About this series

Building Asia is a collection of business stories on CNA that examines the financial forces driving Asia's position as an economic powerhouse.

Perennial Holdings – Evolving beyond borders is the 20th episode in the Building Asia with UOB series and was first aired on 13 December 2021. It looks at how UOB supported Perennial Holdings in its long-term growth strategy and expansion beyond Singapore into China and Southeast Asia.

Transcript

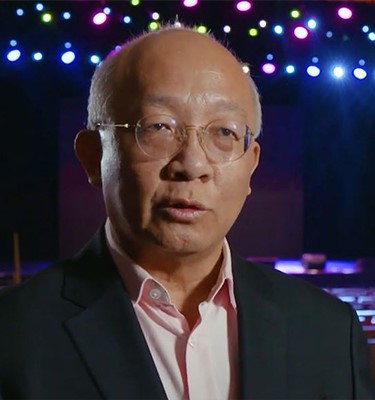

Pua Seck Guan (CEO, Perennial Holdings Pte Ltd, COO, Wilmar International Ltd):

Perennial is an integrated real estate and healthcare company. We have a total asset size of more than S$10 billion. Our businesses are mainly in Singapore, China and Southeast Asia.

We only acquire property where we can create value. We own the likes of Capitol, CHIJMES, AXA Tower, Perennial Business City.

We started our company in 2009. UOB came in to support my very first acquisition and since then UOB has helped us to create our assets to today more than S$10 billion.

Leong Yung Chee (Head, Corporate Banking, UOB):

As a principal bank with Perennial, UOB is committed to providing them with solutions that help them achieve their business goals.

Some of the more complex deals that we have done with the Group have also won banking awards. For example, the Asian Banking & Finance M&A Deal of the Year Award for the acquisition of United Engineers.

Pua Seck Guan:

For United Engineers, I formed a consortium. And we showed a plan to UOB. “This is what we intend to do”.

It’s a very big deal – some even said, "This is a snake trying to swallow an elephant".

We put up a very credible proposal and credible consortium and finally, we won the bid.

Leong Yung Chee:

This is a relationship that has gone from strength to strength over the years. Driven by mutual understanding and business insight.

Clients like Perennial demonstrate our institutional capabilities in driving seamless connectivity, to power their business ambitions in ASEAN and China.

Pua Seck Guan:

In China, we own quite a fair bit of high-speed rail TOD (Transport Oriented Development) projects, like in Chengdu, Xi’an, Tianjin, Kunming and the latest is Hangzhou.

We pivoted from just pure real estate to healthcare, medical care about seven years ago.

UOB saw what we did in our eldercare homes in Shanghai, our integrated medical hub in Chengdu.

They believed this is the value that we can create in the coming years.

Leong Yung Chee:

Our funding also supports their bids for land parcels near transportation hubs in China.

With our global network of over 500 offices, UOB is able to accumulate deep local knowledge to tailor cross-border financing solutions that support the growth plans of the Group.

Pua Sek Guan:

Without a bank like UOB, I think Perennial will not be where we are today.

We believe that UOB will continue to support us and work with us on our expansion journey in Singapore, China and Southeast Asia.