Underpinned by diversified customer franchise and resilient balance sheet

Singapore, 7 August 2025 – UOB Group reported an operating profit of S$4.0 billion for the first half of 2025 (1H25), up 3% compared with a year ago, underpinned by broad-based double-digit growth in fee income. Net profit for 1H25 moderated 3% to S$2.8 billion from the year before, due to pre-emptive general allowance set aside as part of the Group’s risk management measures amid the macroeconomic uncertainties.

The Board declared an interim dividend of 85 cents per ordinary share, representing a payout ratio of approximately 50%. The second tranche of the 50 cents special dividend will also be paid out to shareholders, as part of the Bank’s capital distribution package announced in February 2025.

Net interest income for 1H25 remained stable year on year, as growth in loan volume helped to cushion the impact of margin compression from lower benchmark rates. Non-interest income registered positive momentum, backed by the Bank’s diversified customer franchise. Net fee income for 1H25 grew 11% across wealth management, loan-related and credit cards. Other non-interest income rose 1%, supported by a rise in customer-related treasury flows, although this was partially offset by softer trading and liquidity management activities.

Cost-to-income ratio improved from 44.4% a year ago to 43.5% in 1H25, driven by tighter cost management. Asset quality remained stable with non-performing loan ratio at 1.6%. Credit costs for 1H25 stood at 34 basis points, due to higher specific allowance and pre-emptive general provision set aside.

In 1H25, Group Wholesale Banking’s profit before tax declined 12% from the previous year, impacted by lower interest rates and competition for quality assets. However, investment banking delivered record fees while customer-related treasury income registered double-digit growth. Transaction banking continued to be a key contributor, representing nearly half of total wholesale banking income despite the uncertainties from the US tariffs. This was supported by a 12% year-on-year increase in trade loans and an enlarged CASA base, underscoring deeper client engagement through integrated cash, trade and supply chain platforms across key markets. Cross-border income was steady, accounting for 26% of total wholesale banking income, underpinned by a diversified business franchise and the Group’s strength in regional connectivity.

Group Retail Banking reported profit before tax of S$1.1 billion for 1H25, up 11%, as growth in CASA, wealth and cards countered the income pressures from lower rates and market competition. Retail deposits crossed the S$200 billion mark for the first time, reflecting continued CASA growth. Wealth management income grew 15%, driven by clients’ conversion of deposits into invested assets under management (AUM). High net-worth AUM continued to build momentum with net new money inflows at S$3 billion in the second quarter of 2025. Credit card income increased 5% year on year, along with double-digit growth in card billings, supported by the Group’s regional franchise, strategic partnerships and enhanced rewards offerings.

CEO Statement

Mr Wee Ee Cheong, UOB’s Deputy Chairman and Chief Executive Officer, said, “The Group delivered a steady set of results driven by our core businesses, including robust fee growth across our diversified franchise. Asset quality was resilient, and our balance sheet remained strong, underpinned by healthy capital and liquidity levels.

As the global landscape transitions towards a multipolar world order, ASEAN continues to demonstrate resilient growth. We remain confident in the region’s long-term prospects, anchored by sound fundamentals. With regional integration, trade diversification and rising foreign direct investments, ASEAN is well-positioned to thrive in the evolving global economy.

Our regional franchise has gained significant scale following the Citigroup acquisition, expanding our customer base across ASEAN to more than 8.4 million. We are progressing well in reshaping our business model towards a more diversified and fee-driven revenue mix – leveraging our connectivity strength and regional scale. As a long-term player, we are committed to supporting clients through uncertainties and investing in capabilities for sustainable growth.”

Financial Performance

1H25 versus 1H24

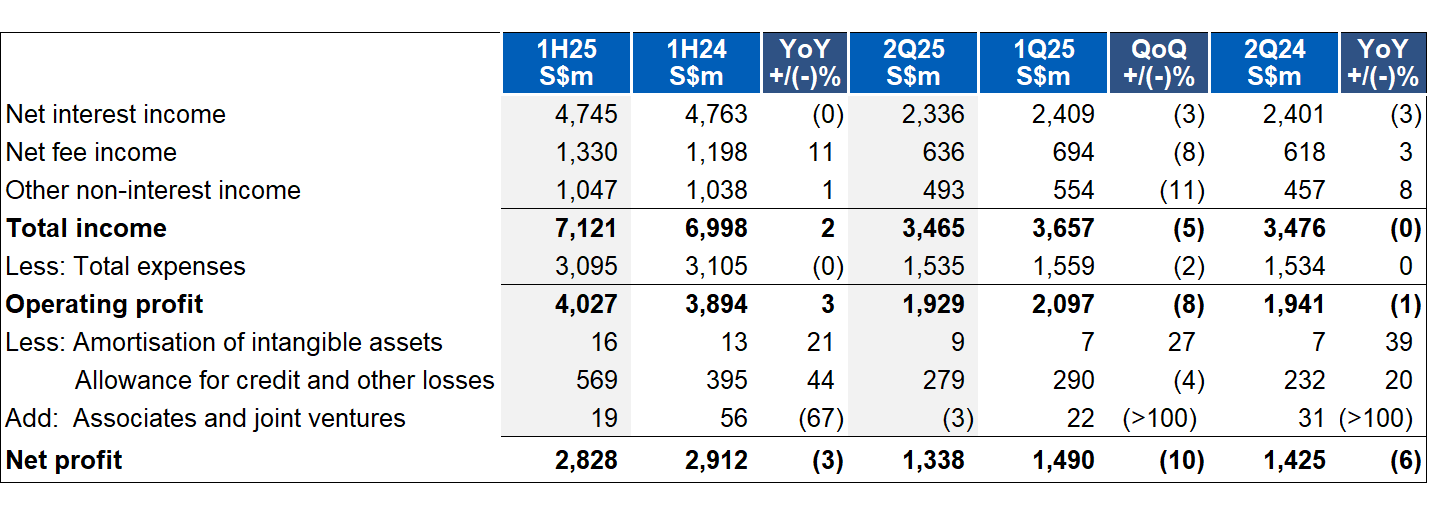

Operating profit rose 3% to S$4.0 billion in 1H25, supported by double-digit growth in fee income. Net profit declined 3% year on year from S$2.9 billion to S$2.8 billion due to pre-emptive general allowance set aside amid macroeconomic uncertainties.

Net interest income remained stable at S$4.7 billion, as asset growth offset the impact of a lower net interest margin from falling benchmark rates. Net fee income rose 11% year on year, contributed by higher wealth management, loan-related and credit card fees.

Other non-interest income improved, primarily due to stronger customer-related treasury income, partially offset by softer performance in trading and liquidity management activities.

Total operating expenses were relatively unchanged at S$3.1 billion, with cost-to-income ratio improving to 43.5% from 44.4%, reflecting the Group’s continued focus on cost discipline. Total allowance rose 44% to S$569 million, attributed to higher specific allowance and pre-emptive general provision to enhance coverage. This brought total credit costs on loans to 34 basis points for 1H25.

2Q25 versus 1Q25

Net profit declined 10% quarter on quarter to S$1.3 billion.

Net interest income eased 3% to S$2.3 billion, as net interest margin narrowed by 9 basis points to 1.91%, impacted by lower asset yields amid declining benchmark rates. Net fee income decreased to S$636 million from the previous quarter’s record high, though loan-related and credit card fees remained strong. Wealth management fees were affected by a cautious approach amid ongoing macroeconomic uncertainties. Other non-interest income softened to S$493 million due to lower trading and liquidity management activities, although customer-related treasury income maintained momentum, backed by demand for hedging solutions.

Total operating expenses decreased 2% to S$1.5 billion, reflecting the Group’s disciplined cost management. Cost-to-income ratio was higher at 44.3% due to lower operating income. Total allowance reduced to S$279 million, bringing total credit costs on loans to 32 basis points for 2Q25. The higher specific allowance from a large corporate account was within expectation, with pre-emptive allowance already set aside previously.

2Q25 versus 2Q24

Net interest income declined 3%, primarily from a lower net interest margin. Net fee income rose 3%, with broad-based growth across wealth management, loan-related services and credit card fees. Other non-interest income increased to S$493 million, supported by higher customer-related treasury income and improved trading and liquidity management performance.

Cost-to-income ratio rose slightly to 44.3%. Total allowance increased 20%, mainly due to higher specific allowance, partially offset by the release of general provision.

Asset Quality

Non-performing loan (NPL) ratio remained stable at 1.6%, with new NPL formation within expectation and offset by higher recoveries and write-offs during the quarter. Non-performing assets (NPA) coverage stood at 88% or 209% including collateral. Coverage for performing loans was maintained at a prudent 0.8%.

Capital, Funding and Liquidity Positions

The Group’s capital, funding and liquidity positions remained strong. Common Equity Tier 1 Capital Adequacy Ratio eased to 15.3% for the quarter due to payout of 2024 final and special dividends. Average all-currency Liquidity Coverage Ratio was 141% and Net Stable Funding Ratio stood at 118%, both well above regulatory requirements.