This is the third article in a six-part series exploring findings from the FinTech in ASEAN 2021 research. It looks at consumers’ digital financial adoption in the Philippines.

Download FinTech in ASEAN 2021

Key takeaways

- The Philippines is still a cash-reliant country, but there has been a steady increase in digital payments due to the pandemic.

- Filipinos exhibit the highest level of trust in cryptocurrency compared with other ASEAN countries; one in three Filipinos use cryptocurrency exchanges.

- Buy now, pay later schemes, which can be customised by merchants and repaid in a number of ways, are expected to grow in the country.

- More Filipinos are expected to bank with digital-only banks as a supplement to existing bank products and services.

According to the Philippines’ central bank, Bangko Sentral ng Pilipinas (BSP), about 48 per cent or 36.9 million Filipino adults do not have a bank account, as of the end of 2020. With COVID-19 making digital payments preferable for its convenience and safety, this presents an opportunity for FinTech companies to fill in the gaps through e-wallets, buy now, pay later (BNPL) schemes, and digital banking.

While Filipinos have been slow to adopt new financial services, our research shows that they are becoming more open to digital products, especially since the onset of the pandemic.

In UOB’s FinTech in ASEAN 2021 report, produced in collaboration with PwC Singapore and the Singapore FinTech Association, we examined the changes in consumer behaviour in the new normal across ASEAN-6 countries — Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam. Our consumer survey1 results paint a clear picture of Filipinos’ growing trust and steady adoption of digital financial services.

Cash is still king in the Philippines, but that’s changing

Cash is still king in the Philippines with 93 per cent of respondents using cash in the last three months2 and 60 per cent of respondents saying it is their most used mode of payment3, the highest percentage for cash among ASEAN-6 countries.

This is not surprising, as Filipinos have historically exhibited a strong preference for cash over digital payments. In 2018, cash still accounted for 99 per cent of local transactions, according to the BSP. This was due to a lack of awareness of digital wallets and how they work, security concerns, and the country’s slow internet speeds.

Which of these payment methods do you use most often?

| Payment method | Philippines | ASEAN-6 |

| Cash | 60% | 38% |

| Debit/Credit cards | 11% | 20% |

| E-wallets | 16% | 20% |

| Mobile banking apps | 4% | 12% |

| E-commerce payment platforms | 6% | 6% |

Table 1: Top five payment methods most frequently used by respondents in the Philippines vs. ASEAN-6. Source: FinTech in ASEAN 2021 research

In 2020, the pandemic spurred the adoption of digital payments, both by merchants and consumers. According to the State of Digital Payments in the Philippines 2021 report, digital merchant payments grew 25 per cent in the first half of 2020, fuelled by the use of prepaid cards and electronic fund transfers. In our research, respondents cited convenience (80 per cent), followed by the ability to earn rewards and loyalty points (63 per cent) and cash rebates (48 per cent)4 as their top reasons for switching to digital payments.

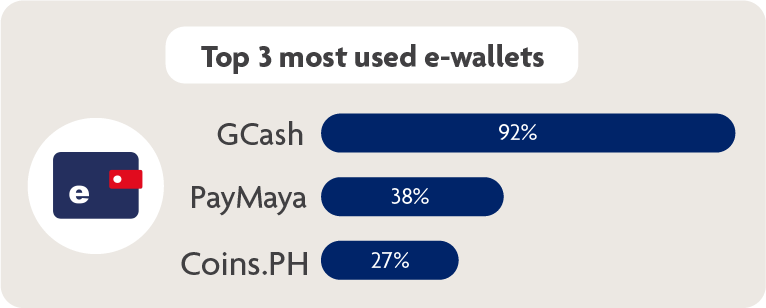

Figure 1: GCash is the most used e-wallet in the Philippines5 due to its low service fee charges and good user experience. Source: FinTech in ASEAN 2021 research

Research group Nielsen Company revealed that Filipinos trust GCash more than other digital wallet brands specifically for money transfers; mobile wallet users prefer GCash because it charges little to no service fees for digital transactions. Here, trust may be a byproduct of familiarity and good user experience—in an interview with us, Martha Sazon, President and CEO of GCash said, “As people begin to use digital payments in all aspects of their lives, they become more familiar with and trusting of digital payments platforms.”

Explore the data | Payment preferences of ASEAN consumers

Cryptocurrency is gaining speed as a wealth management platform, but other digital platforms lag behind

In the Philippines, 55 per cent of respondents have invested using a digital trading and wealth management platform. Among those platforms, cryptocurrency is gaining more traction among Filipino respondents, with 33 per cent of Filipinos investing their funds into a cryptocurrency exchange. This is the second-highest percentage in the region, second only to Thailand at 39 per cent6. Notably, the Philippines also exhibits the highest levels of trust in crypto (48 per cent) compared with the ASEAN average (39 per cent)7.

Trust in central bank-issued digital currencies came in at 52 per cent, significantly lower than the regional average (61 per cent). According to the Philippines FinTech Report 2022, the value of cryptocurrency transactions from 2019 to 2020 jumped 410 per cent to reach P76 billion (US$1.5 billion), while volume rose to 7.2 million transactions.

Have you invested using digital trading and wealth management platforms? If yes, which are the types of platforms you have invested your funds in?

| Type of digital investment platform | Philippines | ASEAN-6 |

| Traditional online brokerage platforms | 25% | 31% |

| Online-only trading platforms | 16% | 22% |

| Cryptocurrency exchanges | 33% | 27% |

| Financial institution-backed robo-advisors | 6% | 14% |

| Non-bank robo-advisors | 4% | 16% |

| Micro-savings cum investment platforms | 15% | 13% |

| Have not invested using digital assets and wealth management platforms | 45% | 41% |

Table 2: Percentage of users who have invested using digital trading and wealth management platforms in the Philippines vs. ASEAN-6. Source: FinTech in ASEAN 2021 research

Cryptocurrency exchanges is followed by traditional online brokerage platforms (25 per cent) and online-only trading platforms (16 per cent).

Meanwhile, 45 per cent of Filipino respondents have yet to use a digital investing platform. This is the highest in the region, tied with Indonesia. The (perceived) large sum of money needed to start investing remains a significant barrier to entry for almost half of Filipino respondents (45 per cent). Financial advisors also attribute this perceived lack of money to a lack of awareness of financial options. This aligns with other reasons Filipinos feel apprehensive about investing8:

- They feel they do not know enough to invest (44 per cent);

- need someone to guide them on the platform (43 per cent);

- or are afraid of the risks involved in investing (42 per cent).

While demand for green investments is growing worldwide, only 38 per cent of Filipinos are aware of green investment-related products9, compared with the ASEAN average of 51 per cent.

Explore the data | How ASEAN consumers are investing

Digital lending has an opportunity to capture the unbanked population

When it comes to buying things on credit, Filipinos prefer the use of credit card instalment plans (54 per cent) over buy now, pay later schemes (30 per cent)10.

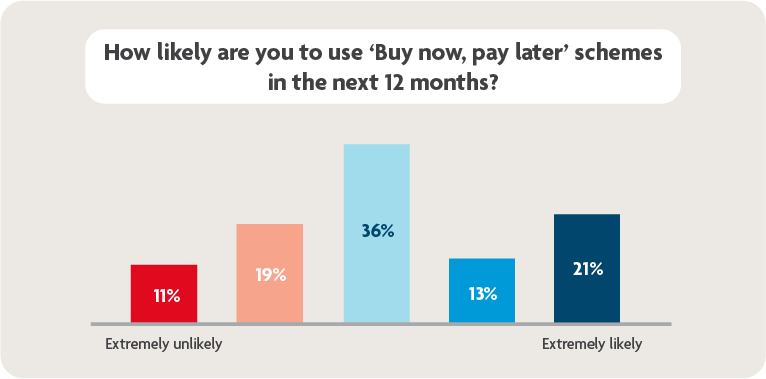

Figure 2: Most Filipinos who have not used BNPL before are on the fence (36 per cent) with it. Source: FinTech in ASEAN 2021 research

Figure 2: Most Filipinos who have not used BNPL before are on the fence (36 per cent) with it. Source: FinTech in ASEAN 2021 research

The biggest barrier to adoption is the perceived lack of need; 39 per cent of Filipinos who have not used BNPL before said they saw no real benefit to their use at the moment. Meanwhile, 31 per cent said they were unaware such schemes existed11.

Given the Philippines’ large unbanked population, BNPL products have plenty of strategic opportunities to appeal to the market. BNPL providers allow Filipinos to pay in different ways, such as via digital wallets or payments at 7-Eleven. Meanwhile, BNPL merchants can customise instalment plans that suit the credit appetite of customers, even if they don’t have a credit record. As a result, BNPL payment adoption is expected to grow steadily from 2021 to 2028 with a compound annual growth rate (CAGR) of 27.4 per cent12. Some key players in BNPL services include BillEase, Jungle, Cashalo and TendoPay.

Interior of a retail outlet selling leather goods. BNPL services allow customers to pay for items via instalments, without the need for a credit card. Photo: Shattha Pilabut / Pexels

Interior of a retail outlet selling leather goods. BNPL services allow customers to pay for items via instalments, without the need for a credit card. Photo: Shattha Pilabut / Pexels

Filipinos are open to banking with digital banks, but prefer having both physical and digital banking options

In 2021, the BSP awarded digital banking licenses to Maya Bank, Overseas Filipino Bank, Tonik Digital Bank, UNOBank, Union Digital Bank and Gotyme, with the hope of shifting 50 per cent of total retail transactions in the Philippines to digital and increasing the number of banked Filipino adults to 70 per cent by 2023.

The majority of Filipino respondents are open to digital-only banks, with 60 per cent saying they would consider banking with one13. The primary reasons cited are better rates and promotions (73 per cent), trying something new (45 per cent), and perks tied to e-commerce sites and food delivery platforms (44 per cent)14. Notably, 40 per cent of Filipinos said they would consider banking with these digital-only banks because they think favourably of the companies behind them.

In terms of banking channels, Filipinos prefer to keep their options open: almost two in five (39 per cent) liked having both physical and digital options when it comes to managing their finances – this is the highest in ASEAN15.

Based on our findings, Filipinos’ adoption of digital financial services rides on an upward trajectory. As such, improvements in basic infrastructure such as the internet and electricity will be necessary to support the growing demand for digital products. Financial literacy also needs to be a key focus area, particularly among the underbanked, so they too can reap the benefits offered by FinTech solutions.

For more insights on The Philippines and ASEAN’s dynamic FinTech industry, please download FinTech in ASEAN 2021: Digital takes flight.

1An electronic survey was conducted from 25 August to 7 September 2021 with a total of 3,086 respondents across Indonesia (519), Malaysia (513), the Philippines (512), Singapore (508), Thailand (515) and Vietnam (519) to find out more about their digital financial behaviours.

2FinTech in ASEAN 2021 research question A1: Thinking about your shopping habits, which of the following payment methods have you used in the past 3 months (both in-store and online)? Base: Total respondents

3Question A1_2: And which of these have you used MOST OFTEN? Base: Total respondents

4Question A2: What are the factors that influence your choice of paying via a digital payment method? Base: Total respondents

5Question A3: Which e-wallet(s) do you use most regularly, if any? Base: Total respondents

6Question D1: Have you invested using digital trading and wealth management platforms? If yes, which are the type of platforms that you have invested your funds in? Base: Total respondents

7Question A7_2: Which type of digital currencies would you trust MORE to use? Base: Those who would use digital currency

8Question D1C: What are some of the reasons stopping you from investing using a digital and wealth management platform? Base: Those who have not invested using digital trading and wealth management platforms

9Question D5: Sustainability is becoming increasingly important, including in finance. A 'Green Portfolio' refers to investments with a focus on investing in companies that promote socially and environmentally conscious policies and business practices. Are you aware of such green investment-related products? Base: Total respondents

10Question B6: Some retailers offer the option of pay later plans for purchases (electronics, fashion items, etc). Which pay later methods have you used or intend to use? Base: Total respondents

11Question B6A: What are some of the reasons why you have not used or considered using 'Buy Now Pay Later' schemes? Base: Those who prefer not to use pay later methods

12Philippines Buy Now Pay Later Market Report 2021: BNPL Payments to Grow by 66.6% in 2021 - Forecast to 2028, Research and Markets news, 23 September 2021

13Question E2: With the increase in digital-only banks across Asia, would you consider banking with a digital bank? Base: Total respondents

14Question E3A: What are the factors that would make you want to open a bank account with them? Base: Those who considered banking with a digital bank

15Question E1: Banks provide many services, ranging from savings account to loans and investments. What is your preferred channel when dealing with your bank? Base: Total respondents