This is the fifth article in a six-part series exploring findings from the FinTech in ASEAN 2021 research. It looks at consumers’ digital financial adoption in Thailand.

Download FinTech in ASEAN 2021

Key takeaways

- Thailand leads ASEAN in the awareness of sustainability-focused investment assets.

- Thai consumers are the least likely in ASEAN to use e-wallets regularly; however, their usage of mobile banking apps for payments is highest in the region.

- About one in five people in Thailand (21 per cent) actively use digital currencies – the highest percentage in ASEAN.

- For Thai consumers, ease of access to peer-to-peer (P2P) services and lower interest rates for buy now, pay later (BNPL) services have led to greater adoption of alternative lending services.

The pandemic has boosted Thailand’s FinTech firms as well as its internet economy at large. According to the e-Conomy SEA 2021 report on digital consumption in Southeast Asia by Google, Temasek, and Bain & Company, nine out of 10 internet users in Thailand have made at least one online purchase – making it the country with the second-highest percentage of digital consumers in the region.

This digital consumption spans a range of major sectors, from e-commerce and online media to financial services and food delivery. Thailand’s gross merchandise volume (GMV) — the total volume of sales made via a marketplace — reached an estimated US$21 billion in 2021, fuelled by a 68 per cent growth in e-commerce from 2020.

Beyond the pandemic, this surge is set to become a long-term trend as consumers embrace digital adoption, spurring on the growth of digital financial services. The same report forecasts that Thailand’s internet economy will hit US$56 billion in value by 2025, from US$30 billion in 2021.

In UOB’s FinTech in ASEAN 2021 report, produced in collaboration with PwC Singapore and the Singapore FinTech Association, we looked at the shifting attitudes towards digital financial services in ASEAN-6 — namely Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam. Here, we highlight the key findings from Thailand1 alongside developments in the Thai FinTech ecosystem.

Thai retail investors hungry to back green investment portfolios

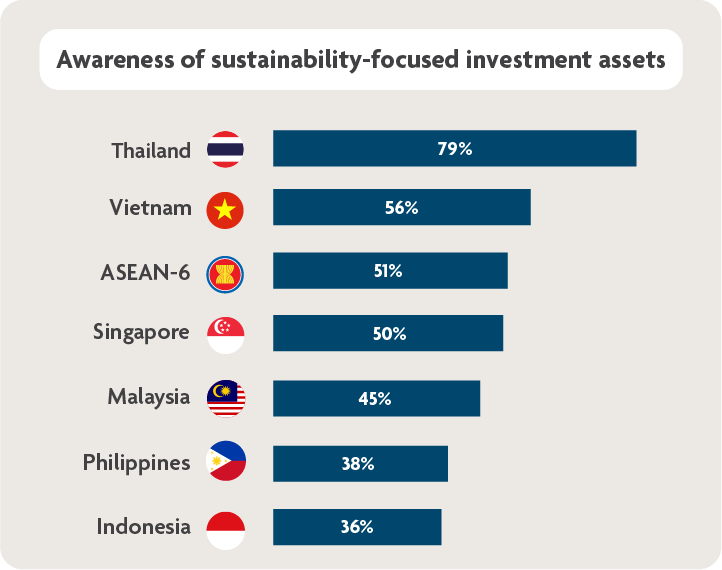

Thailand topped the list of ASEAN countries with the highest awareness of sustainability-focused assets, with 79 per cent of respondents saying they were aware compared with an average of 51 per cent across ASEAN-6 respondents2.

Figure 1: Thailand leads ASEAN in the awareness of green investment-related products. Source: FinTech in ASEAN 2021 research

Figure 1: Thailand leads ASEAN in the awareness of green investment-related products. Source: FinTech in ASEAN 2021 research

Sustainability is gaining popularity as more people embrace an environmentally friendly lifestyle. A 2021 study by Blackbox Research found that four in five Thais will use sustainable brands. PwC Thailand also found that Thai consumers have become more eco-conscious during the COVID-19 pandemic, with Thai investors and fund managers keen on assets that incorporate environmental, social and governance (ESG) issues. Fifty-seven per cent of our respondents who were aware of green investment products have purchased them3.

People in Thailand are committed to and aware of the importance of sustainability-linked practices and green investments. Photo: Noah Buscher/Unsplash

People in Thailand are committed to and aware of the importance of sustainability-linked practices and green investments. Photo: Noah Buscher/Unsplash

Institutional investors have also stepped up to offer green investment opportunities. The total asset value of Thai ESG mutual funds has grown four times to over US$1 billion since 2019. For Thai retail investors, interest in such sustainability-related investment products correlates with the promise of competitive returns. This was cited by 55 per cent of our respondents and is consistent with findings from the rest of the region4.

Mobile banking apps lead digital payments scene in Thailand

Digital payments services saw a surge in demand from pandemic-related restrictions. Thailand’s national digital payment service PromptPay facilitated an average of 28 million transactions daily in 2021, four times the number of transactions from pre-pandemic levels in 2019, showing encouraging signs of digital payment service adoption in Thailand.

From our survey, we found that convenience drives the use of digital payments (82 per cent), followed by the opportunity to earn rewards or loyalty points (44 per cent)5.

The convenience of digital payments makes it an attractive payment method for some. Photo: Clay Banks/Unsplash

The convenience of digital payments makes it an attractive payment method for some. Photo: Clay Banks/Unsplash

Mobile banking apps play a vital role in the adoption of digital payments in Thailand. Our survey found that while cash is still the most used payment method in Thailand, mobile banking apps topped the list of non-cash payment methods used in the past three months at 70 per cent, significantly higher than the ASEAN average of 52 per cent6.

Thinking about your shopping habits, which of the following payment methods have you used in the past three months (both in-store and online)?

| Payment method | Thailand | ASEAN-6 |

| Cash | 86% | 85% |

| Mobile banking apps | 70% | 52% |

| Debit cards/Credit cards | 43% | 56% |

| E-commerce payment platforms (e.g. ShopeePay, Q-money, Lazada wallet) |

39% | 43% |

| E-wallets | 37% | 60% |

| PayPal | 33% | 30% |

| Mobile payment app (e.g. Apple Pay, Samsung Pay, Google Pay) | 30% | 24% |

Table 1: Payment methods used in the last three months for both in-store and online payments in Thailand, compared with the ASEAN average. Source: FinTech in ASEAN 2021 research

Explore the data | Payment preferences of ASEAN consumers

According to usage data from Kasikornbank, Thai consumers are some of the world's most avid users of mobile banking applications, with 68.1 per cent of all internet users using them monthly in 2020. These users “prefer to go cashless, avoid leaving their house”, and habitually shop online.

These applications address the needs of consumers who use their smartphones to automate their investments, transfer funds and shop online. This shift in behaviour is likely to continue in the long term; in the e-Conomy SEA 2021 report, 98 per cent of Thai consumers indicated their intent to continue using digital services after the pandemic. The Monetary Authority of Singapore (MAS) and the Bank of Thailand (BOT) have also linked Singapore's PayNow with Thailand's PromptPay in April 2021, suggesting that adoption of digital payments will continue to rise in the coming years.

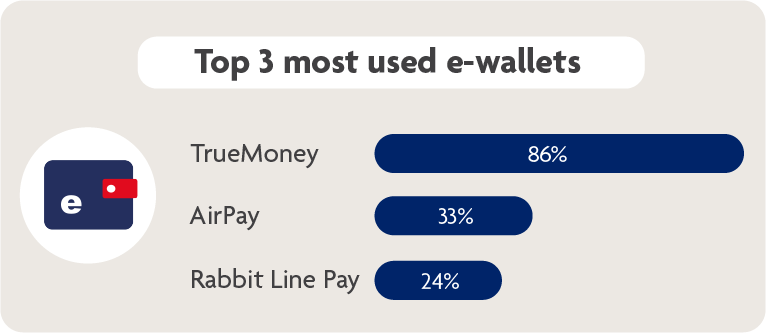

Although e-wallets did not seem to be top-of-mind among consumers, when prompted, 86 per cent of survey respondents noted they use TrueMoney7, an e-wallet backed by Ascend Money, Thailand’s first FinTech unicorn.

TrueMoney goes beyond e-wallet services to offer agent-based payment services, investing, and remittance services across Southeast Asia. It can be used in ecosystems like Google’s Play Store, Apple’s App Store and the Alibaba network, enhancing stickiness. According to a Reuters report, Ant Financial owns a 25-30 per cent stake in Ascend Money.

Figure 2: The TrueMoney wallet is the clear winner in the e-wallet market in Thailand, with a 53 per cent lead over AirPay. Source: FinTech in ASEAN 2021 research

Figure 2: The TrueMoney wallet is the clear winner in the e-wallet market in Thailand, with a 53 per cent lead over AirPay. Source: FinTech in ASEAN 2021 research

Preference for banking digitally augurs well for future digital banks

Thailand offers strong potential to new digital bank operators in Southeast Asia, thanks to the BOT’s forthcoming policy directions and guidelines for virtual banks slated for release by June 2022.

These initiatives are well-timed to meet consumer needs. Consumers seem to be supportive of digital banks, with 56 per cent8 of our respondents saying they would consider banking with a digital-only bank. Thailand also has the highest percentage of respondents in ASEAN-6 who prefer digital-only banking (44 per cent vs. the regional average of 35 per cent)9.

Banks provide many services, ranging from savings to loans and investments. What is your preferred channel when dealing with your bank?

| Preferred channel | Thailand | ASEAN-6 |

| Digital/Online only | 44% | 35% |

| I prefer having both physical and digital options | 29% | 30% |

| Bank branches and ATMs | 19% | 28% |

| Speak to a bank staff over a phone/video call | 8% | 7% |

Table 2: Preferred banking channels for Thai respondents vs. ASEAN-6. Source: FinTech in ASEAN 2021 research

To gain customers’ trust and eventual patronage, operators may consider reaching out through competitive marketing efforts, like offering better rates and promotions. Fifty-four per cent of our respondents showed that these incentives were key to convincing them to use a digital-only bank10.

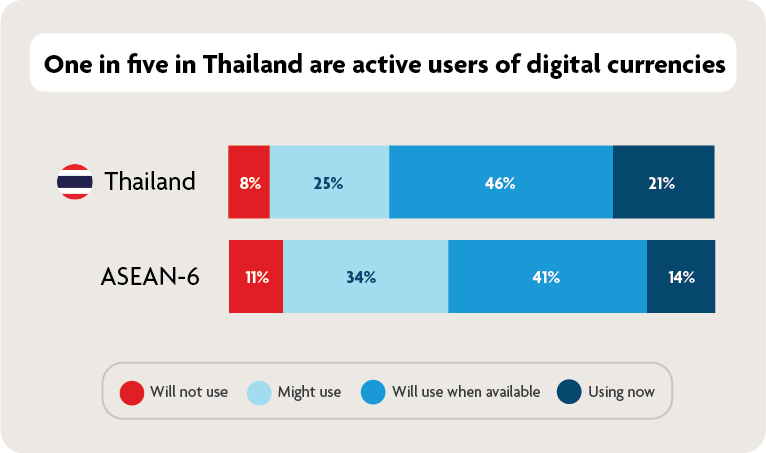

Thailand has the highest percentage of active digital currency users in ASEAN

Based on our survey, Thai consumers are currently the most open to using digital currencies in the region, including cryptocurrency and central bank digital currencies (CBDCs). Thailand has the largest percentage of active digital currency users (21 per cent) among its respondents, significantly higher than the ASEAN-6 average of 14 per cent11.

An active digital currency environment may explain Thailand's higher-than-average adoption rate. The BOT, Thailand's central bank, has shown support for digital currency, with plans to test its Retail Central Bank Digital Currency, Project Inthanon in late 2022.

Figure 3: When asked about whether they would use a digital currency like cryptocurrencies or CBDCs, most Thai consumers appear open to using it. Source: FinTech in ASEAN 2021 research

Figure 3: When asked about whether they would use a digital currency like cryptocurrencies or CBDCs, most Thai consumers appear open to using it. Source: FinTech in ASEAN 2021 research

Thailand's commercial sector drives digital currency development beyond central bank efforts. Bitkub, a Thai cryptocurrency exchange company, holds 95 per cent of the Thai market. They also sold a majority (51 per cent) stake to Siam Commercial Bank (SCB) in November 2021, signifying the 115-year-old local bank’s willingness to invest in emerging financial assets like cryptocurrency.

Despite these developments, challenges remain in improving digital currency adoption.

Digital currencies are still relatively new in the market, with an unproven track record for consumers. Nearly half (46 per cent) of respondents in Thailand adopt a 'wait and see' attitude towards digital currencies, despite the relatively positive reception environment. Out of those who would not use a digital currency, 42 per cent questioned the need for digital currencies given the ubiquity of cash, and 33 per cent admitted to a lack of trust and understanding of how they work12.

Why would you not want to use a digital currency?

| Reasons | Thailand | ASEAN-6 |

| Don't see a need to – cash will remain | 42% | 33% |

| Don't understand how digital currencies work | 33% | 43% |

| Don't trust digital currencies | 33% | 48% |

| Concerns over volatility of cryptocurrency value | 26% | 38% |

| Concern that my crypto assets will get hacked | 21% | 33% |

| Concerns over privacy if I use CBDCs | 16% | 27% |

Table 3: Digital currencies are not widely regarded as a necessary transaction medium - Thailand vs. ASEAN-6. Source: FinTech in ASEAN 2021 research

Thais remain cautious about using digital currencies. Security and stability concerns have prompted the BOT and the Securities and Exchange Commission to ban the use of cryptocurrency to pay for goods and services to minimise the risk of money laundering and cyber theft in financial markets. Meanwhile, a planned 15 per cent withholding tax on cryptocurrency transactions has been scrapped due to push back from crypto traders.

BNPL services overshadowed by credit cards

Despite the increasing popularity of BNPL services like Atome and hoolah in the region, Thai consumers still prefer to pay by credit card instalments (62 per cent) over BNPL services (36 per cent)13. Consumers who chose not to use BNPL explained it was because of a lack of awareness (41 per cent) and lack of understanding of how it works (25 per cent)14.

Some retailers offer the option of pay later plans for purchases (electronics, fashion items, etc). Which pay later methods have you used or intend to use?

| Pay later methods | Thailand | ASEAN-6 |

| Credit card instalment plans | 62% | 47% |

| Buy now, pay later schemes (e.g. Atome, hoolah) | 36% | 31% |

| I prefer to pay upfront | 23% | 35% |

Table 4: Preferred pay later methods in Thailand vs. ASEAN-6. Source: FinTech in ASEAN 2021 research

Among those who use BNPL services, respondents cite lower interest rates (67 per cent) and a desire to try out the services (57 per cent)15. To raise awareness and adoption in Thailand, BNPL providers can consider promoting these benefits to the public.

Another trend disrupting conventional lending and banking models is the rise of peer-to-peer (P2P) lending platforms as a more flexible method to get funding in times of need. These platforms connect lenders directly with borrowers without relying on a bank. Borrowers who may not fulfil the credit score or minimum loan amount requirements to borrow from a bank can have an alternative to access the funds they need. Currently, four P2P lending platforms – DeepSparks Peer Lending, NestiFly, Peer Power Platform and Daingern Dotcom – are being tested under the BOT’s regulatory sandbox in preparation for operation in 2022.

Thailand is open to the use of alternative lending platforms. Alongside Vietnam, respondents in Thailand were the most open among ASEAN-6 peers (26 per cent)16 to consider these platforms to borrow money, citing ease of access compared to getting a bank loan, fast approval time, and curiosity as compelling reasons17. This is encouraging news for alternative lending firms, which dominate Thailand's FinTech scene.

The Thai consumer is receptive to non-traditional financial services, especially in green investments and digital currencies. For businesses and FinTech providers, addressing barriers to the adoption of digital currencies and establishing a commitment to sustainability to meet the demand for green investments will be the next avenue for growth for the industry.

For more insights on Thailand and ASEAN’s dynamic FinTech industry, please download FinTech in ASEAN 2021: Digital takes flight.

1An electronic survey was conducted from 25 August to 7 September 2021 with a total of 3,086 respondents across Indonesia (519), Malaysia (513), the Philippines (512), Singapore (508), Thailand (515) and Vietnam (519) to find out more about their digital financial behaviours.

2FinTech in ASEAN 2021 research question D5: Sustainability is becoming increasingly important, including in finance. A ‘Green Portfolio’ refers to investments with a focus on investing in companies that promote socially and environmentally conscious policies and business practices. Are you aware of such green investment related products? Base: Total respondents.

3Question D5A: Have you started investing in green investment related products? Base: Those who are aware of green investment related products.

4Question D6: What factors would make you invest in / invest more in green investment related products? Base: Total respondents.

5Question A2: What are the factors that influence your choice of paying via a digital payment method? Base: Total respondents.

6Question A1: Thinking about your shopping habits, which of the following payment methods have you used in the past 3 months (both in-store and online)? Base: Total respondents.

7Question A3: Which e-wallet(s) do you use most regularly, if any? Base: Total respondents.

8Question E2: With the increase in digital-only banks across Asia, would you consider banking with a digital bank? Base: Total respondents.

9Question E1: Banks provide many services, ranging from savings account to loans and investments. What is your preferred channel when dealing with your bank? Base: Total respondents.

10Question E3A: What are the factors that would make you want to open a bank account with them? Base: Those who considered banking with a digital bank

11Question A7_1: A growing number of merchants worldwide are starting to accept digital currencies [like cryptocurrencies and central bank-issued digital currencies] as a mode of payment. Given a choice, would you use a digital currency? Base: Total respondents.

12Question A7_4: Why would you not want to use a digital currency? Base: Those who would not use digital currency.

13Question B6: Some retailers offer the option of pay later plans for purchases (electronics, fashion items, etc). Which pay later methods have you used or intend to use? Base: Total respondents.

14Question B6A: What are some of the reasons why you have not used or considered using 'Buy Now Pay Later' schemes? Base: Those who prefer not to pay later methods.

15Question B7: What are some reasons why you have chosen or may choose to use BNPL schemes? Base: Those who have used or intend to use pay later methods.

16Question B1: If you need to borrow some money to ease your cash flow (i.e. emergency or medical needs), which lending facilities would you use? Base: Total respondents.

17Question B4. What led you to use/consider an alternative Peer-to-peer (P2P) lending platform? Base: Those would use Alternative / Peer-to-Peer (P2P) online lending platforms to borrow money.