For corporate clients, we provide working capital loan and medium/long term loans of TWD and major currencies.

About UOB Taiwan

United Overseas Bank (UOB) Group first set foot on Taiwan in January 1992 as a representative office. On 28 August 1995, UOB Taipei Branch was formally established. As the banking industry continues to liberalize in Taiwan, our business concurrently expanded to include an Offshore Banking Unit (OBU) on 2 April 2001.

UOB Taipei is a full-license bank that can undertake all forms of banking activities. Other than providing the traditional services in facilitating trade and remittances, we also engage actively in corporate & investment banking as well as, treasury services.

With a complete setup that is centrally located in the commercial heart of Taiwan, UOB Taipei Branch has successfully established a strong network of clientele both locally and abroad. We strongly believe in teamwork, and we cooperate very closely with other branches of the Group. The Group has placed significant emphasis on us, and we will remain dedicated to our mission: "To become a premier bank in the ASEAN region, committed to providing quality products and excellent customer service".

Product & Services

Loans

Working Capital Loan

Global Markets

Global Markets

UOB offers you various treasury products such as FX spot, FX forward, FX swap, Interest Rate Swap, Cross Currency Swap, MM/Repo/ Reverse Repo and structured product to meet your hedging needs and funding requirements.

Trade Finance

Import/Buyer

Comprehensive import solutions to enhance your working capital and procurement cycle.

- Import Letter of Credit

- Import Collection

- Shipping Guarantees

- Import Financing

Trade Finance

Export/Seller

Convert receivables to cash with comprehensive export solutions.

- Export Letter of Credit Advising

- Export LC Document Checking and Negotiation

- Export Collection

- Export Financing

- Account Receivable Purchase

Trade Finance

Banker’s Guarantee & Standby Letter of Credit

Secure business with assurance and confidence.

Cash Management

Deposits

For DBU and OBU corporate clients, we provide deposit account services of TWD and major foreign currencies as for the safety and the liquidity of money, and the stable deposit yield. Our deposit products include:

Current account and saving account deposit

- for TWD and major foreign currencies

Fixed deposit (i.e. time deposit)

- for TWD, USD, SGD, CNH and tenor within 1 year.

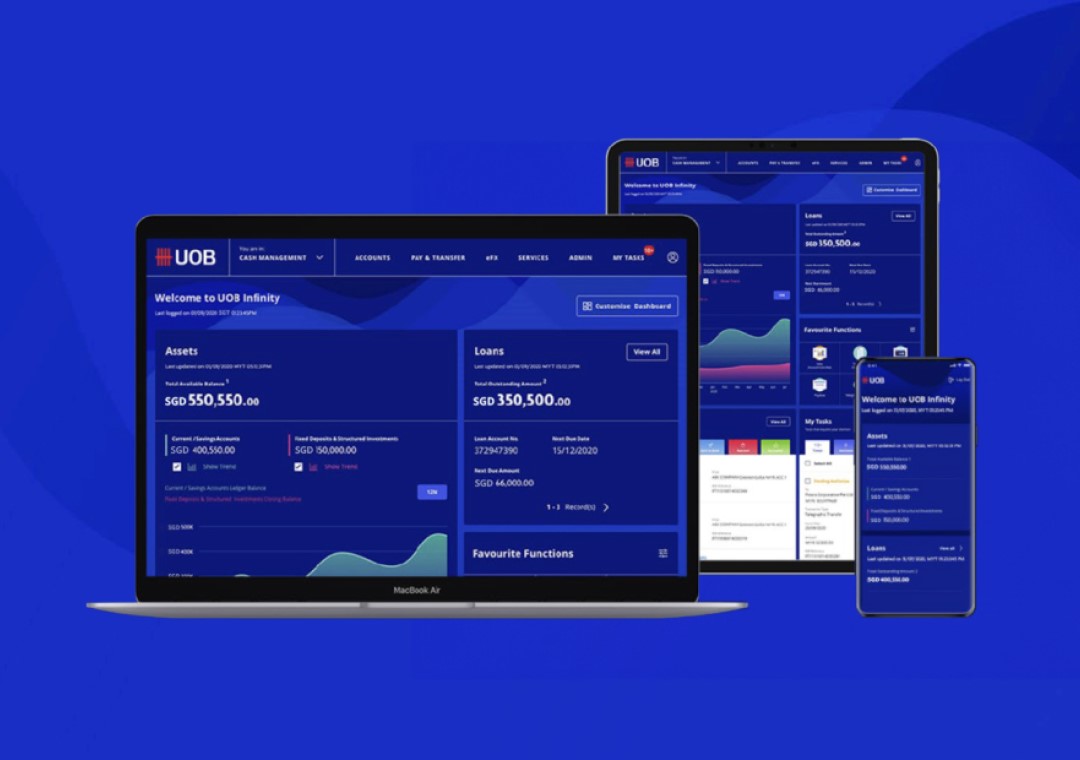

UOB Infinity

Giving you financial management control via e-banking platform to grow your business

We are here to help

Kindly let us know should you need any clarifications on our products and services and we are happy to touch base with you at your convenient time.

Visit us

United Overseas Bank Ltd.

Taipei Branch

30F, Cathay Landmark,

No. 68, Sec. 5, Zhongxiao E. Rd.,

Taipei City 110, Taiwan

Contact us

Tel: (886)(2) 2722 3838

Fax: (886)(2) 2722 2322

Email:

UOB.Taipei@UOBgroup.com