ABA Interoperable Data Framework

UOB is committed to building the future of ASEAN for the people and business within and connecting with ASEAN. Therefore, it actively leads in industry developments and collaborations to share and shape frameworks and best practices especially in areas of personalisation, connectivity and sustainability.

UOB is a 2021-2022 chairman bank for the Association of Banks in Singapore (ABS) Council. The Council is drawn from the senior managerial ranks of the other two local banks and 15 foreign banks to provide policy and strategic directions for the Association.

UOB Group Chief Data Officer, Mr Richard Lowe, also chairs the ABS Standing Committee on Data Management (SCDM) established in November 2019 to promote collaboration on data management issues faced by member banks across the banking sector within Singapore and beyond.

Since August 2021, UOB has been leading the ASEAN Bankers Association (ABA) Interoperable Data Framework (IDF) Taskforce to drive the development of the IDF across ASEAN, with the support of 13 ASEAN banks.”

The ASEAN region is a growing market and will play an increasingly important role in the global economy in the years ahead. As proof of the rapid pace at which digital transformation is taking place, the World Economic Forum projected ASEAN’s digital economy to grow significantly, adding an estimated $1 trillion to regional GDP over the next 10 years.

Also, in 10 years, digital technologies in ASEAN could potentially be worth up to USD 625 billion (accounting for 8% of ASEAN’s GDP for that year). This may be derived from innovation in products and services, improved efficiency and cost management etc.”

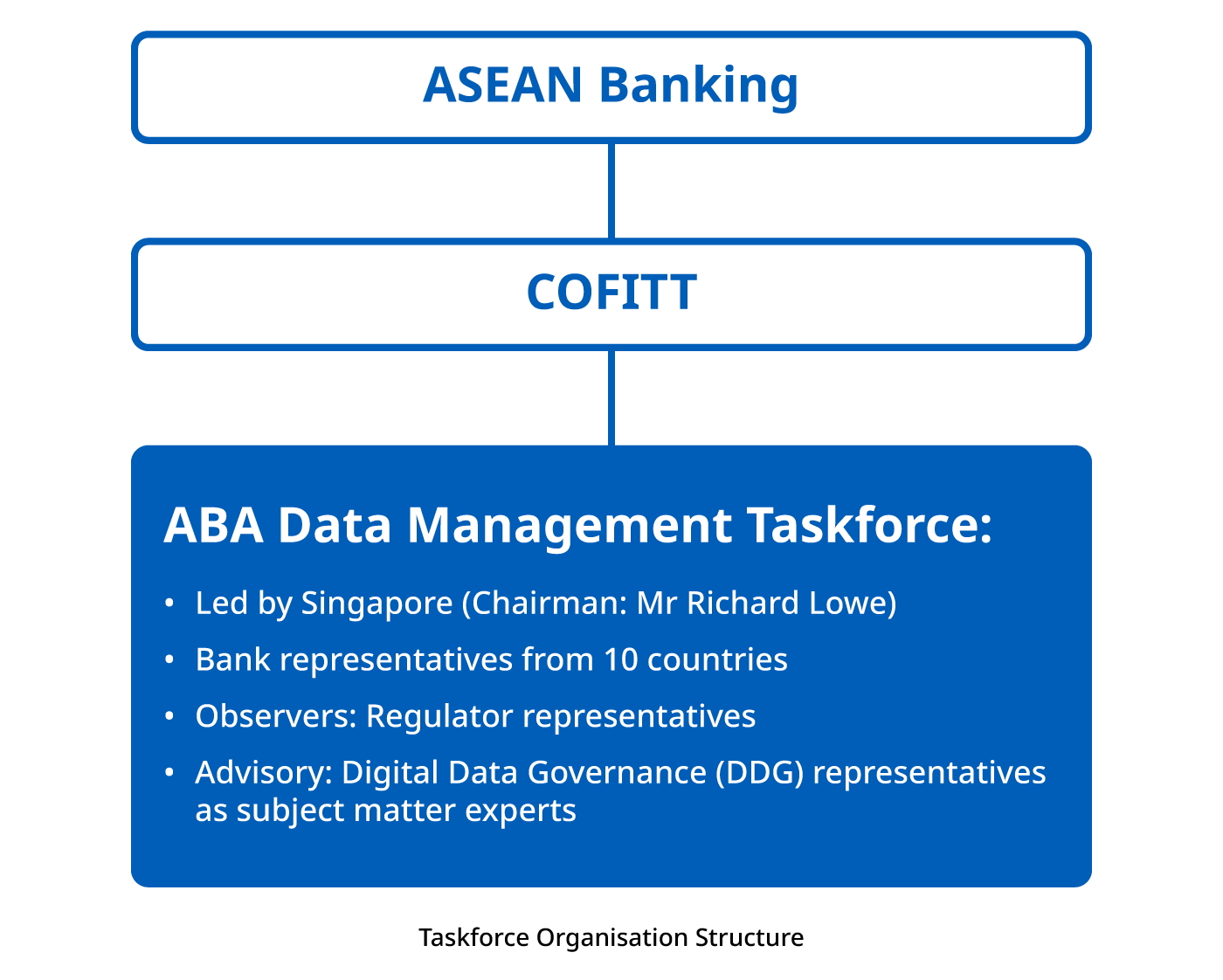

A discussion was held at the ASEAN Central Bank Governors and CEOs Dialogue in March 2021 on the benefits of data interoperability across ASEAN Member States. Because of the benefits, the ASEAN Central Bank Governors and CEOs supported the formation of a Taskforce to develop an ASEAN Banking Interoperable Data Framework. The Taskforce was set up in July 2021 with UOB Group Chief Data Officer, Mr Richard Lowe, as chairman and was formed under the Cooperation in Finance, Investment, Trade and Technology (COFITT) Permanent Committee of the ASEAN Banking Council. It comprises members from different national banking associations representing each of the 10 ASEAN Member States.

The objective of the ASEAN Banking IDF is to create an inter-territory flow of data without imposing such regulatory requirements to override existing initiatives for interoperability, data regulations and policies that exist in each country.

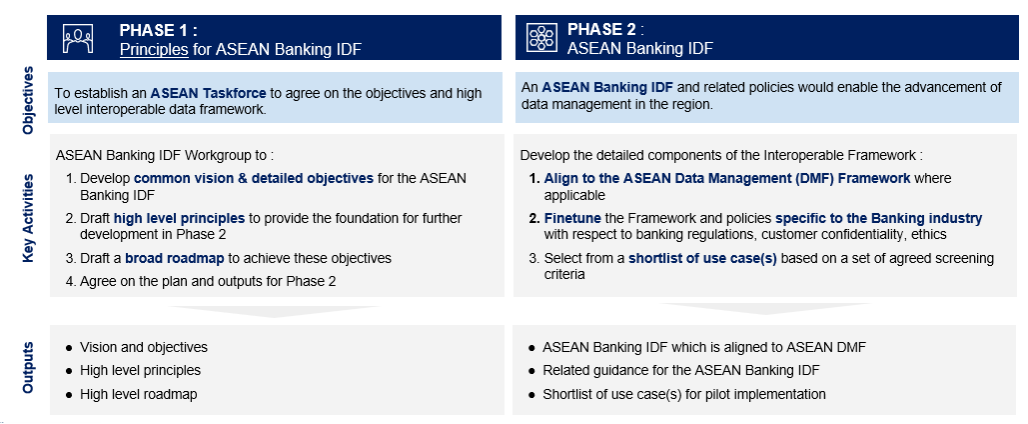

It is being developed via a two-phased approach:

The intent of the Framework is to establish minimum practices for safe and secure data sharing. With stronger safeguards and clarity on regulatory compliance, banks across all ASEAN nations will be more ready to interoperate their data and consequently benefit consumers with more personalised goods and services.

With this intent, the vision was established as:

To support the vision statement, three key objectives were defined:

The design principles were researched and aligned to multiple international cross-border data sharing frameworks and the ASEAN Data Management Framework. The development of the Framework will be underpinned by the following design principles:

The IDF enables an inter-territory flow of data within the boundaries of applicable legal and regulatory requirements that exist in each country.

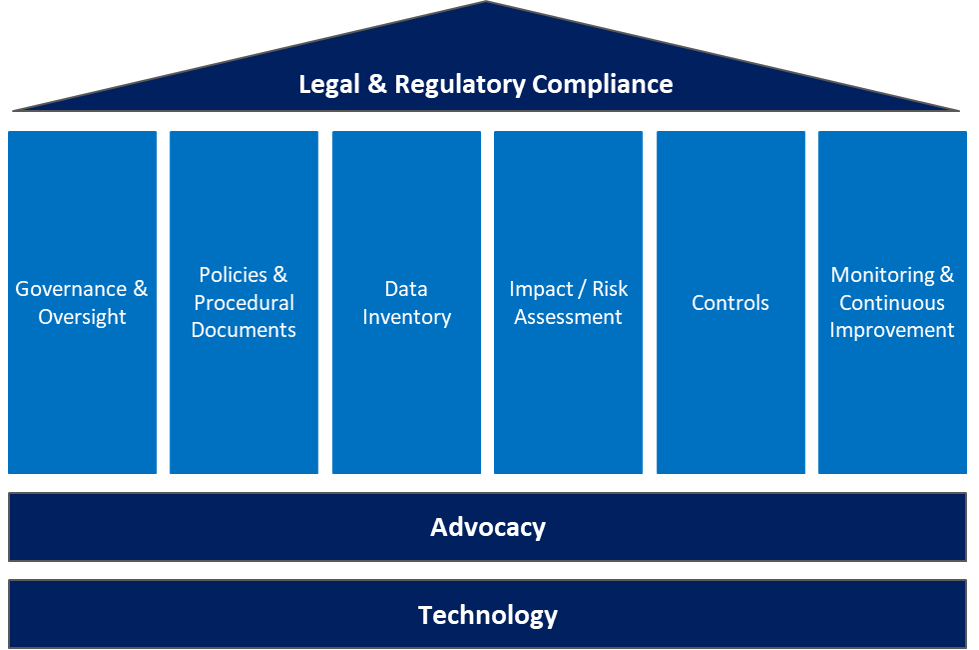

It builds upon the six foundational components of the endorsed ASEAN Data Management Framework (DMF):

Two core enablers have been included to be considered across all components in order to facilitate

data interoperability:

1. Advocacy

2. Technology

To walk the talk as an active advocate for data interoperability, UOB implemented data privacy policies consistent with the APEC Privacy Framework to facilitate the trusted and seamless cross border flow of data in the digital economy.

On 5 January 2022, UOB received the Asia-Pacific Economic Cooperation APEC Cross Border Privacy Rules (CBPR) Certification, making us the first bank in Singapore to be awarded both APEC CBPR and Data Protection Trustmark (DPTM) certification.

The APEC CBPR certification enables the Bank to make transfers of personal data safely and seamlessly across international borders to other certified organisations without needing to negotiate separate agreements for each requested transfer.