This third white paper, co-published by Deloitte and UOB, examines the use of innovation and advanced analytics in a world dominated by digital technology and disruption. We will touch on potential risks that stem from business disruptions in unprecedented times, including how the global coronavirus pandemic has resulted in a rise in financial crime. We describe how technology and innovation are necessary in weathering unforeseen circumstances and in achieving better outcomes for Financial Crime Compliance (FCC).

The financial services sector is now facing greater challenges from sophisticated criminals who have found ways to profit from an increasingly digitalised economy, accelerated partly due to the COVID-19 pandemic. Efforts to enhance detection by augmenting investments made in artificial intelligence (AI) and machine learning (ML), analytics and robotic process automation (RPA) have paid off. However, more work still needs to be done to ensure that the sector is able to adequately respond and curb various risks including financial crime, and maintain the trust it has established with its relevant stakeholders.

Compliance is about doing things right. A strong risk management and compliance culture demands financial institutions examine how their systems measure up against current threats and the new ways in which criminals seek to infiltrate the financial system. Investing in technologies such as artificial intelligence and analytics are important as they give financial institutions the firepower they need to fight back and to keep the system secure.

Victor Ngo, Head of Group Compliance, UOB

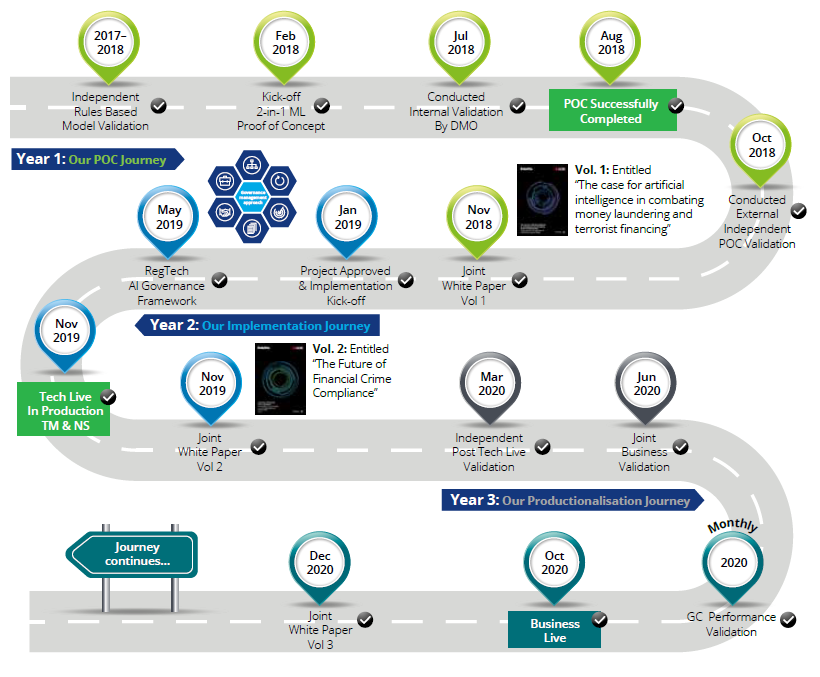

Our white paper examines the ongoing journey of UOB’s AI anti-money laundering solution, from proof of concept (POC) to production stage, explaining how it gradually calibrated models for integration into current banking operations. It outlines the justification for the Bank’s investment in advanced analytics, AI/ML and robotics – noting how these have been instrumental in mitigating major disruptions.

Deloitte and UOB previously published two white papers in 2018 and 2019. The first white paper titled, “The case for artificial intelligence in combating money laundering and terrorist financing” explains how financial institutions (FI) can leverage innovation to manage FCC effectively. It shared UOB’s case study in successfully piloting machine learning to identify suspicious accounts and transactions with greater accuracy. The second white paper titled, “The future of financial crime compliance”, depicted the future-state of FCC that incorporates AI and Machine Learning, Advance Analytics and RPA to manage evolving financial crime risks. It details what is involved to operationalise ML for FCC, taking reference from UOB’s successfully implemented ML model.

UOB’s Transformation Story

UOB’s AI journey – A prudent approach to developing a RegTech ecosystem

UOB’s AI journey – A prudent approach to developing a RegTech ecosystem

Sharing UOB’s transformation story – on its use of innovative technologies to combat financial crime provides insight into the implementation process and challenges experienced. It sheds light on the governance of the technology, the engagement required with stakeholders to build trust in the solutions, and how to integrate these into the business as usual operating environment. We hope the insights shared in this white paper will encourage FIs to focus on applying FCC technologies, reaping its benefits, while helping to innovate in and enhance FCC efforts across the industry.