Key takeaways

- Singapore financial technology (FinTech) firms amassed a record-breaking US$725 million in funding for the first half of 2021 (1H2021), surpassing total funding for FinTech firms in Singapore for all of 2020 (US$468 million).

- Digital payments attracted the most investment, with ride-hailing unicorn subsidiary Grab Financial Group raising US$300 million in investment—the largest funding round yet in ASEAN as of 1H2021.

- There were a total of 43 Singapore-based FinTech firms that received funding in 1H2021; more than a quarter were cryptocurrency companies.

- Government regulations, digitalisation efforts by incumbent banks, and the upcoming entry of digital banks are reshaping the financial landscape in Singapore.

Overview of FinTech funding in Singapore

Despite a tumultuous year caused by the COVID-19 pandemic, Singapore's FinTech industry saw major gains in consumer interest and investor activity in 1H2021. Here is a summary of how the first half of 2021 has been going so far for Singapore-based FinTech firms:

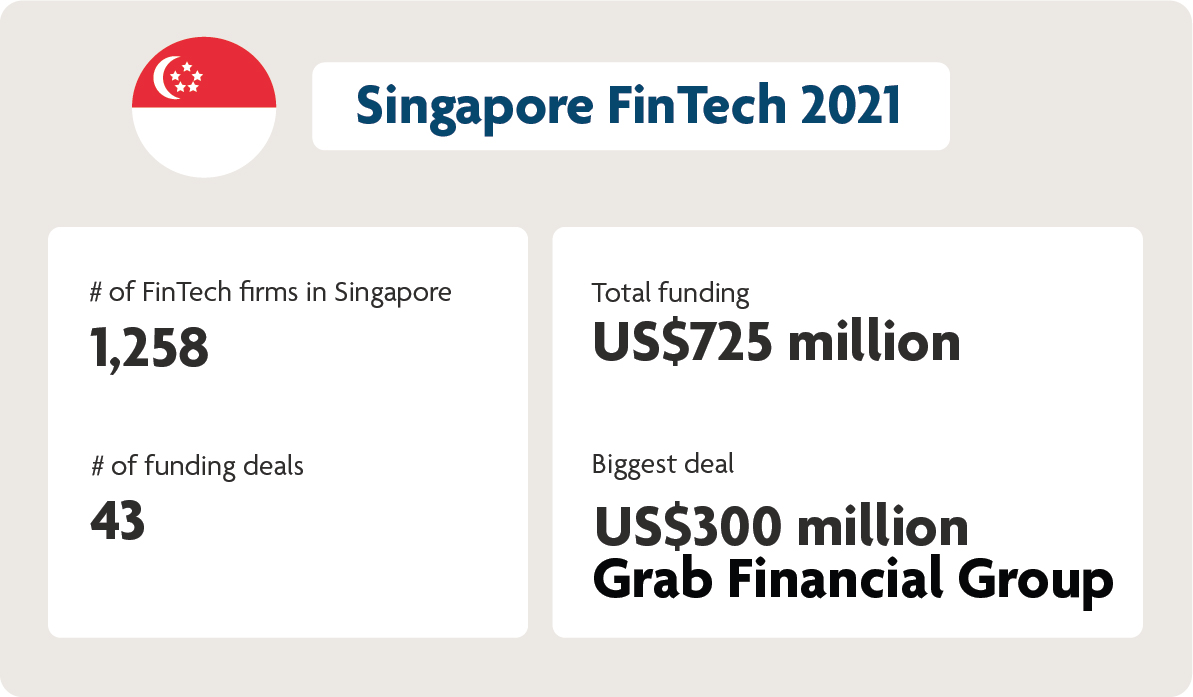

Figure 1: A summary of funding activity in Singapore, 1H2021. Source: Tracxn (last accessed 2 July 2021)

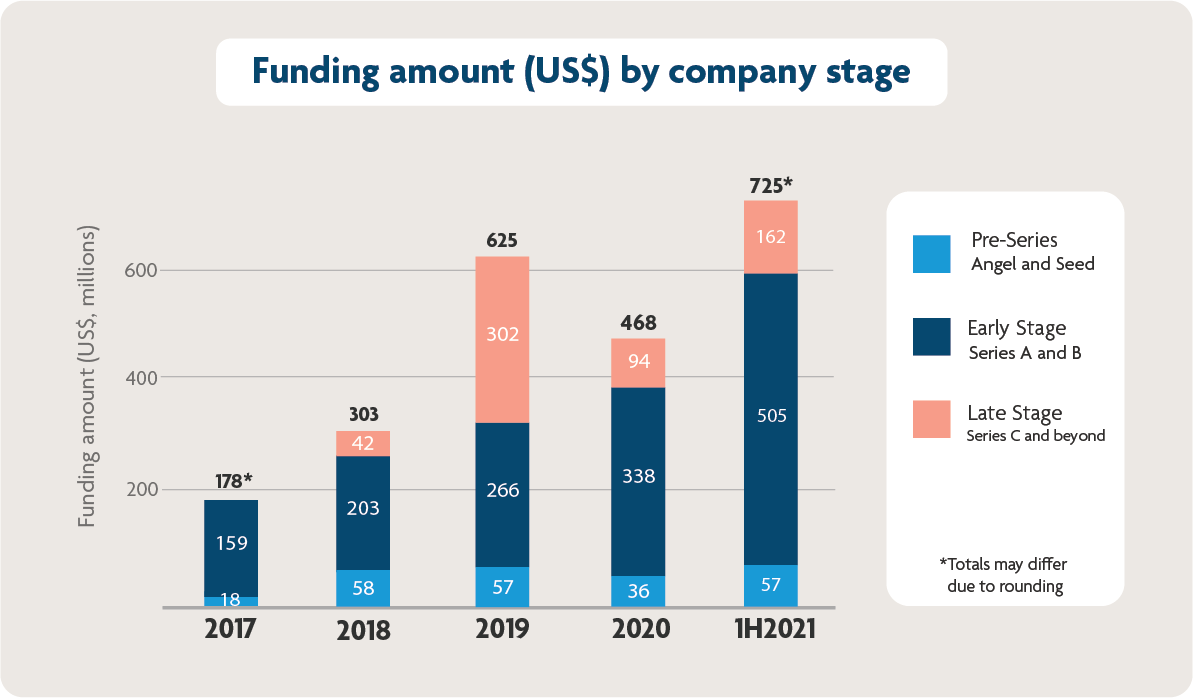

2021 poised to be the biggest year for FinTech in Singapore

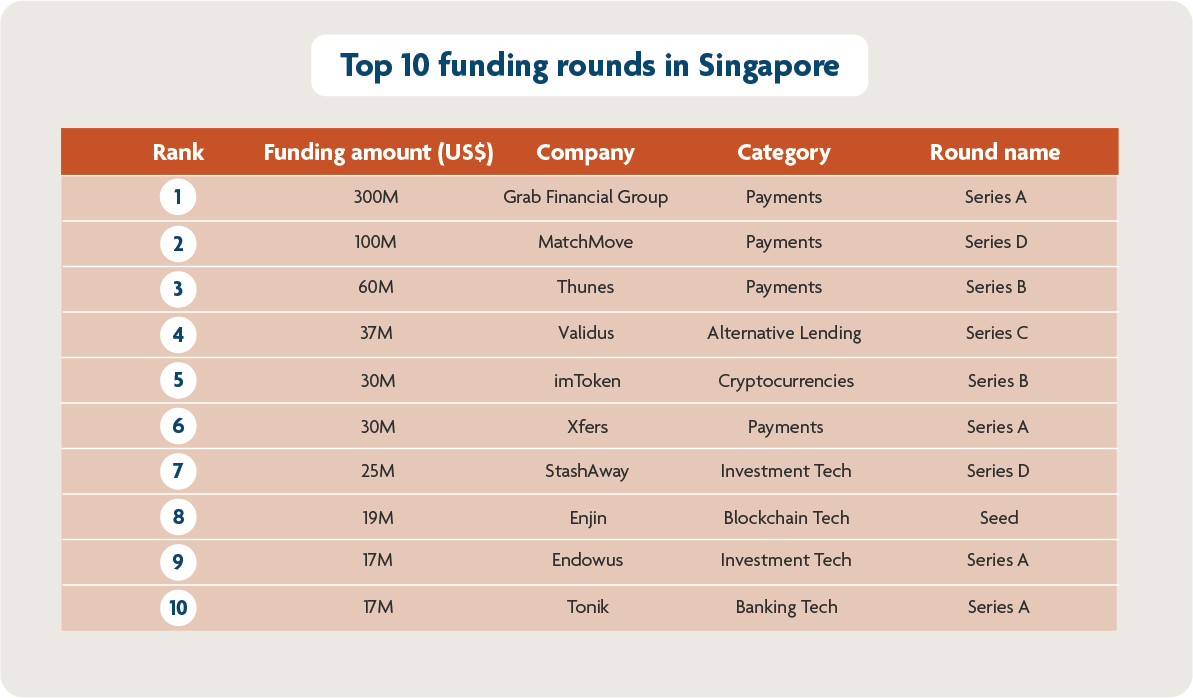

In the first half of 2021, 43 Singapore-based FinTech firms received funding, totalling US$725 million1—the highest in the industry's history. Grab Financial Group (GFG) raised US$300 million in its Series A funding round, three times as much as the next-biggest deal (MatchMove's US$100 million Series D funding). This is a major milestone for GFG as in previous years funds were raised under its parent company's name, Grab.

Most funded FinTech categories in Singapore as of 1H2021

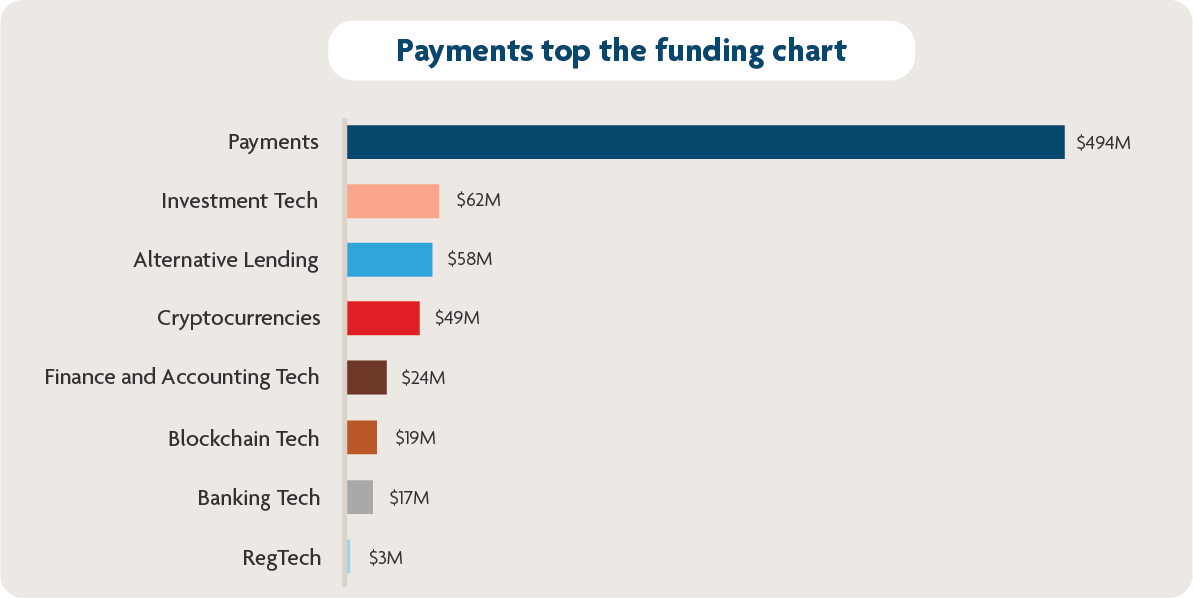

Figure 2: Funding raised per category, 1H2021, rounded to nearest million (US$). Source: Tracxn (last accessed 2 July 2021)

While funding of Singapore's FinTech categories run the gamut from peer-to-peer (P2P) lending and cryptocurrencies to finance and accounting tech, payments led the way with US$494 million in total funding for the first half of 2021 (see Figure 2).

Grab Financial Group, a subsidiary of ride-hailing unicorn Grab, falls in this category. In its January 2021 announcement, the company said its total revenue grew more than 40 per cent in 2020 compared with 2019, driven by strong consumer adoption of services linked to the Grab platform.

Payments (including remittances) is also one of the more mature and established FinTech categories in Singapore, accounting for 23 per cent2 of FinTech firms in the country. The category's steady growth has also been supported by various Singapore initiatives over the years, such as the FAST (Fast And Secure Transfers) project in 2014 and the more recent partnership between NETS and NCS to launch a new electronic payments platform for central banks in Asia Pacific.

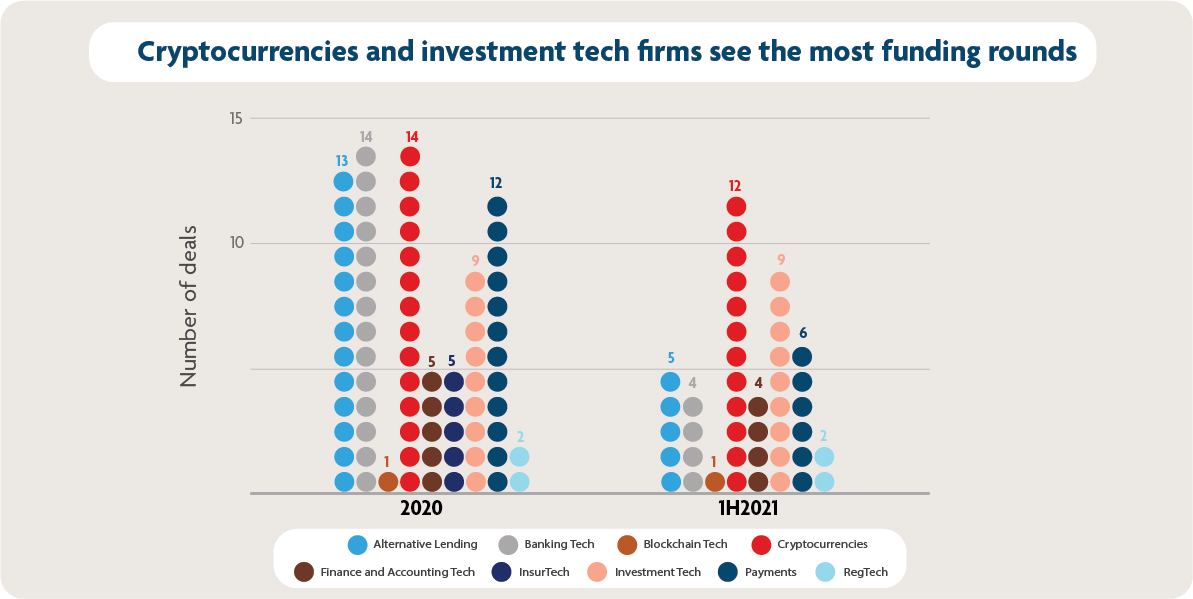

Figure 3: Number of funding rounds by category in Singapore, 1H2021. Source: Tracxn (last accessed 2 July 2021)

In terms of the number of companies funded, investors turned to cryptocurrency and investment tech, which saw 12 and nine firms funded, respectively.

Investor interest in the crypto segment is likely fuelled by the cryptocurrency boom of 2020, which saw Bitcoin reaching record highs. There is also the fact that Singapore is a fairly stable and welcoming environment for crypto startups to set up and operate, albeit with stringent regulations.

Meanwhile, digital wealth management apps such as StashAway and Endowus—which raised a combined US$42 million—are riding on the uptick of Singaporeans wanting to save more amid the uncertainty of the pandemic. The trend is especially pronounced among millennials3 and Gen Z—digital natives who are now active investors.

As Singaporeans rethink both their financial and physical wellness as a result of the pandemic, digital wealth management apps and insurance players will likely see greater demand for their products.

FinTech trends and opportunities

An open digital payments ecosystem

COVID-19 is one of the swiftest and most impactful drivers of digital adoption across the globe. Even though Singapore already enjoys high adoption rates for digital payments, the pandemic has accelerated usage even further.

Ravi Menon, Managing Director of the Monetary Authority of Singapore (MAS), noted that as of December 2020, four out of five people and three out of four businesses in Singapore have adopted PayNow, a payments system that enables people to send money using just their mobile phone numbers or personal ID numbers to other individuals or businesses. Monthly transaction values on the system crossed the US$3 billion mark in December 2020—a fourfold increase from July 2019.

In February 2021, PayNow was extended to three non-bank Financial Institutions (NFIs): Grab Financial Group, Liquid Group and Singtel. Customers using GrabPay, Liquid Pay, and Singtel's Dash can now top up their e-wallets directly from their bank accounts and transfer funds between these e-wallets via PayNow.

And in a world first, Singapore's PayNow and Thailand's PromptPay systems were linked in April 2021, enabling fast, secure and affordable funds transfers between both countries using only mobile numbers. UOB was among the three of Singapore's 12 PayNow banks that participated together with four banks in Thailand. The linkage is part of the ASEAN Payment Connectivity initiative that aims to connect payment systems across ASEAN at scale, in the future.

The pandemic saw a rise in digital payments adoption in Singapore, with four out of five consumers adopting PayNow. Photo: David Dvoracek/Unsplash

Continued government and regulatory support

For years, FinTech stakeholders have recognised the need to build a secure infrastructure to allow data sharing to be conducted securely and in compliance with regulations. The Singapore Government has stepped in to build the infrastructure to enable this via the Singapore Financial Data Exchange (SGFindex) and the recently launched Singapore Trade Data Exchange (SGTraDex).

- SGFindex is a joint initiative by MAS and the Smart Nation and Digital Government Group, and 'the world's first public digital infrastructure to use a national digital identity and centrally managed online consent system'.

- SGTraDex is an initiative of the Singapore Together Alliance for Action on Supply Chain Digitalisation; it 'aims to streamline information flow across a fragmented global supply chain ecosystem through a common data highway'.

In December 2020, MAS announced four successful digital bank applicants for Digital Full Bank and Digital Wholesale Bank licenses. These digital banks are set to operate exclusively online in early 2022 and will not have traditional brick-and-mortar branches.

Emerging technologies and the push for sustainability

Singapore is also seeing its FinTech industry move into new territory: sustainability. The MAS has been pushing the sustainability agenda since 2019 with the launch of the Green Finance Action Plan, which aims to position Singapore as a leading centre for green finance in Asia and globally.

To help develop a vibrant green FinTech ecosystem in Singapore, Project Greenprint was launched in December 2020. The ongoing conversation on green FinTech alludes to FinTech being used as a force for good in creating a more inclusive society and sustainable planet.

Even blockchain technologies—a key enabler of cryptocurrency—are going green by using Proof-of-Stake protocols instead of traditional Proof-of-Work protocols, which require a great deal of computing power, to validate block transactions. Bitcoin's massive energy consumption via its Proof-of-Work algorithm has shed light on the need to improve the sustainability of blockchain technologies.

An innovation hub

FinTech is central to Singapore's vision of transforming itself into a Smart Nation—one that harnesses technologies to remain globally competitive while improving the lives of its citizens. This vision has inspired developments such as:

- The Singapore National Digital Identity (SingPass), a Digital ID that allows banks and FinTech firms to set up accounts and authenticate users near-instantly.

- The National Artificial Intelligence Strategy, which outlines how the country plans to use AI to transform the economy. It could also revolutionise financial processes, such as credit scoring and customer marketing.

- The Payment Services Act, a framework for payment systems and payment service providers which sets regulatory controls and safeguards while encouraging innovation in FinTech and new payment services.

- The Central Bank Digital Currencies Global Challenge, a joint initiative between MAS and global financial stakeholders to enhance payment efficiencies and promote financial inclusion all over the world.

The shift towards digital ecosystems is driving greater collaboration between FinTech firms and incumbent banks. This partnership enables FinTech companies to tackle the issues of scale and risk management. Meanwhile, incumbent banks can work towards creating seamless digital customer experiences and leverage FinTech companies' technological innovations.

All these initiatives accelerate the adoption of FinTech in the country. "2021 has been a pivotal year for the FinTech sector in Singapore, and that's no coincidence. The combination of a progressive regulatory approach and the collaboration across the financial ecosystem has turned the country into a hub for FinTech innovation, bringing us one step closer to becoming a Smart Nation," says Shadab Taiyabi, President of the Singapore FinTech Association.

Already, technology is reshaping how consumers and businesses in Singapore use financial products, whether they are investment apps, digital payments or wealth management platforms. As more funding is poured into FinTech, Singapore is continuously taking strides towards its vision of a Smart Nation.

For more insights on ASEAN’s growing FinTech industry, check out UOB’s FinTech in ASEAN 2021: Digital Takes Flight report

You can also get up to speed on the FinTech landscape by reading our previous reports, FinTech in ASEAN: Get Up, Reset, Go! (2020) and FinTech in ASEAN: From Start-up to Scale-up (2019).