Asset Tokenisation

Transforming capital markets by tokenising securities.

Blockchain is a shared database or ledger where data or transactions are stored in data structures known as blocks, that is added into the database via a consensus mechanism and linked together via cryptography. In this way, these ledgers are immutable and records of transactions on the blockchain cannot be altered, deleted, destroyed or duplicated.

These features of blockchain build the foundation for trust to be build into the internet, which brought about the next evolution of internet from its ability to store and transfer “data” to the ability to potentially store and transfer “value” over the internet.

This ability to transfer value over the internet, added with the introduction of smart contracts to blockchain that can automate, and self-execute tasks and agreements, makes this a disruptive force particularly to the banking and finance industry.

Currently, blockchain is still an emerging technology. However, we have observed that interest and trust in this technology is rising, suggesting that the path to blockchain adoption by the traditional financial industry is increasingly tangible.

Asset Tokenisation is the process by which a digital asset is created on a blockchain.

A digital asset is anything of value whose ownership is represented in a digital form and the blockchain keeps an immutable record of the digital asset’s ownership whenever its transferred.

Traditional financial assets include capital markets products such as bonds, equities, funds, structured products to commercial banking products such as loans and trade finance products. Real economy assets are much broader including physical assets such as real estates, wine and luxury cars to digital native assets such as songs, photos and digital art.

The asset tokenisation process aims to use blockchain technology to fractionalize and transform these traditional financial assets and real economy assets into digital assets, thereby generating better value and injecting more liquidity into capital markets.

Most recently in Sep 2022, the Monetary Authority of Singapore (MAS) published the updated Financial Services Industry Transformation Map 2025. According to the MAS, “the ITM 2025 lays out the growth strategies to further develop Singapore as a leading international financial centre in Asia – to connect global markets, support Asia’s development, and serve Singapore’s economy.” Amongst the various action items, the MAS aims to shape the future of capital markets and financial networks via supporting the tokenisation of financial and real economy assets. We are UOB support this initiative and believe that tokenising financial assets is indeed the future of capital markets.

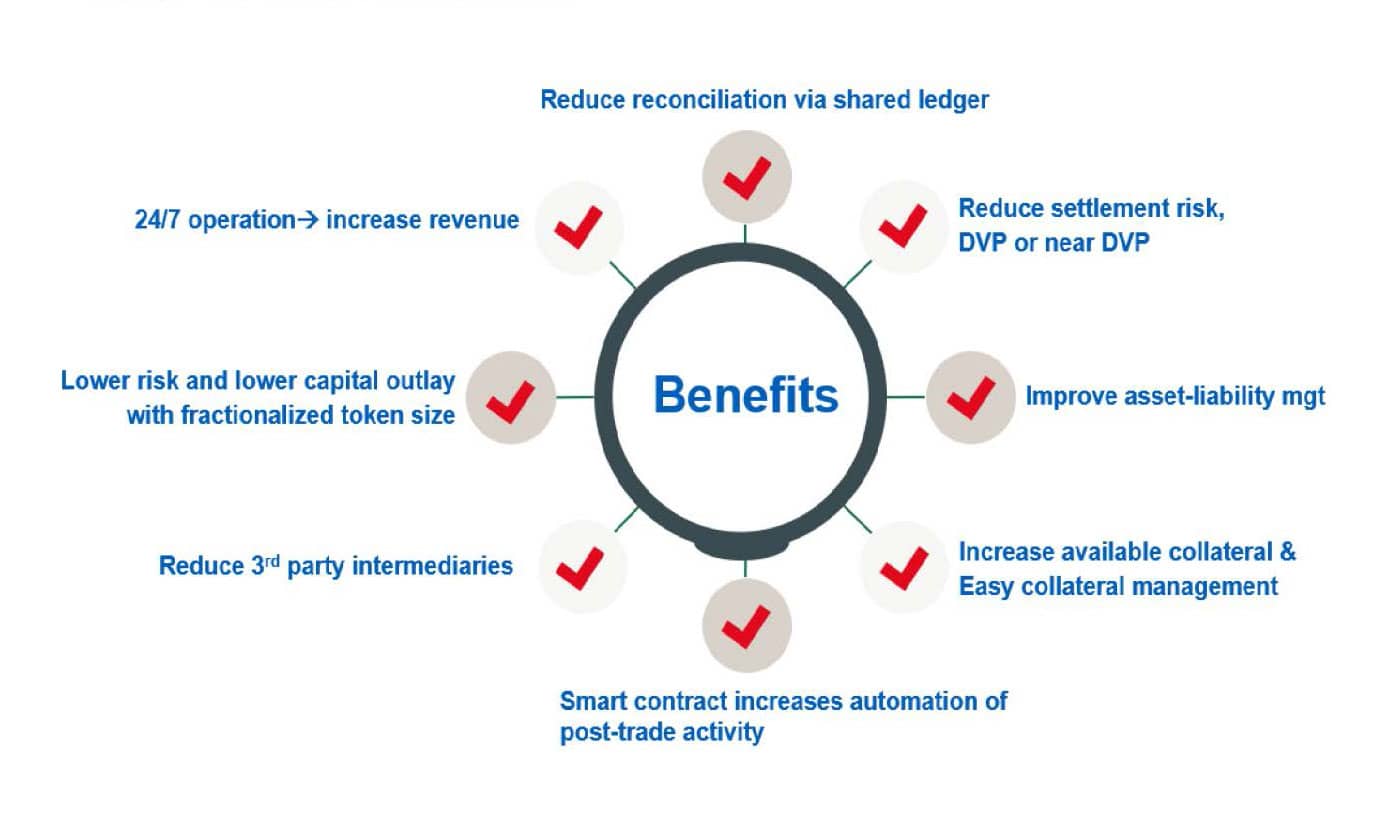

Fundamentally, blockchain enables ownership of an asset to be recorded on an immutable ledger, allowing the asset to be traded securely and seamlessly without the need for intermediaries, resulting in many potential benefits that can be achieved when widely adopted.

The diagram above highlights some of the key benefits that the financial services industry can achieve through asset tokenisation on blockchain. There are more benefits that are not listed in the diagram when applied to different use cases. However, we can generally categorise benefits into the following:

At UOB, we share the same view with MAS and choose to focus our attention on leveraging on blockchain innovation in tokenising financial and real economy assets to unlock the benefits that the technology can bring to these asset classes and to deliver value creation to the bank, our clients and our shareholders.

We will put our initial focus in tokenising capital markets securities products such as digital bonds, funds (particularly private market funds), equities and real estate related products. We will look to expand this to more asset classes such as loans, gold and potentially more illiquid and exotic assets such as luxury cars, wine and art as regulations becomes clearer and when there’s client demand.

UOB partners with MAS licensed companies ADDX (a private digital exchange) and Marketnode (a subsidiary of SGX) to pilot and pursue early commercialization of asset tokenisation opportunities to serve our clients to raise capital and invest in digital assets. In addition to UOB piloting with our own digital bond issuance on Marketnode, we have also partnered with ADDX to support like-minded clients such as Sembcorp and Singtel to issue digital bonds and are working on a pipeline of other transactions. Please visit the UOB Techecosystem website to find out more about the 2 use cases UOB has partnered with Marketnode and ADDX.

UOB has been an active thought leader and participant in MAS’ Project Guardian, a collaborative initiative with financial industry players that seeks to test the feasibility of applications in asset tokenisation and DeFi while managing risks to financial stability and integrity.

UOB teamed up with HSBC, Marketnode and ADDX to pilot the issuance and distribution of tokenised structured products natively issued on a public blockchain. A successful technical pilot was completed in Jun 2023 to demonstrate to lower issuance cost, settlement time and deepen customizability and broaden distribution of structured product. The group is continuing its pilot efforts which we hope to move this into commercial pilots in the coming year.

In addition, the Bank of International Settlements’ (BIS) Committee on Payments and Market Infrastructure (CPMI), MAS and participating Project Guardian financial institution, jointly released a report in Jun 2023 proposing a framework for designing open interoperable networks (OIN).

You can find out more about Project Guardian, the OIN report and follow the progress of our pilots in the links below.

We will continue to work with our partners to pilot and launch asset tokenisation projects, expanding into different use cases and asset classes, on the issuance and distribution of tokenised assets.