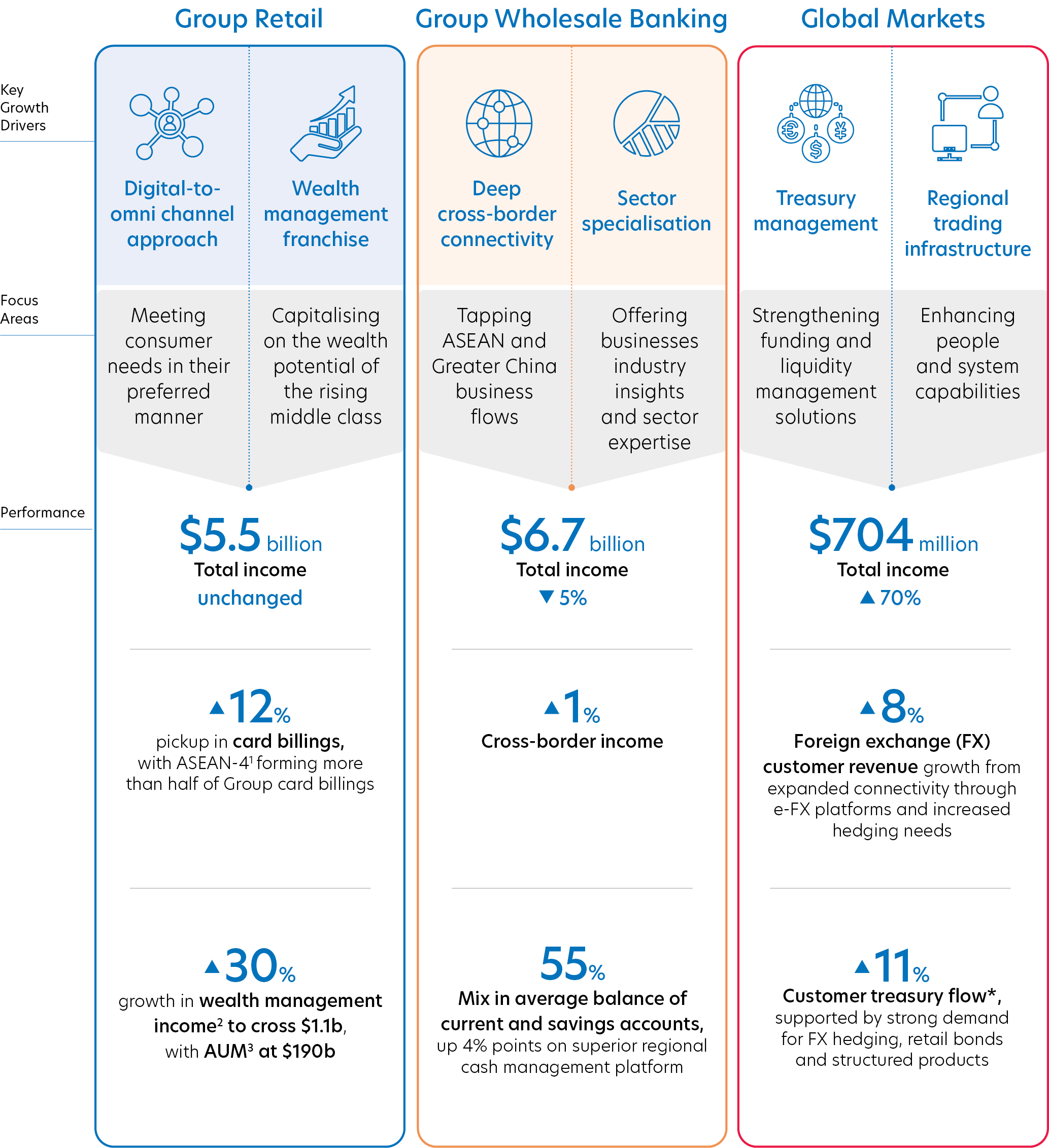

Staying focused on our regional strategy and customer centricity

Group Retail

Group Wholesale Banking

Global Markets

Digital-to-omni channel approach

Wealth management franchise

Key

Growth

Drivers

Growth

Drivers

Meeting consumer needs in their preferred manner

Capitalising on the wealth potential of the rising middle class

Focus

Areas

Areas

$5.5

billion

Total income

unchanged

Performance

12

%

pickup in card billings, with ASEAN-41 forming more than half of Group card billings

30

%

growth in wealth management income2 to cross $1.1b, with AUM3 at $190b

Deep

cross-border connectivity

cross-border connectivity

Sector specialisation

Tapping ASEAN and Greater China business flows

Offering businesses industry insights and sector expertise

$6.7

billion

Total income

5%

1

%

Cross-border income

55

%

Mix in average balance of current and savings accounts, up 4% points on superior regional cash management platform

Treasury management

Regional trading infrastructure

Strengthening funding and liquidity management solutions

Enhancing people and system capabilities

$704

million

Total income

70%

8

%

Foreign exchange (FX) customer revenue growth from expanded connectivity through e-FX platforms and increased hedging needs

11

%

Customer treasury flow*, supported by strong demand for FX hedging, retail bonds and structured products

*

Income derived from the treasury flow from Group Retail and Group Wholesale Banking customers is reflected in the income of the respective business segments.

1

ASEAN-4 comprises Indonesia, Malaysia, Thailand & Vietnam

2

Comprises wealth management fees and customer-related treasury income

3

Refers to Privilege Banking and Private Bank