The UOB EVOL Card (formerly known as UOB YOLO) aims to serve one in two Gen Z consumers in Singapore over the next three years

In anticipation of the increased spending power of Generation Z consumers (Gen Zs)1 as they enter the workforce, UOB has revamped the UOB YOLO credit card2 to serve the needs of Gen Zs across ASEAN. To signify the change in generations, the UOB YOLO credit card has been renamed the UOB EVOL Card, a name which was chosen by the Bank’s Gen Z customers3.

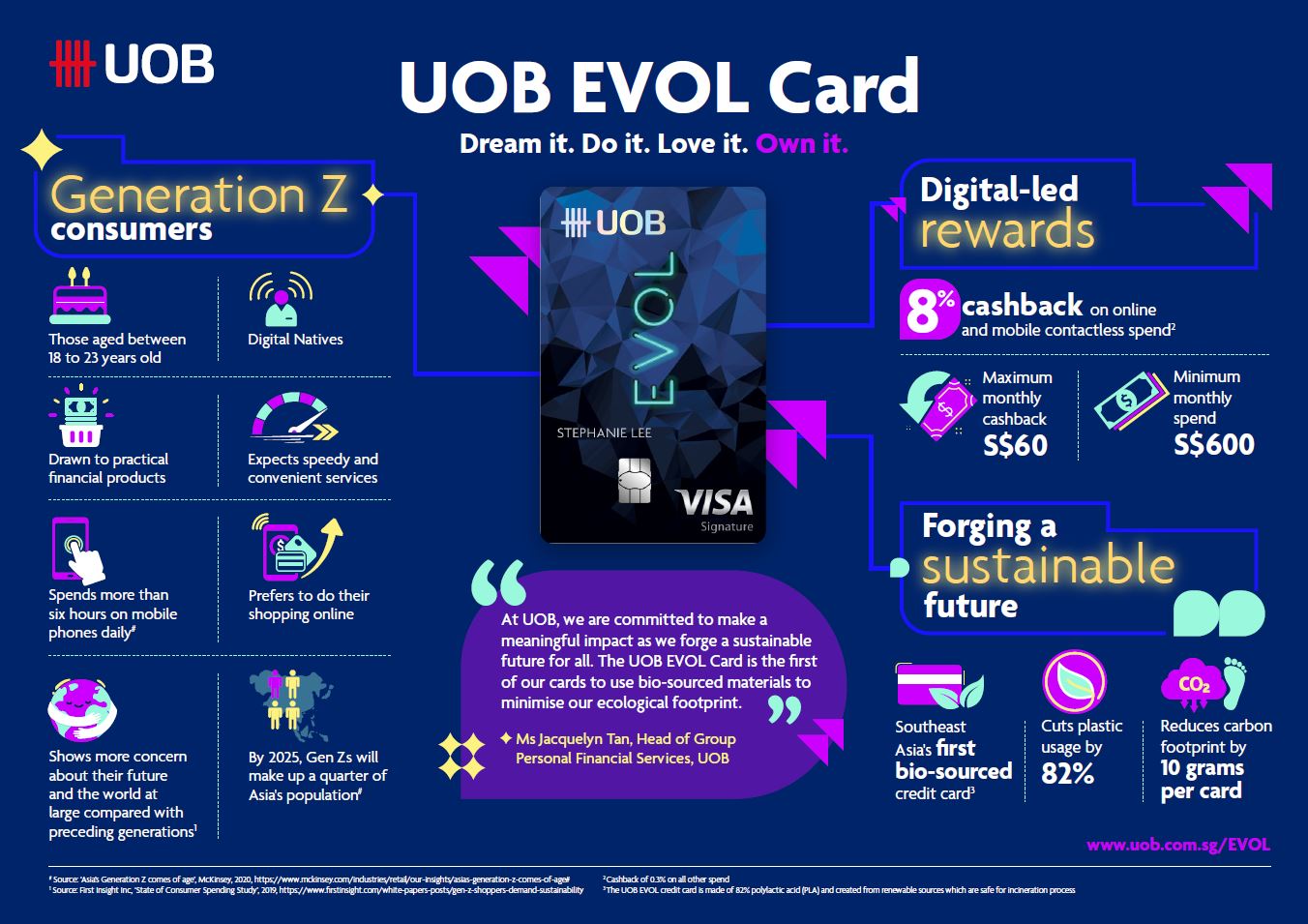

Gen Zs are expected to make up a quarter of Asia’s population by 20254 and have vastly different needs to Millennials5, 6. For instance, research has also shown that Gen Zs are more pragmatic having grown up during the global financial crisis and are more conscientious about their financial well-being as a result. Born in an age of rapid innovation, Gen Zs are also mobile-first consumers who value speedy, convenient digital services, spend more than six hours a day on mobile phones and do most of their shopping online.

Ms Jacquelyn Tan, Head of Group Personal Financial Services, UOB, said that the Bank’s focus is to design progressive solutions to serve customers across ASEAN through their different life stages.

“At UOB, we have been supporting generations of ASEAN consumers as they enter the workforce and advance through the different milestones and life stages for more than 85 years. Our strategy to serve Millennials, for example, has guided us well over the past five years. We currently serve one in two Millennials in Singapore, largely through the UOB YOLO as well as our flagship current account, the

UOB One Account.

“With Gen Zs making up more than one million of Singapore’s population today and expected to form the bulk of Singapore’s workforce by 20307, we have revamped our flagship credit card to serve their unique lifestyle priorities and financial goals. The UOB EVOL Card has been redesigned for a generation who are sustainability-oriented and digital natives with a preference to shop online. Our ambition is to be the primary choice of card for Generation Z consumers and to bank one in two consumers in this segment within the next three years,” Ms Tan said.

The UOB EVOL Card will also be rolled out progressively in Indonesia, Malaysia and Thailand. Existing UOB YOLO cardmembers will enjoy the UOB EVOL Card benefits automatically from today.

Purpose-driven card for the purpose-driven individual

As UOB doubles down on its sustainability efforts, the UOB EVOL Card is Southeast Asia’s first bio-sourced credit card. The UOB EVOL Card is made of 82 percent polylactic acid (PLA) and created from renewable sources which are safe for incineration process. A UOB EVOL Card that has expired and discarded is biodegradable in an industrial facility.

“At UOB, we are committed to make a meaningful impact as we forge a sustainable future for all. The UOB EVOL Card is the first of our cards to use bio-sourced materials to minimise our ecological footprint. Compared with a traditional plastic credit card which is typically made up of Polyvinyl Chloride or PVC, every UOB EVOL Card cuts down the use of plastic by 82 per cent and reduces our carbon footprint by 10 grams per card.”

“We started with the UOB EVOL Card because research has shown that Gen Zs also want products and services that align with their worldviews and values, with seven in 10 in this age group saying that they place greater value on products that are linked to sustainability8. We are reviewing the rest of our debit and credit cards and will progressively replace plastic cards with more environmentally-friendly options in the future,” Ms Tan said.

Digital-led rewards for the digital natives

Digitally focused and always on the go, many digital natives prefer to do their shopping online, with online spend making up more than half of all of all spend by UOB customers aged 21 to 35 years9. Mobile payments made by this group of customers also grew more than 300 per cent from 2018 to 202010.

To help Gen Zs optimise the value of their expenses wherever and however they make the most spend online, the UOB EVOL Card offers eight per cent cashback on purchases made online or via mobile contactless such as ApplePay, SamsungPay or GooglePay each month. They will also earn 0.3 per cent cashback on all other spend. With a maximum monthly cashback amount of $60, UOB EVOL cardmembers can receive up to $720 in cashback in a calendar year. To be eligible for cashback, UOB EVOL cardmembers simply need to charge a minimum of $600 on their card each month.

Given that they are a mobile-first generation, UOB EVOL cardmembers will also be able to track their expenses and cashback effortlessly, at any time and anywhere, through UOB’s AI-driven insights service Mighty Insights. This service is integrated within the Bank’s all-in-one mobile banking app UOB Mighty. Mighty Insights provides customised insights on each customer’s unique spending and saving patterns to guide them to be more financially disciplined and to optimise their UOB EVOL Card benefits.

New customers can apply for the UOB EVOL Card from today at https://www.uob.com.sg/personal/cards/credit-cards/rebates-cards/evol/index.page.

1 UOB defines Generation Z as individuals aged between 18 to 23 years old.

2 The UOB YOLO was launched in 2016 to serve one in two millennials over the next three years as they will soon make up the largest demographic of consumers in Singapore.

3 Based on a focus group of UOB Gen Z customers.

4 Source: ‘Asia’s Generation Z comes of age’, McKinsey, 2020, https://www.mckinsey.com/industries/retail/our-insights/asias-generation-z-comes-of-age#

5 UOB defines Millennials as individuals aged between 24 to 39 years old.

6 Source: ‘True Gen’: Generation Z and its implications for companies, McKinsey, 2018, https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/true-gen-generation-z-and-its-implications-for-companies#

7 Source: ‘Population and Population Structure’, Singapore Department of Statistics, 2021, https://www.singstat.gov.sg/find-data/search-by-theme/population/population-and-population-structure/latest-data

8 Source: First Insight Inc, ‘State of Consumer Spending Study’, 2019, https://www.firstinsight.com/white-papers-posts/gen-z-shoppers-demand-sustainability

9 Source: UOB data

10 Source: UOB data