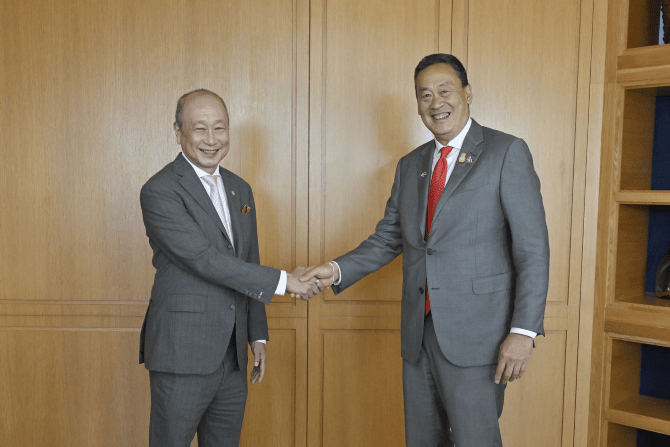

Mr Wee Ee Cheong, UOB’s Deputy Chairman and CEO (left) hosted the new Prime Minister of Thailand, Mr Srettha Thavisin, at its headquarters at the UOB Plaza on 12 October 2023 during the latter’s first official visit to Singapore.

Singapore, 12 October 2023 – UOB hosted the new Prime Minister of Thailand, Mr Srettha Thavisin, at its headquarters at the UOB Plaza today during his first official visit to Singapore. The visit is part of the Thai Premier’s five-day trip to strengthen trade ties with key regional economies. UOB was the only bank that he visited for this Singapore day trip.

PM Srettha, who took office in August 2023, was welcomed by Mr Wee Ee Cheong, UOB Deputy Chairman and Chief Executive Officer, Mr Tan Choon Hin, UOB Thailand President and CEO, and other members of the Bank’s senior management.

During the meeting, Mr Wee reiterated UOB’s long-term commitment to Thailand and discussed with PM Srettha on strengthening ties to boost ASEAN connectivity through foreign direct investments.

Mr Wee said: “For more than 20 years, UOB has been steadfast in deepening our commitment to Thailand, including supporting our regional clients to invest into the country. For instance, in the recent four years, our Foreign Direct Investment Advisory unit in Bangkok has facilitated S$2.1 billion of foreign direct investments into Thailand. Our deep local knowledge, strong industry expertise and extensive regional network have helped our clients enter new markets and supported their growth across ASEAN and Greater China.”

UOB has been operating in Thailand for more than 20 years and it is a key market in the Bank’s regional franchise. UOB Thailand is the largest Singapore bank and also the second largest foreign bank in Thailand. It is also the only Singapore bank offering full banking services in Thailand. UOB Thailand is a wholly-owned subsidiary of the UOB Group and has a network of more than 150 branches across the country. It is rated among the top banks in Thailand by Moody’s Investor Services and Fitch Ratings.

UOB has a dedicated one-stop Foreign Direct Investment (FDI) Advisory Unit in Bangkok to support businesses navigating the diverse ASEAN landscape. Since 2019, the FDI Advisory Unit in Bangkok has helped more than 370 companies expand into Thailand, bringing in S$2.1 billion of foreign direct investments.

Last November, UOB announced the completion of the acquisition of Citigroup's consumer banking businesses in Thailand. The consumer businesses comprise Citigroup's unsecured and secured lending portfolios, wealth management and retail deposit businesses. With expanded touchpoints and more partner networks, UOB Thailand is now providing a wider range of products, services and benefits to its enlarged customer base.

UOB Thailand also supports its customers on their sustainability journeys, by providing solutions that are easy to understand. UOB’s commitment to net zero is grounded in the need for a just transition that continues to support socioeconomic growth and improve energy access across ASEAN.