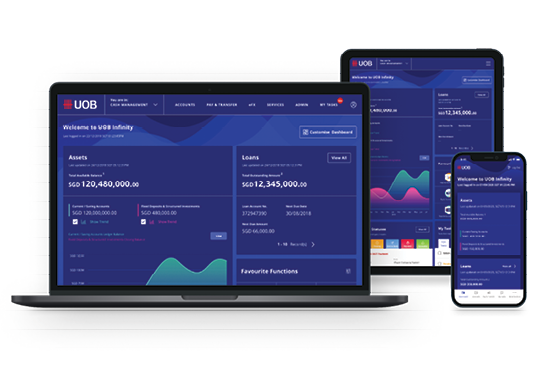

Our UOB Infinity platform provides clients with access to payment, collections, treasury, trade and supply chain management services for all their entities via a single log-in.

UOB Infinity provides a wide range of services including cash, trade and financial supply trade management.

UOB Infinity

Penetration rate

2024

83%

Digital transactions

(2022 – 2024)

+37%

Our deep relationship with the Mustafa Group has enabled us to understand the client’s needs holistically. We have been able to provide advisory and a comprehensive suite of solutions to meet business requirements and facilitate its cross-border ambitions.

In 2024, the Mustafa Group was onboarded to UOB Infinity, and this enabled the company to speed up payments to suppliers. Mustafa’s suppliers can now access UOB’s trade financing solutions more easily, making pre-shipment financing and streamlined credit underwriting possible.

Mustafa, whose businesses include shopping malls, gold retail and general trading, also makes electronic bulk payments, collects payments made via credit card, cash and NETS and manages its payroll through UOB Infinity.

Mr Vinit Patel, Marketing Manager, Mustafa Group, said, “UOB’s integrated digital solution not just enhances the efficiency of our processes and payments, but also helps to link our suppliers within one single interface where they too have access to UOB’s trade financing solutions.“

Our deep relationship with Mustafa Group has allowed us to provide a comprehensive suite of solutions to meet its business requirements. (Photo: Mustafa Group)

Our regional network connectivity and cash management advisory services enabled Thai Oil to optimise interest rates across various countries and currencies.

With the integrated regional cash and liquidity management solutions on UOB Infinity, Thai Oil was able to increase its visibility and control of their operating accounts across markets. Its liquidity management was enhanced for its combined portfolio of balances held with UOB across Thailand, Hong Kong, Indonesia, and Vietnam.

In addition, our connectivity and in-country coverage provided Thai Oil’s headquarters with greater convenience which allowed the company to more efficiently navigate its banking requirements across its locations.

We received the awards for the World, Asia and Singapore’s Best SME Bank from Euromoney. These demonstrate our ambition and strategy in connectivity, digitalisation and sustainability, as we support SMEs in their growth journeys and long-term viability.