This is the fourth article in a six-part series exploring findings from the FinTech in ASEAN 2021 research. It looks at consumers’ digital financial adoption in Malaysia.

Download FinTech in ASEAN 2021

Key takeaways

- Shifts in consumption during the pandemic sped up the adoption of digital financial services for Malaysian consumers.

- E-wallet usage is closing in on cash and debit/credit cards, thanks in part to government subsidies delivered through e-wallets.

- Online sales of motor insurance highest in region, driven by government policy responding to pandemic.

- Overall, consumer sentiment towards digital banks is positive. Upcoming digital-only banks must address concerns over trust and data security – the top two reasons why our respondents did not consider banking with a digital bank.

After having gone through various permutations of Movement Control Orders and other pandemic-related restrictions, Malaysian consumers have had little choice but to shift their consumption behaviours online.

According to Google's e-Conomy SEA 2021 report, the nation has seen over three million new digital consumers, from the start of the pandemic up until the first half of 2021. And at last count, 98 per cent of Malaysian businesses now accept digital payments1.

These factors tie directly into the growing popularity of FinTech services in Malaysia, with consumer interest spiking demand in e-wallets, digital insurance, and digital banking.

As a follow-up to UOB’s FinTech in ASEAN 2021 report2, produced in collaboration with PwC Singapore and the Singapore FinTech Association, we now zoom in on consumer sentiments on FinTech services in Malaysia. In this article, we highlight the key findings associated with developments in the Malaysian FinTech ecosystem.

E-wallets close in on debit/credit cards and cash

Since the pandemic, more merchants have started to accept digital payments, as seen in this café displaying the DuitNow QR code (Malaysia’s interoperable QR standard). Photo: Lennie Chan

While cash and debit/credit cards remain the top two preferred payment methods for Malaysian consumers (81 per cent and 79 per cent respectively), e-wallets are not far behind (74 per cent)3. In fact, Malaysian e-wallet usage exceeds the ASEAN-6 average by 14 per cent.

Thinking about your shopping habits, which of the following payment methods have you used in the past three months (both in-store and online)?

| Malaysia | ASEAN-6 | |

| Cash | 81% | 85% |

| Debit/Credit cards | 79% | 56% |

| E-wallets | 74% | 60% |

| Mobile banking apps | 55% | 52% |

| Mobile payment apps | 21% | 24% |

| E-commerce payment platforms | 54% | 43% |

Table 1: Top payment methods used in-store and online in the last three months: Malaysia vs. ASEAN-6. Source: FinTech in ASEAN 2021 research

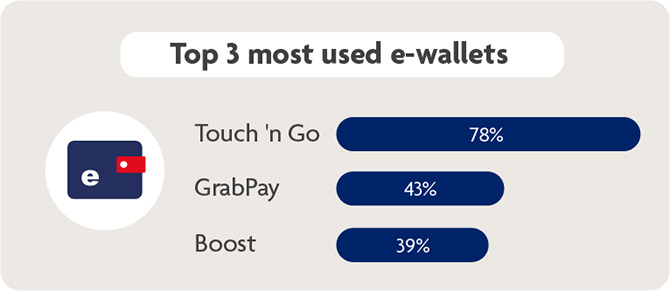

Among e-wallet players, Touch ’n Go is a clear favourite among respondents. A joint venture between Touch ’n Go Group and China’s Ant Financial, the Touch ’n Go e-wallet leads the market with more than 16 million users and 550,000 merchants on board4, compared with Boost’s 9.6 million users5. The Touch ’n Go brand is linked to its longstanding mobility solution for parking, tolls and public transport in Malaysia. Touch ’n Go also launched its GO+ micro-investment platform in March 2021, acquiring one million users within three months6 of its launch. Meanwhile, its digital personal loan facility GOpinjam aims to disburse up to MYR300 million through 20227.

Touch ’n Go e-wallet is the most popular e-wallet in Malaysia, with more than 16 million users nationwide. Source: FinTech in ASEAN 2021 research8

Malaysians also favour payments via e-commerce payment platforms (54 per cent) like ShopeePay and LazadaWallet, the country’s top two performers in the category. They lead the region in the usage of these payment methods (54 per cent versus the ASEAN-6 average of 43 per cent).

This increased interest in e-payments represents a significant turnaround in Malaysian consumer opinion. An earlier survey found that e-wallets were initially perceived as ‘troublesome and worthless’9; several intervening factors have since reframed the Malaysian consumer’s perception of e-payments as a whole, contributing to its healthy growth. These include:

- The enforcement of Malaysia’s Movement Control Order (MCO) shifted retail activities to online venues, leading to the growth in digital payments.

- Necessity led to e-wallet conversion, most often seen in prudent demographics like senior citizens and migrant workers, who weren’t initially on board with e-payment technology but now use such services regularly. According to Lazada Malaysia chief operating officer Shah Suriye Rubhen, during the MCO, the platform saw a 120 per cent and 220 per cent increase in the number of users and buyers aged 50 and above respectively10.

- The Malaysian Government started initiatives like the e-Tunai Rakyat campaign to incentivise e-wallet usage. The campaign gives away MYR30 worth of e-wallet credit to newly-registered Touch ’n Go e-wallet, Boost, and GrabPay users11.

Explore the data | Payment preferences of ASEAN consumers

Cryptocurrencies draw lukewarm reception in Malaysia

Our survey found only middling enthusiasm for cryptocurrency among Malaysian respondents; only 12 per cent admitted using cryptocurrencies, almost level with ASEAN-6’s 14 per cent average. Forty-two per cent answered “maybe” to the possibility of using cryptocurrencies, compared to the 34 per cent ASEAN-6 average for that response12.

The present regulatory landscape for crypto in Malaysia may help account for this lukewarm level of acceptance. Malaysia’s Securities Commission (SC) and central bank Bank Negara Malaysia (BNM) have explicitly disavowed cryptocurrency as legal tender in Malaysia, following this up with public advisories of crypto’s vulnerability to price volatility and security threats13.

Our survey found only middling enthusiasm for cryptocurrency among Malaysian respondents. Photo: RODNAE Productions/Pexels

When survey respondents were asked why they didn’t use digital currencies, 58 per cent cited a lack of trust, while 42 per cent admitted they ‘don’t understand how digital currencies work’14. If cryptocurrency providers and exchanges were to make any headway addressing this trust gap, they may need to include confidence-building initiatives to improve the perception of cryptocurrency in Malaysia.

Interestingly, 62 per cent of Malaysian respondents were more open to using a central bank issued digital currency (CBDC)15. This suggests that a digital legal tender issued and backed by BNM may shift people’s current stance on digital currencies. Presently, the Malaysian central bank reports no immediate plans to issue a CBDC; however, as of January 2022, they are actively assessing the feasibility of issuing a CBDC16.

Malaysia leads demand for digital motor insurance in region

Malaysia may trail the rest of ASEAN-6 in purchasing insurance online, but it outperforms the region in one area: the online purchase of motor insurance.

This might be due to a government directive issued in the midst of the pandemic: as MCO closed insurers’ offices nationwide in 2020, the government urged people to renew and purchase motor insurance online instead17. Our survey may simply reflect the outcome of this policy – motor insurance was the most purchased insurance category online in Malaysia at 63 per cent, the highest in the region18 (see Table 2).

Among consumers who have purchased digital insurance, 75 per cent cited convenience as their primary reason for buying insurance online, followed by faster approvals and better deals (60 per cent)19.

What types of insurance have you purchased online?

| Malaysia | ASEAN-6 | |

| Motor insurance | 63% | 45% |

| Health insurance | 44% | 53% |

| Life insurance | 40% | 48% |

| Accident plans | 29% | 28% |

| Travel insurance | 27% | 31% |

| Property insurance | 17% | 17% |

| Disability insurance | 7% | 9% |

Table 2: Types of insurance purchased online: Malaysia vs. ASEAN-6. Source: FinTech in ASEAN 2021 research

Based on our survey’s findings, Malaysians were the most open in the region to sharing their driving and transport data with insurance companies, in return for a more personalised plan or potentially cheaper premiums (42 per cent vs. the regional average of 37 per cent).

This represents an opening for InsurTech companies in Malaysia to invest in telematics technology that can collect driving behaviour data for predicting claims frequency, improve return on investment for insurance companies, and reward Malaysian vehicle owners with cheaper premiums or other incentives.

Explore the data | Privacy vs. Potential perks

AXA Affin General Insurance Berhad’s SmartDrive Safe insurance product, for instance, installs a “microtag” device in premium-holders’ cars. The data collected by the microtag (speed, braking, cornering, and how frequently the driver uses their phone while driving, among others) can be used to earn points for safe driving practices; premium-holders can exchange these points for e-vouchers with partner merchants20.

Telematics-linked insurance products like AXA’s have led to steady growth in the Southeast Asia automotive original equipment manufacturing (OEM) telematics market, which is expected to grow at a CAGR of 19.3 per cent to reach US$5.55 billion in value by 202521.

Compared with their ASEAN-6 counterparts, Malaysians are the most willing in the region to sharing their driving and transport data with insurance companies. Photo: George Bakos/Unsplash

Government guidance on digital insurance licences are likely to encourage further interest and uptake of protection plans in Malaysia. On 4 January 2022, BNM issued a discussion paper intended to lay the foundations for licence issuances to new digital insurers and takaful operators (DITO).

Additions to the ranks of insurance providers in Malaysia, along with improved accessibility to coverage, may help enhance financial inclusion in the country and plug a critical protection gap among Malaysians with lower income. For example, 2017 data from BNM reveals a significant gap of 20 percentage points in insurance and takaful coverage between the bottom 40 per cent (B40) income group and the national working population22.

Given this market segment’s vulnerability to events like the devastating flash floods in December 202123 and the ongoing pandemic, their need for substantial insurance coverage has never been more important.

Active central bank support and positive consumer sentiment fueling digital bank growth

The survey results have uncovered positive overall consumer sentiment towards digital-only banks, with just 8 per cent saying they wouldn’t consider banking with a digital bank. Fifty-two per cent of respondents said “yes” to the possibility of signing up with a digital-only bank24.

For the respondents who answered in the affirmative, 69 per cent reported that they were looking for better rates and promotions as a prerequisite for opening an account25. Out of a menu of digital bank's offerings, respondents reported they were most likely to open a new savings (52 per cent) or wealth management account (23 per cent)26.

BNM received 29 applications for five digital bank licences; the Malaysian central bank announced the successful bidders in late April 2022. Photo: Mohd Jon Ramlan/Unsplash

Policy-makers in Malaysia are already laying the groundwork for digital-only banks in the country. In late April, BNM announced the winners of the country’s first five digital banking licences, making Malaysia the third country in ASEAN (after Singapore and the Philippines) to issue digital banking licences to potential operators.

Financial inclusion is a key pillar of BNM27, and the new digital banks are expected to improve financial inclusion for Malaysians, of whom 55 per cent are counted among the “underbanked” and “unbanked”28.

Despite promising demand in Malaysia, digital-only banks looking to open in the country must look beyond simply attracting new customers for their offerings; they also need to address underlying concerns about trust and security to win over potential customers.

Our survey’s findings bear this out. Concerns over trust (55 per cent) and how digital banks may treat IT security and consumer data (57 per cent) were the top two reasons cited by respondents who did not consider banking with a digital bank.

While the rising adoption of digital financial services is positive for Malaysia, fostering long-term consumer trust is something providers of financial services will need to focus on.

For more insights on Malaysia and ASEAN’s dynamic FinTech industry, please download FinTech in ASEAN 2021: Digital takes flight.

1e-Conomy SEA 2021 report, Google, Temasek and Bain & Company.

2An electronic survey was conducted from 25 August to 7 September 2021 with a total of 3,086 respondents across Indonesia (519), Malaysia (513), the Philippines (512), Singapore (508), Thailand (515) and Vietnam (519) to find out more about their digital financial behaviours.

3Question A1: Thinking about your shopping habits, which of the following payment methods have you used in the past 3 months (both in-store and online)? Base: Total respondents.

4Touch 'n Go official site, retrieved April 2022.

5Boost doubles revenue, on track for Southeast Asia expansion and growth, Boost press release, 26 January 2022.

6From strength to strength, Touch 'n Go article, August 2021.

7Touch 'n Go's GOpinjam facility to promote responsible microlending, The Edge Markets article, 1 April 2022.

8Question A3: Which e-wallet(s) do you use most regularly, if any? Base: Total respondents.

9Impact of COVID-19 Pandemic on Consumer Behavior towards the Intention to Use E-Wallet in Malaysia, International Journal of Accounting & Finance in Asia Pasific (IJAFAP) article, October 2021.

10Seniors becoming digitally savvy during pandemic, The Edge Malaysia article, 24 October 2020.

11RM30 e-Tunai: Here’s What You Need To Know, the Rakyat Post article, 10 January 2020.

12Question A7_1: A growing number of merchants worldwide are starting to accept digital currencies [like cryptocurrencies and central bank-issued digital currencies] as a mode of payment. Given a choice, would you use a digital currency? Base: Total respondents.

13BNM and SC's Joint Response on “Policy confusion over cryptocurrencies” - Media Releases, Securities Commission Malaysia article, December 2020.

14Question A7_4. Why would you not want to use a digital currency? Base: Those who would not use digital currency.

15Question A7_2: Which type of digital currencies would you trust MORE to use? Base: Those who would use digital currency.

16Malaysia's Digital Currency: Central Bank Studies Need for Electronic Money, Bloomberg article, January 2022.

17Wee: Renew motor insurance and licence online, The Star Online article, March 2020.

18Question C1A: What types of insurance have you purchased online? Base: Those who have purchased insurance online before.

19Question C2: What are some reasons why you opted to buy insurance online? Base: Those who have purchased insurance online before.

20SmartDrive Safe, AXA Malaysia article, 2022.

21Automotive OEM Telematics in Southeast Asia Market to Reach $5.55 Billion by 2025, Allied Market Research article, May 2021.

22Upcoming licenses for digital insurers create buzz in industry, The Edge Markets article, January 2022.

23Malaysia : Flood : 2021/12/17, Asian Disaster Reduction Center report, December 2021.

24Question E2: With the increase in digital-only banks across Asia, would you consider banking with a digital bank? Base: Total respondents.

25Question E3A: What are the factors that would make you want to open a bank account with them? Base: Those who considered banking with a digital bank.

26Question E3B: Which of the digital bank's offerings are you most likely to use? Base: Those who considered banking with a digital bank.

27Bank Negara Malaysia, Financial Inclusion report, January 2021.

28Fulfilling its Promise: The future of Southeast Asia's digital financial services, Bain & Company report, October 2019.