand, runs on the homegrown messaging platform Zalo, whose 52 million monthly active users can conveniently initiate and receive ZaloPay payments right in their messages.

The growth of digital payments in Vietnam is shaped by a series of related factors, including:

- A mobile-first nation: Vietnam ranks 10th in a list of countries with the most smartphone users as of 2020, with more than 61 million active users. A 2021 We Are Social review found that Vietnam’s smartphone internet users make up 94.3 per cent of total internet users. The country has achieved 4G coverage of 99.8 per cent, and is set to roll out commercial 5G services in 2022.

- Pandemic factors: High-profile COVID-19 movement restrictions in Binh Thuan, Ben Tre, Ha Giang, and Hanoi and worries about handling cash have led to an increasing preference for contactless methods, including the use of e-wallets for money transfers, bill payments and payments to merchants.

- Appeal to the “unbanked”: Consulting firm BCG estimates that only 40 per cent of Vietnamese consumers have bank accounts. For the unbanked majority of the population, e-wallets provide a lower barrier to entry to financial services.

- An ongoing rise in the “consuming class”: Over the next decade, McKinsey predicts that 36 million more consumers will join Vietnam’s consuming class (defined as consumers who spend at least US$11 a day in purchasing power parity terms). Less than 10 per cent of Vietnam’s population were counted among the consuming class in 2000. This figure shot up to 40 per cent in 2021, and may be close to 75 percent by 2030.

Explore the data | Payment preferences of ASEAN consumers

According to our study, the promise of convenience (73 per cent), the chance to earn rewards or loyalty points (52 per cent), and wide acceptance by merchants they frequent (50 per cent)5 influenced our respondents’ choice of digital payments.

Vietnam’s e-wallets work hard to provide them with these and other perks – and are constantly innovating to one-up their competition and increase market share.

Consider MoMo’s annual Tet (Lunar New Year) promotion Lắc Xì. In 2022, participants were provided an initial value of VND500,000 (US$22) to spend in-game. Participants can earn millions in Vietnamese dong in prizes and cash by completing challenges from the God of Fortune. Lắc Xì is so popular that its contestants doubled in two years from five million in 2019 to 11 million in 2021.

Rise in digital investing, with familiar partners

Vietnamese investors show a strong interest in digital trading and wealth management platforms. Our survey found that only 37 per cent of respondents say they have not invested using digital assets and wealth management platforms. This figure compares favourably against the ASEAN-6 average of 41 per cent6.

Of those who have invested using digital trading, 40 per cent of respondents preferred investing through traditional online brokerages, versus ASEAN’s 31 per cent. Meanwhile, 29 per cent preferred cryptocurrency exchanges, while 21 per cent favoured online-only trading platforms. This reveals some conservatism among Vietnamese investors in the face of the rapid rise of crypto exchanges.

Have you invested using digital trading and wealth management platforms? If yes, which are the type of platforms that you have invested your funds in?

| Digital trading and wealth management platforms | Vietnam | ASEAN-6 |

| Traditional online brokerage platforms | 40% | 31% |

| Cryptocurrency exchanges | 29% | 27% |

| Online-only trading platforms | 21% | 22% |

| Non-bank robo-advisors | 19% | 16% |

| Micro-savings cum investment platform | 18% | 13% |

| Financial institution-backed robo-advisors | 15% | 14% |

| No, I have not invested using digital assets and wealth management platforms | 37% | 41% |

Table 2: Digital trading and wealth management platforms Vietnamese respondents prefer investing through. Source: FinTech in ASEAN 2021 research

In recent years, dwindling bank deposit rates have prompted a flood of new investors into the stock market. Local investors opened more than 620,000 new securities accounts in the first half of 2021, compared to the 393,659 accounts opened in the combined 2019-2020 period.

Explore the data | How ASEAN consumers are investing

Vietnam is second only to Thailand in the list of ASEAN countries with the highest awareness of sustainability-focused assets. According to our survey, 56 per cent of respondents said they were aware of green investment-related products, compared with an average of 51 per cent across ASEAN-6 respondents7. Out of those who were aware of green investments, about 77 per cent reported having already invested in green investment-related products8.

This will come as no surprise to industry-watchers who have observed high interest in Vietnam’s upcoming green growth projects. In response to Vietnam’s vulnerability to climate change, its Government has mandated a national target of reducing total greenhouse gas emissions by nine per cent in 2030, which opens opportunities in Vietnamese climate investment between 2016 and 2030 to the tune of US$753 billion.

Solar panels and windmills in Bắc Phong, Vietnam. Vietnam is second only to Thailand in the list of ASEAN countries with the highest awareness of sustainability-focused assets. Photo: Shutterstock

Solar panels and windmills in Bắc Phong, Vietnam. Vietnam is second only to Thailand in the list of ASEAN countries with the highest awareness of sustainability-focused assets. Photo: Shutterstock

CBDCs gain ground as ambivalence towards cryptocurrencies remains

While Vietnamese consumers are relatively open to using digital currencies in future, our survey reveals divergent attitudes towards government-backed central bank digital currencies (CBDCs) and cryptocurrencies. Overall, only 13 per cent of respondents were already using digital currencies; of those who had not already started, 33 per cent expressed interest, 46 per cent said “maybe” on future digital currency use, and 8 per cent of respondents gave an outright “no”9.

When asked to choose which digital currencies they put their trust in, an overwhelming majority of digital currency users trusted CBDCs (70 per cent) over cryptocurrencies (30 per cent)10.

These respondents cited a growing acceptance by established corporations (70 per cent), confidence in the privacy of transactions (59 per cent) and increased legitimacy from regulators in other countries (58 per cent) as reasons for wanting to use digital currencies11.

On the other hand, serious concerns remain among non-digital currency users. Confidence in cash and concerns over crypto value volatility were the most cited reasons for not adopting digital currencies, tied at 48 per cent each12.

The greater confidence in CBDCs, juxtaposed against sceptical attitudes towards cryptocurrencies, can be traced back to the Government's divergent stance on these two forms of digital currencies. While cryptocurrencies have been banned from being used as a form of payment, the Government has instead started looking into how CBDCs can be implemented to further the development of non-cash payments and to promote innovation in this space.

For pay-later schemes, credit cards are still preferred

Buy now, pay later (BNPL) is a fast-growing FinTech market in Vietnam, with a gross merchandise value reaching USD496.4 million in 2021. At the same time, challenges remain. When asked about their preferred pay-later methods, our survey respondents expressed greater interest in credit card instalment plans (51 per cent) and upfront payment (39 per cent) over BNPL (24 per cent) for future purchases13.

Some retailers offer the option of pay later plans for purchases (electronics, fashion items, etc). Which pay later methods have you used or intend to use?

| Pay later plans | Vietnam | ASEAN-6 |

| Credit card instalment plans | 51% | 47% |

| I prefer to pay upfront | 39% | 35% |

| Buy now, pay later (BNPL) schemes (i.e. Atome, Hoolah) | 24% | 31% |

Table 3: Pay-later methods Vietnamese consumers have used or intend to use. Source: FinTech in ASEAN 2021 research

When non-BNPL users were asked why they did not use that scheme, 25 per cent said they were already satisfied with their credit card. Thirty-two per cent of respondents cited difficulty in keeping track of outstanding bills owed across different BNPL providers as a key point of resistance.

Notably, 31 per cent of respondents indicated a lack of BNPL awareness as a reason, while 30 per cent cited a lack of perceived benefits to users14. These findings hint at market opportunities for BNPL providers to tap into, for instance through efforts to promote awareness of BNPL and its benefits.

Estimates elsewhere forecast fast-growing demand for BNPL in Vietnam, which is expected to grow 126.4 per cent annually to an estimated US$1,123.9 million by 2022. BNPL gross merchandise value in Vietnam is also expected to increase from US$207 million in 2020 to US$4.33 billion by 2028.

Credit cards may stay Vietnam’s preferred pay-later method for some time to come. The number of credit card payments in Vietnam is growing at a robust rate, from 29.1 million in 2016 to 112.0 million in 2020 at a CAGR of 40.1 per cent.

Digital banking: new services and promotions driving adoption

Vietnam’s regulation on digital-only banks remains nascent. Without a digital banking licencing regimen, digital-only banks in Vietnam must be offshoots of legacy banks or financial institutions to offer digital banking services. That hasn’t stopped a handful of pioneers from launching digital-only banking services in Vietnam, like Timo Digital Bank (partnered with Viet Capital Bank) in 2015 and Cake by VPBank in 2021.

Vietnam’s young population use digital payments as the norm, paying via contactless credit cards, e-wallets and QR code-based transfer services from their smartphones. Photo: Shutterstock

Vietnam’s young population use digital payments as the norm, paying via contactless credit cards, e-wallets and QR code-based transfer services from their smartphones. Photo: Shutterstock

Vietnam is wide open for FinTechs offering digital-only banking services. The country’s large unbanked population and high internet penetration are just a few of the factors contributing to the growth of digital-only banks. Our survey findings show that 68 per cent of respondents said they would consider banking with a digital bank – the highest percentage within ASEAN-6. A quarter of respondents were not sure, and only seven per cent ruled it out altogether15.

Out of those who said they would consider digital banks, over half (52 per cent) of these respondents would open a savings account, 18 per cent chose investments and wealth management services, while 15 per cent were interested in money management tools16. In terms of incentives for opening a digital banking account, the respondents also sought novelty and greater digital banking choices (54 per cent), along with better rates and promotions (53 per cent)17.

Respondents who did not consider banking with a digital bank voiced concerns over IT security (68 per cent) and a lack of trust in digital-only banks (51 per cent)18.

Given the potential of Vietnam’s large unbanked population, Vietnamese FinTech firms can expect a receptive market for their services.

Vietnamese consumers already embrace digital-only banking services and e-wallets. Cryptocurrency may be a tougher sell due to an incomplete regulatory environment, while BNPL adoption is currently low but anticipated to grow rapidly in the next few years.

With so much of the global FinTech environment in flux, Vietnam’s FinTech companies have their work cut out for them: to answer Vietnam consumers’ concerns about their services, and rise above resistance to deliver the full potential of their digitalised services.

For more insights on Vietnam and ASEAN’s dynamic FinTech industry, please download FinTech in ASEAN 2021: Digital takes flight.

1An electronic survey was conducted from 25 August to 7 September 2021 with a total of 3,086 respondents across Indonesia (519), Malaysia (513), the Philippines (512), Singapore (508), Thailand (515) and Vietnam (519) to find out more about their digital financial behaviours.

2Question A1_2: Thinking about your shopping habits, which of the following payment methods have you used most often? Base: Total respondents.

3FinTech in ASEAN 2021 report by UOB, PwC Singapore and the Singapore FinTech Association, based on data from Tracxn (as at 30 September 2021, accessed on 5 October 2021).

4Question A3: Which e-wallet(s) do you use most regularly, if any? Base: Total respondents.

5Question A2: What are the factors that influence your choice of paying via a digital payment method? Base: Total respondents.

6Question D1: Have you invested using digital trading and wealth management platforms? If yes, which are the type of platforms that you have invested your funds in? Base: Total respondents.

7Question D5: Sustainability is becoming increasingly important, including in finance. A ‘Green Portfolio’ refers to investments with a focus on investing in companies that promote socially and environmentally conscious policies and business practices. Are you aware of such green investment related products? Base: Total respondents.

8Question D5A. Have you started investing in green investment related products? Base: Those who are aware of green investment related products.

9Question A7_1: A growing number of merchants worldwide are starting to accept digital currencies [like cryptocurrencies and central bank-issued digital currencies] as a mode of payment. Given a choice, would you use a digital currency? Base: Total respondents.

10Question A7_2: Which type of digital currencies would you trust MORE to use? Base: Those who would use digital currency.

11Question A7_3: Why would you want to use a digital currency? Base: Those who would use digital currency.

12Question A7_4: Why would you not want to use a digital currency? Base: Those who would not use digital currency.

13Question B6: Some retailers offer the option of pay later plans for purchases (electronics, fashion items, etc). Which pay later methods have you used or intend to use? Base: Total respondents.

14Question B6A: What are some of the reasons why you have not used or considered using 'Buy Now Pay Later' schemes? Base: Those who prefer not to pay later methods.

15Question E2: With the increase in digital-only banks across Asia, would you consider banking with a digital bank? Base: Total respondents.

16Question E3B: Which of the digital bank's offerings are you most likely to use? Base: Those who considered banking with a digital bank.

17Question E3A: What are the factors that would make you want to open a bank account with them? Base: Those who considered banking with a digital bank.

18Question E4A: Why would you not be interested to open a digital-only bank account with a new digital bank? Base: Those who didn't consider banking with a digital bank.