Strategic partnerships resulting in more than

1,000

deals regionally

Cross-border Billings

+16%

year on year

Market Share

Cross border scan-to-pay

Cross border scan-to-pay

>30%

Peer-to-peer

>65%

To reinforce our leadership position in offering unique experiences to our ASEAN customers, we continually strengthen our partnership ecosystem, working with leading partners in various sectors to offer exclusive privileges in the key pillars of dine, shop, e-commerce, travel and entertainment.

In 2024, we inked a first-of-its-kind tripartite collaboration with the Singapore Tourism Board and Marina Bay Sands to introduce world-class programming and exclusive offers around the Marina Bay precinct, driving quality spend and enlivening the bay as a premium lifestyle destination. We also signed a pioneering reciprocal card partnership with South Korean card company Woori Card to offer cardholders from each company privileges from the other in their respective key operating regions. Teaming up with Disney Cruise Line through a strategic collaboration, we are the first regional bank to offer special benefits to our cardholders when they make bookings for the Disney Adventure, the first Disney cruise ship to homeport in Asia, starting 15 December 2025.

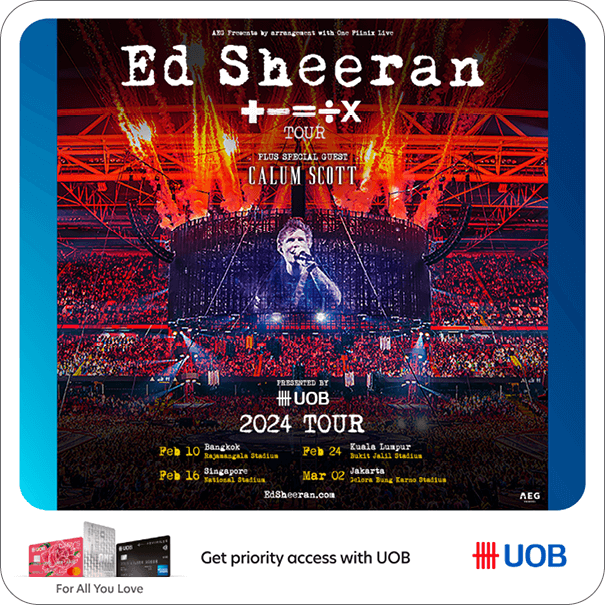

We continue to make waves in the entertainment arena by bringing forth the biggest names in Western entertainment, the K-pop scene and Mandopop royalty, the most dramatic theatre productions and the hottest music festivals to our ASEAN customers.

In 2024, we inked a first-of-its-kind tripartite collaboration with the Singapore Tourism Board and Marina Bay Sands to introduce world-class programming and exclusive offers around the Marina Bay precinct, driving quality spend and enlivening the bay as a premium lifestyle destination. We also signed a pioneering reciprocal card partnership with South Korean card company Woori Card to offer cardholders from each company privileges from the other in their respective key operating regions. Teaming up with Disney Cruise Line through a strategic collaboration, we are the first regional bank to offer special benefits to our cardholders when they make bookings for the Disney Adventure, the first Disney cruise ship to homeport in Asia, starting 15 December 2025.

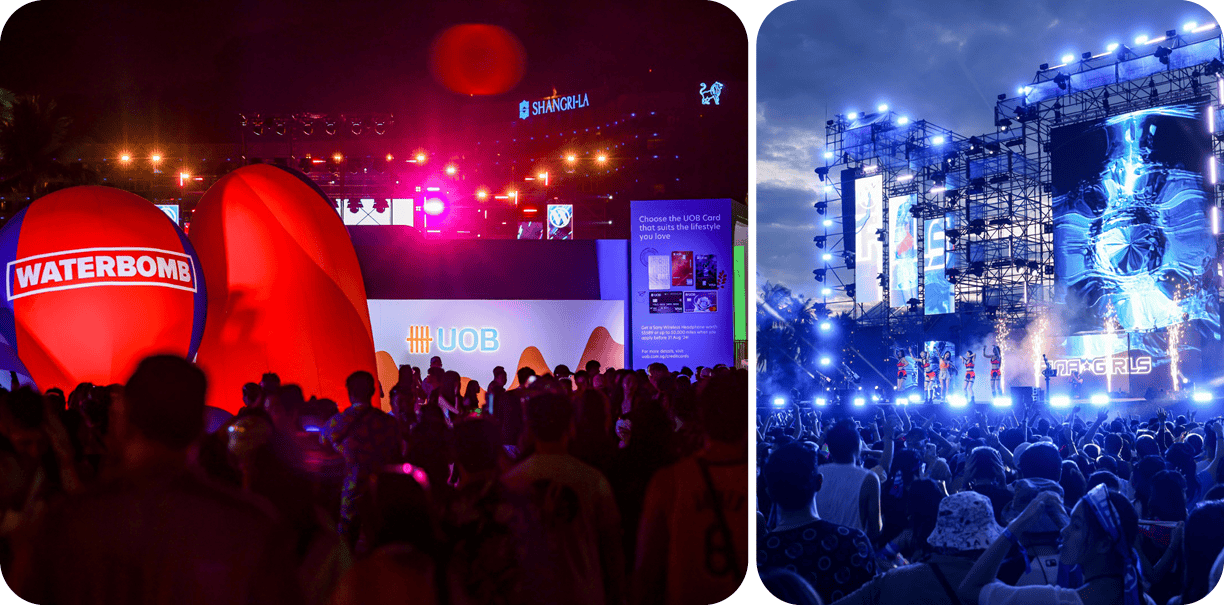

We continue to make waves in the entertainment arena by bringing forth the biggest names in Western entertainment, the K-pop scene and Mandopop royalty, the most dramatic theatre productions and the hottest music festivals to our ASEAN customers.

“We are thrilled to embark on this pioneering reciprocal card partnership with UOB. We strongly believe that this strategic alliance will increase our customers’ satisfaction as they enjoy various merchant privileges at their favourite travel destinations, provided by UOB.”

Andrew Park

Chief Digital Officer and Head, Group of Platform Business, Product Innovation and IT, Woori Card

UOB was the regional Presenting Sponsor of the Ed Sheeran: + − = ÷ × Tour in ASEAN.

UOB was the presenting sponsor for the music and water extravaganza – WATERBOMB SINGAPORE 2024.