Central Bank Digital Currency (CBDC)

A new form of digital money.

According to the International Monetary Fund (IMF), the Central Bank Digital Currency (CBDC) is a new form of digital money, issued by a central bank and is intended to be legal tender. Economically, the CBDC is backed by legislation to be equivalent in value to the respective fiat currency and is fully backed and regulated by the respective central bank.

While wholesale CBDC are designed for use among financial intermediaries, retail CBDC are designed for use by the wider economy in day-to-day payments and transfer transactions. In designing CBDC, there are many options to consider such as distribution model, remuneration, privacy setup and policy options.

CBDCs are an interesting evolution of money whereby blockchain technology and smart contracts can be utilized to reduce transaction cost and payment friction associated with cash with the eventual goal of providing equal access to payment, thereby improving financial inclusion. The blockchain technology can allow central banks and governments alike to fine-tune monetary policy changes more effectively as well as carry out more targeted fiscal transfers.

The idea of CBDC is not new, there were attempts by central banks since the 90s but in quite different forms. For example, Bank of Finland’s Avant system in 1992 and Ecuador’s Sistema de Dinero Electrónico in 2014; however, both had been short lived.

Most recently in 2020, Sweden’s Riksbank noted the consequences and potential problems arising from the “marginalization of cash”. In Sweden, cash usage has dropped to as low of 7% of total transactions. As a result, the Riksbank has initiated a pilot project to develop a technical solution for the Swedish Kroner in digital form, i.e. a CBDC version in the form of a e-Krona.

Closer to home in Asia, Cambodia has in 2020 launched its domestic version of a retail CBDC, called the Bakong, to improve financial inclusion and allow citizens to perform basic transactions on their smartphones.

With the emergence of new technologies such as blockchain or distributed-ledger-technologies (DLT) and rise of stablecoins, there had been overwhelming interest in CBDC. As stablecoins become popular, central banks may be looking to provide alternatives - a new form of central bank money.

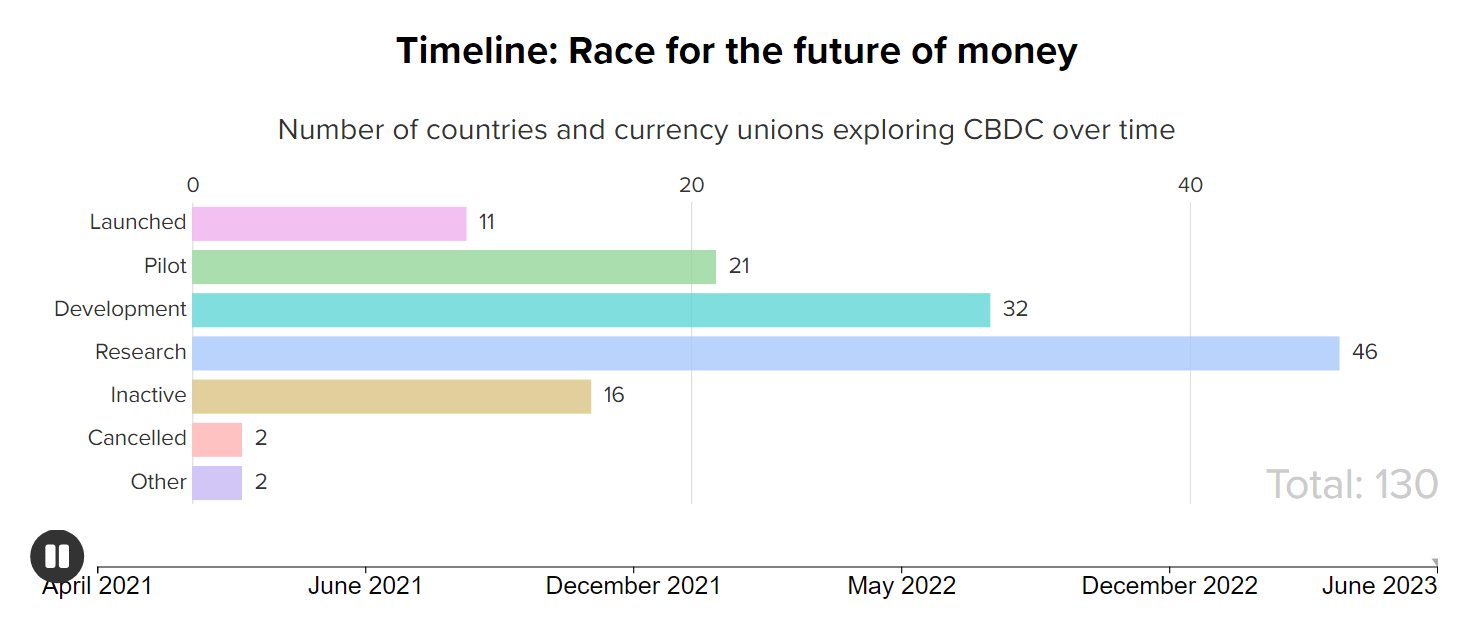

Based on Atlantic Council’s Central Bank Digital Currency Tracker (June 2023), it is noted that 130 countries representing 98% of global GDP are exploring a CBDC. 11 countries have fully launched a digital currency namely the 8 member states of the Eastern Caribbean, The Bahamas, Jamaica and Nigeria. While there are concrete examples of successful CBDC rollouts, they are not without challenges for example, the Eastern Caribbean DCash went offline for 3 months in early 2022 as customers could no longer transact using the wallet due to technical issues.

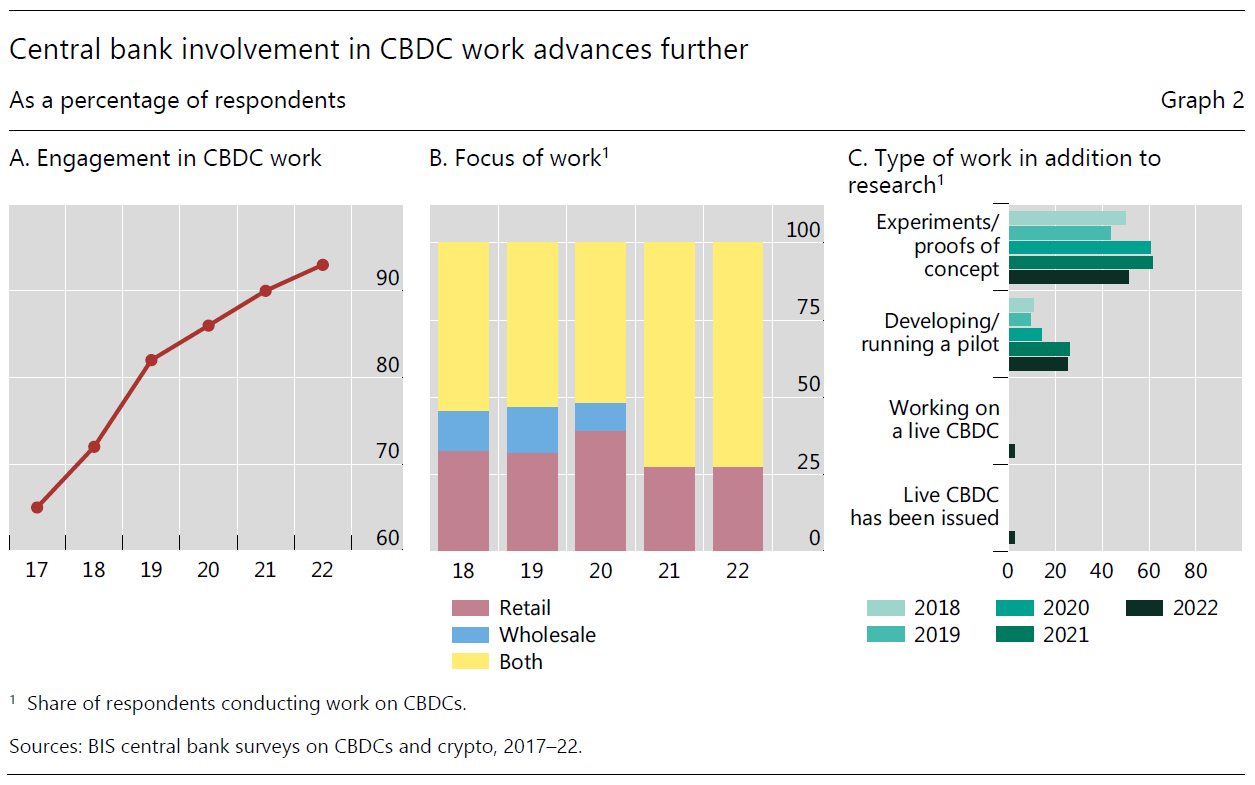

According to the latest Bank of International Settlements (BIS) survey on CBDCs published July 2023, Paper No. 136, central banks’ CBDC work has made progress, with the work on retail CBDC being most advanced. Of the 86 central banks represented in this survey, the results indicated that emerging markets and developing economies (EMDEs) are more advanced in their CBDC work than advanced economies (AE) where EMDEs almost double the number of retail and wholesale CBDC pilots.

Over the past few years, many Asian central banks have embarked on their respective domestic studies of CBDCs. The People’s Bank of China (PBoC) has led the race with extended domestic public trials and pilots of the e-CNY. Similarly, the Reserve Bank of India had also launched retail pilot program and working towards scaling the user base of digital rupee. There have also been various collaborative studies on CBDCs as well. In 2017, the Hong Kong Monetary Authority (HKMA) collaborated with Bank of Thailand (BoT) on joint wholesale CBDC study for cross border payment under the auspices of Project Inthanon-Lion Rock.

In 2022, the BIS announced that it has successfully conducted real value transaction trials under its m-Bridge CBDC pilot. mBridge is an international CBDC study involving the Hong Kong Monetary Authority (HKMA), Bank of Thailand (BoT), People’s Bank of China (PBoC) and Central Bank of the UAE (CBUAE). Altogether, 20 participating commercial banks conducted over 160 transfers and FX trades, worth a total of over USD 22 million, focusing on cross border trade. mBridge CBDC is poise to launch a minimum viable product with the aim of paving the way for gradual commercialization. Simultaneously, Project Dunbar – a joint project led by BIS with partnership with Reserve Bank of Australia (RBA), Central Bank of Malaysia (BNM), Monetary Authority of Singapore (MAS), and South African Reserve Bank (SARB) also published results proving how a common platform for multi-CBDC could enable cheaper, faster and safer cross-border payments.

This year, the Federal Reserve Bank of New York’s New York Innovation Center (NYIC) collaborated with MAS under the banner of Project Cedar Phase II x Ubin+ which explored the ability of DLT to establish connectivity across heterogeneous currency ledgers, reduce settlement risks, and decrease settlement time. MAS along with BIS, Banque de France (BdF) and Swiss National Bank (SNB) also successfully concluded Project Mariana which tests cross-border trading and settlement of multiple wholesale CBDCs between simulated financial institutions with Automated Market Maker. Domestically in Singapore, we also see more pilots coming out of Project Orchid further exploring use cases of Purpose Bound Money (PBM).

Given the well-functioning payment systems and broad financial inclusion, Singapore has shared that there is no compelling case for retail CBDC in Singapore for now. MAS has instead focused on developing the competency and digital infrastructure for the issuance of a digital Singapore dollar through Purpose Bound Money (PBM). PBM, explored in Phase 1 of Project Orchid, builds upon the concept and capabilities of programmable payment and programmable money. MAS has partnered the industry to explore the use of PBM across various use cases and published a technical whitepaper. MAS announced Ubin+, which advances Singapore’s cross-border connectivity through wholesale digital currencies. Project Ceder II x Ubin+ and Project Mariana are collaborative projects with central banks and international financial institutions featured within Ubin+ initiative . UOB participates in Project Orchid.

At the forefront of the CBDC race. Domestically, e-CNY piloted in over 23 cities across China achieving ¥13.61 billion e-CNY in circulation, 261 million wallets with close to ¥100 billion of transaction value. e-CNY is also accepted at over 4.57 million outlets. On the cross-border front, entering phase 2 technical testing of cross-boundary use of e-CNY with Hong Kong and actively participating in m-bridge CBDC. The e-CNY cross border aspirations and pilots also plan to target ASEAN with focus on trade.

Actively working on laying the technologies and legal foundation while deep diving into use cases, application, implementation and design issues. e-HKD pilot programme deep dives into potential uses cases in full-fledged payments, programmable payments, offline payments, tokenised deposits, settlement of Web3 transactions and settlement of tokenised assets. The learnings from the pilots would feed into onward implementation planning and timeline for launching e-HKD.

Piloting retail CBDC with approximately 10,000 retail users to assess suitability of technology and CBDC design. Thai government pledge a 10,000- baht digital currency handout to eligible citizens to stimulate the economy. Exploring CBDC for cross border payments with Hong Kong, China and UAE through m-bridge.

Announced Project Garuda, a domestically focused 3 stage CBDC project focusing on exploring the optimal design for Digital Rupiah. Starting with wholesale Digital Rupiah study for the issuance and redemption of interbank fund transfer, integrating with the existing Real Time Gross Settlement (RTGS) payment system; follow by including cash and securities ledger, potentially experimenting with tokenization of securities and ends with an end-to-end Retail Digital Rupiah. A whitepaper on the high-level design of the Digital Rupiah was published to supplement the announcement. The immediate stage is in works with consultation paper issued and POC being pushed for.

While there is no immediate plan to issue retail CBDC, BNM believes that wholesale CBDC has the potential to elevate the domestic wholesale payment system to the next level and will look into the need of introducing a wholesale domestic CBDC before determining the need to issue a domestic retail CBDC. Malaysia participated in Project Dunbar and initiated multi-year CBDC exploration effort.

Working group established in 2020 to explore digital assets and digital currencies with aim to research, develop and pilot CBDC using blockchain technology between 2021 to 2023.

While many open questions remain, some of the key lessons learned thus far includes:

As central banks continue to explore, learn, experiment and design CBDC, we should see more public-private sector collaborations and sharing of best practices across countries to further enrich this exciting journey.

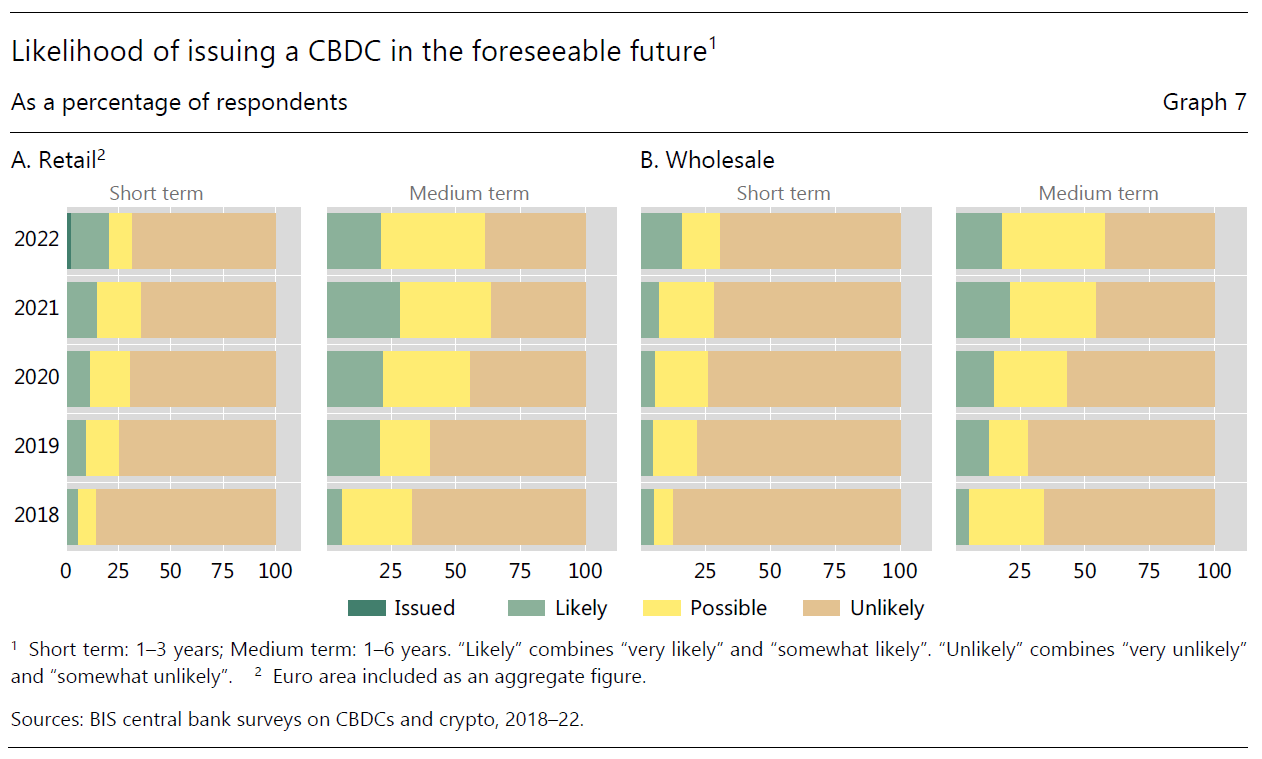

Based on central banks’ self-reported likelihood of issuing CBDC in foreseeable future, there is growing sentiments on the likelihood of issuing CBDC especially in the short term. The trend is likely to continue as the future of CBDC ecosystem come into sharper focus for retail CBDC and the potential role of CBDC in improving cross-border payments efficiencies is further explored.

G20 TechSprint 2023 focuses on promoting innovative solutions aimed at improving cross-border payments:

“Tokenised deposits… embody the key aspect of our current system, whereby central bank money and commercial bank money are indistinguishable and come with certain assurances… Tokenised deposits and CBDCs could also open the door for more efficient payment arrangements in business settings or for larger purchases… by using tokenised deposits and smart contracts, costs would fall, making payments more efficient. This would facilitate inclusion.”

Agustín Carstens, General Manager of the BIS

UOB views CBDCs as one of the key pillars in blockchain applications that will significantly transform the payment landscape in the years to come. It is worth noting that amidst this flourish in CBDC pilots across Asia, the debate is still raging as to which CBDC is a priority, whether it is Retail CBDC for the masses or Wholesale CBDC for financial institutions. While CBDCs are being widely explored, let’s also keep an eye on tokenized deposit and its potential in complementing CBDC. To that end, UOB aims to work and collaborate with regional central banks across Asia and ASEAN and to help bring central bank led CBDC innovations to the region and our clients.

More information is available via our publication: Digital Asset - Asian & ASEAN Central Banks Intensify CBDC Pilots