The Enterprise Artificial Intelligence function in the Data Management Office (DMO) provides leadership to promote the adoption and implementation of artificial intelligence (AI), data science and analytics initiatives and projects across the Bank. The function also oversees the group AI ethics strategy, governance and implementation, as well as the strategic build of our AI enablers. Working with business stakeholders, the function deploys AI responsibly to solve business problems and drives AI innovation to create value, with our customers in mind.

Collaboration has been a cornerstone of our strategy, extending from planning to execution, with multi-disciplinary teams engaged across different functions. These collaborative initiatives foster the cross-fertilization of ideas, leading to innovative solutions to the complex challenges faced by the Bank. Featured below are 3 use cases that have garnered prestigious awards – a) Qorus Accenture Banking Innovation Awards 2023 for the Cash-in-Transit initiative, b) Global Retail Banking Innovation Awards 2023 for the Personetics Insight Feedback initiative, and c) currently shortlisted as a finalist at the Banking Tech Awards 2023 for the SREITS Portfolio Investment Decision Advisor initiative.

We also showcase an innovative use case that employs advanced computer vision and natural language generation capabilities to help our branch staff address our customers’ queries more efficiently and accurately. Let us walk through each of them in more detail.

Cash-in-Transit

UOB has over 600 self-service banking machines across Singapore, including Automated Teller Machines, Cash Deposit Machines and Multi-Function Machines that support Passbook Update and Coins Deposits functions. In order to steadily maintain cash-levels at optimal levels, cash transportation trips need to be regularly scheduled to replenish the machines. It is worth noting that such trips constitute a considerable share of operating cost.

As part of cost reduction efforts, we collaborated with Group Channels and Digitalisation (GCD) and Group Technology and Operations (GTO) to leverage our in-house platform to develop a Cash-in-Transit machine-learning model. Trained on cash behaviour patterns, the trip-scheduling process was optimised by the model to produce a schedule that generates the best cash availability. This increases accuracy in machine replenishment and therefore improves operating cost by minimising the amount of idle cash.

As a consequence, the number of cash replenishment trips was reduced by up to 25%. By the same token, customer experience improves because machine downtime and cash-out situations are minimised. Fewer cash replenishment trips also result in shorter vehicle road time. In turn, this helps the Bank progress towards better sustainability and a lower carbon footprint, as well as mitigate the risk of cash lost in transit.

Personetics Insight Feedback

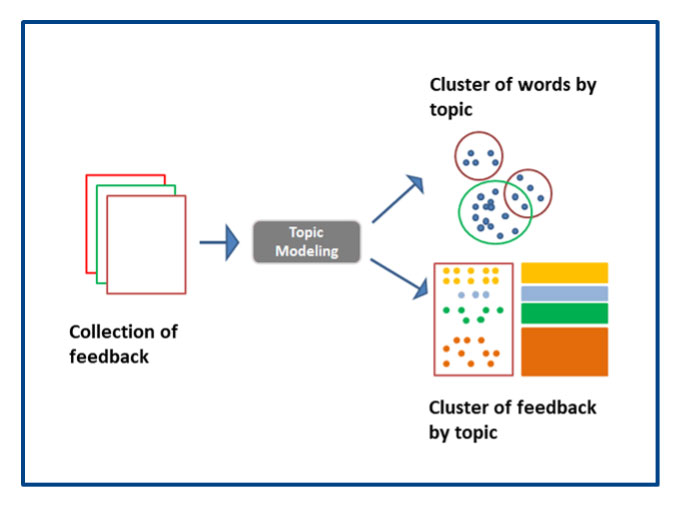

Due to substantial accumulation of customer feedback over time, it became increasingly difficult to perform a comprehensive and unbiased analysis of the feedback. To tackle this challenge, UOB's Personetics Insight Feedback Analysis Engine was developed in collaboration with TMRW Digital Group, using a myriad of natural language processing techniques.

This includes keyword extraction, part-of-speech tagging, word co-occurrence analysis, topic modelling, among others. Through the utilisation of advanced analytics, the engine effectively empowers the engagement team to extract actionable insights and discern patterns within the voice of the customer.

An interactive dashboard was also developed to further streamline the operationalisation of the analysis process, making it easier to uncover and examine actionable insights to enhance insights cards. This enables the team to develop both short-term and long-term action plans to address customer pain points.

Through the refinement of the insights cards derived from feedback, channel effectiveness saw a significant improvement at delivering targeted content, boosting engagement, and the number of digitally engaged customers.

S-REITs

Enhancing the transparency and impartiality of investment decisions is a key objective of the Corporate Investment Unit (CIU). In a joint-endeavour between DMO and CIU, the S-REITs Portfolio Investment Decision Advisor was developed with the goal of enhancing traditional investment portfolio management and existing practices of CIU’s S-REITs mandate. This was achieved by actively exploring and implementing state-of-the-art AI methodologies and alternative data sources to enable data-driven investment decisions.

The solution was constructed using a composable structure, where each module satisfies a particular function of the investment lifecycle such as buying and selling equity selection, portfolio composition, position sizing and timing, which can be operated as separate modules. This facilitates the seamless integration of AI into the existing workflow, expediting agile development and adoption, whilst boosting investment returns of the portfolio.

Computer Vision and Natural Language Generation

Unlike classical AI, which focuses on mapping input to output, natural language generative models represent a type of AI capable of generating original and realistic natural language text.

In contrast to traditional chatbots trained on textual FAQ data, our Process-Map QA Chatbot was trained on an extensive knowledge base comprising graphical process maps – which are flowchart diagrams of processes at UOB. These maps can be stored in different types of file formats (including Word, Excel, and PowerPoint files), and often proving less intuitive for users when it comes to searching and interpretation. Naturally, the process of having to look up and analyse complex flowcharts, followed by crafting accurate responses to customer queries in real-time, can be cumbersome and time-consuming.

The model uses advanced computer vision techniques to perform object detection and image processing to extract information into text. Through natural language generation techniques, our branch staff can now query and interact with the database to provide accurate and timely information to our customers. This leads to increased customer satisfaction and higher productivity.