Downloads

Our Corporate Milestones

Since 1935, our entrepreneurial spirit, focus on long-term value creation and unwavering commitment to do what is right for our customers have made UOB a leading bank in Asia. Our timeline captures the corporate milestones of our 86-year history.

1930s - 1960s

Our Beginning

1935

Amid the uncertainties of the Great Depression, a group of seven businessmen led by Datuk Wee Kheng Chiang (first row, centre) founded a bank to serve the merchant community in Singapore.

1935 (6 August)

United Chinese Bank (UCB) is incorporated

1935 (1 October)

UCB begins operations at Bonham Building

1956

Introduces coin banks for children

1958

Drives 1st mobile branch

1959

Opens 1st UCB branch at Beach Road

1962

1st bank to focus on women as customers

1965

UCB is renamed United Overseas Bank

Opens 1st overseas branch in Hong Kong

› 1970s – 1980s

1971

Acquires majority stake in Chung Khiaw Bank (CKB) in Singapore

Opens Tokyo branch

Reveals iconic five-bar logo

Opens Tokyo branch

Reveals iconic five-bar logo

1973

Acquires Lee Wah Bank in Singapore

1974

Dr Wee Cho Yaw succeeds Datuk Wee as Chairman and CEO

Begins operating from the new 30-storey building which stood on the same site as Bonham Building (the current UOB Plaza 2)

Begins operating from the new 30-storey building which stood on the same site as Bonham Building (the current UOB Plaza 2)

1975

Opens London branch

1977

Opens New York agency

1980

Introduces Singapore’s 1st ATM offering 24-hour banking

Opens Los Angeles agency

Opens Los Angeles agency

1982

Holds inaugural UOB Painting of the Year competition

1983

Opens Seoul representative office

1984

Opens Beijing representative office

Acquires majority interest in Far Eastern Bank in Singapore

Acquires majority interest in Far Eastern Bank in Singapore

1985

Expands into Sydney and Xiamen

1986

Expands into Vancouver

1987

Acquires majority interest in Industrial & Commercial Bank in Singapore

1988

1st Singapore bank to launch Visa cards

1st bank to launch Singapore’s only credit card for women

1st bank to launch Singapore’s only credit card for women

› 1990s – 2000s

1992

1st Singapore bank to set up representative office in Vietnam

Opens Taipei representative office

Opens Taipei representative office

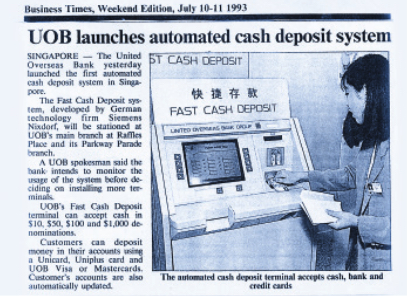

1993

1st bank in Singapore to launch automated

cash deposit machine

cash deposit machine

1994

Expands into Yangon

1995

Celebrates 60th anniversary and official

opening of UOB Plaza 1

opening of UOB Plaza 1

1997

UOB Malaysia merges with CKB Malaysia

1998

Opens Shanghai branch

1999

Acquires Westmont Bank in the Philippines

Acquires Radanasin Bank in Thailand

Acquires Radanasin Bank in Thailand

› 2000s

2000

Mr Wee Ee Cheong is appointed Deputy Chairman

2001

Acquires Overseas Union Bank in Singapore

2004

Acquires 96.1% in Bank of Asia Public Company in Thailand

2005

Increases controlling stake of PT Bank Buana

in Indonesia to 61.1%

in Indonesia to 61.1%

2007

Mr Wee Ee Cheong succeeds Dr Wee Cho Yaw

as CEO

Launches 1st UOB Heartbeat Run/Walk

as CEO

Launches 1st UOB Heartbeat Run/Walk

2009

Opens Mumbai branch

2010

Merges PT Bank UOB Indonesia with PT Bank UOB Buana

2011

1st bank in Singapore to establish a Foreign Direct Investment Advisory Unit to support our clients’ regional expansion

2013

Dr Wee Cho Yaw becomes Chairman Emeritus and Adviser

2014

Named Most Admired ASEAN Enterprise for ASEAN Centricity by ASEAN Business Advisory Council

2015

Celebrates 80th anniversary, introduces refreshed logo and a corporate seal.

Opens Yangon branch

Completes full acquisition of Far Eastern Bank

Opens UOB Southeast Asia Gallery at National Gallery Singapore, housing the world’s largest collection of modern Southeast Asian Art

Introduces UOB Mighty, First mobile app outside of the US to enable contactless payments with tokenised security

Opens UOB Southeast Asia Gallery at National Gallery Singapore, housing the world’s largest collection of modern Southeast Asian Art

Introduces UOB Mighty, First mobile app outside of the US to enable contactless payments with tokenised security

2016

1st in the world to launch instant digital card issuance

1st in Southeast Asia to enable smartphones for contactless transactions at UOB ATMs

1st in Southeast Asia to enable smartphones for contactless transactions at UOB ATMs

2017

Launches UOB Art in Ink Awards in Hong Kong

2018

1st Singapore bank to establish a subsidiary in Vietnam

Officially opens new China head office building in Shanghai’s Lujiazui Financial District

Sets up Singapore’s largest car ecosystem and unites Singapore’s largest property ecosystem under one roof

Dr Wee Cho Yaw retires from the Board

Dr Wee Cho Yaw retires from the Board

2019

Launches TMRW, ASEAN’s first mobile-only digital bank, in Thailand

Expands into Hanoi, northern Vietnam

Deepens client support in the Greater Bay Area with opening of Zhongshan branch (7th in GBA)

Launches U-Solar, Asia’s first solar ecosystem to power the region’s development and adoption of renewable energy

Deepens client support in the Greater Bay Area with opening of Zhongshan branch (7th in GBA)

Launches U-Solar, Asia’s first solar ecosystem to power the region’s development and adoption of renewable energy

2020s

2020

Supports more than 1.4 million individuals and businesses, and contributes more than $2.7 million for the community under the #UnitedForYou COVID-19 Relief Programme

Donates more than one million pieces of personal protective equipment to healthcare workers and vulnerable communities around the world

Extends TMRW to Indonesia

Extends TMRW to Indonesia

Rolls out the UOB Smart City Sustainable Finance Framework, the first by a bank in Asia to support companies contributing to the creation of smart cities

Launches UOB Infinity, a new digital banking experience for businesses

Launches UOB Infinity, a new digital banking experience for businesses

2021

Launches UOB TMRW, a unified digital banking platform, and UOB Rewards+, Singapore’s largest cards rewards programme

Sets up a dedicated Corporate Sustainability Office and appoints the first Chief Sustainability Officer

Rolls out U-Energy, the first integrated financing platform for energy efficient projects in Asia, across four markets

Celebrates 40th milestone of UOB Painting of the Year competition

Celebrates 40th milestone of UOB Painting of the Year competition