Second quarter net profit up 11% year on year driven by margin expansion

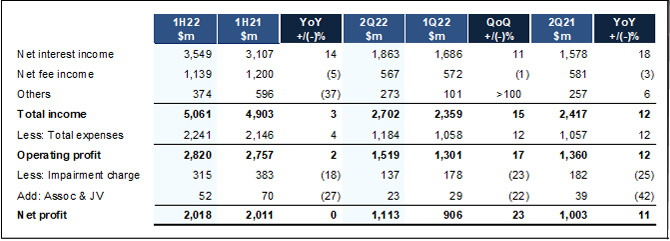

Singapore, 29 July 2022 – UOB Group reported net profit of S$2.0 billion for the first half of 2022 (1H22), stable year-on-year, with the strong performance in the second quarter ended 30 June 2022 (2Q22) making good a slower first quarter.

Net profit for 2Q22 of S$1.1 billion was 11% higher than a year ago. Net interest income grew 18% year on year led by strong margin improvement and healthy loan growth. Asset quality remained resilient with total credit costs at 22 basis points and non-performing loan (NPL) ratio at 1.7%.

In 1H22, Group Wholesale Banking income increased 16% year on year to S$2.9 billion with margin lift and loan growth from short-term working capital and debt capital market deals. Loan and investment banking fees hit a new high as the Group supported its business clients in their regional expansion. The Group’s cross-border income grew 13% year on year, despite near-term headwinds from macroeconomic uncertainties around the world.

Group Retail’s income in 1H22 declined 3% from a year earlier to S$1.7 billion, impacted by softer wealth momentum as investors turned cautious amid market uncertainties. Assets under management from affluent customers were stable at S$138 billion. The Group’s deposits registered margin improvement and volume growth across key markets in the region while credit card billings posted strong growth as regional economies reopen and travel resumes.

The Group continued to expand its sustainability portfolio with new products, solutions and initiatives in 1H22. The Group’s sustainable financing portfolio rose to S$20.0 billion, while its total assets under management in environmental, social and governance-focused investments stood at S$11.7 billion as at 30 June 2022.

The Board declared an interim dividend of 60 cents per ordinary share, representing a payout ratio of approximately 50%.

CEO Statement

Mr Wee Ee Cheong, UOB’s Deputy Chairman and Chief Executive Officer, said, “We have delivered stable profits buoyed by higher-than-expected net interest income driven by rising interest rates and our active balance sheet management. This rising interest rate environment is set to further boost our margins for the year.

“We continue to see economic activity picking up as borders reopen and investment flows resume. In Singapore, consumer sentiment is holding up well and employment is strong. Institutional and private wealth inflows remain steady given the country’s safe haven and regional hub status. As such, while the aggressive rate increases around the world are going to put a damper on global growth, we remain fairly optimistic of the resilience of our key markets in Southeast Asia.

“The long-term potential of our region remains bright. Backed by our strong balance sheet, healthy capital and liquidity positions and prudent approach, we are well-positioned to navigate the near-term headwinds with our customers and the community.”

Financial Performance

1H22 versus 1H21

Net profit stayed above S$2 billion in 1H22 driven by strong net interest income growth with stable credit allowance. However, it was partially offset by lower gains from investment securities amid market volatilities.

Net interest income expanded 14% to S$3.5 billion as net interest margin rose seven basis points coupled with a healthy loan growth of 8%, mainly from an increase in working capital loans and mortgages.

Net fee and commission income was 5% lower at S$1.1 billion. Wealth and fund management fees dipped as investors were cautious amid macroeconomics uncertainties. However, loan and trade-related were at a new high, spurred by a pick-up in business demand for trade and investment opportunities. Credit card fees were also at record levels as consumer spending rose with borders reopening and travelling resumed.

Customer-related treasury income grew 9% as more customers opted to hedge their exposures. However, the Group’s non-interest income declined 37% to S$374 million in the absence of large gains from bond sales a year ago and from lower valuation on investments in a bearish market.

Total expenses increased 4% to S$2.2 billion in tandem with higher income. The Group continued to prioritise strategic investments in people and technology while maintaining cost discipline. The cost-to-income ratio for the year rose marginally to 44.3%.

Total allowance declined 18% on lower general allowances while specific allowance was higher due to downgrade of a major but non-systemic corporate account. Total credit costs on loans were at 20 basis points, in line with expectations.

2Q22 versus 1Q22

Net profit for the second quarter was 23% higher at S$1.1 billion, as margins expanded and trading and investment income recovered.

Net interest income rose 11% to S$1.9 billion, boosted by a nine basis point improvement in net interest margin to 1.67%. Net fee and commission income were relatively flat at S$567 million, as record credit card and loan-related fees were offset by lower wealth fees on the back of weaker market sentiment. Other non-interest income normalised to S$273 million, up from a low base in the last quarter.

With cost increase slower than income growth, the cost-to-income ratio improved to 43.8%. Total allowance fell 23% to S$137 million, largely due to lower general allowance as allowances remained adequate.

2Q22 versus 2Q21

Net interest income increased 18%, as net interest margin added 11 basis points to 1.67% and loans grew at a healthy pace of 8%. Net fee and commission income were 3% lower as the new high for credit card and loan-related fees were more than offset by lower wealth and fund managements fees. Other non-interest income rose 6% on higher customer-related treasury income.

Total operating expenses increased 12% to S$1.2 billion in line with higher income. Total allowance fell to S$137 million, largely due to lower general allowance.

Asset Quality

Asset quality remained resilient with the NPL ratio increased slightly to 1.7% as at 30 June 2022. Non-performing assets coverage remained adequate at 91% or 185% after taking collaterals into account. Performing loans coverage was maintained prudently at 0.9%.

Capital, Funding and Liquidity Positions

The Group’s liquidity and funding positions remained healthy with 2Q22’s average all-currency liquidity coverage ratio at 141% and net stable funding ratio at 111%, well above the minimum regulatory requirements. The loan-to-deposit ratio held steady at 88.7%.

As at 30 June 2022, the Group's Common Equity Tier 1 Capital Adequacy Ratio remained healthy at 13.1%. Leverage ratio of 6.6% was more than two times above the regulatory requirement.