Key Features

Make TMRW yours

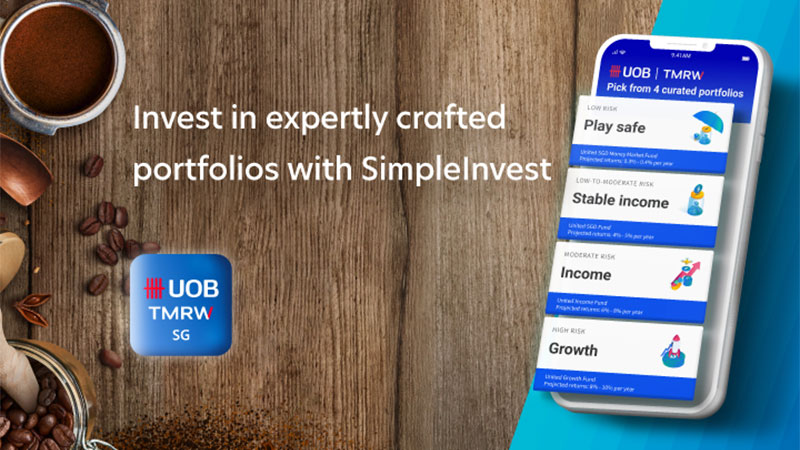

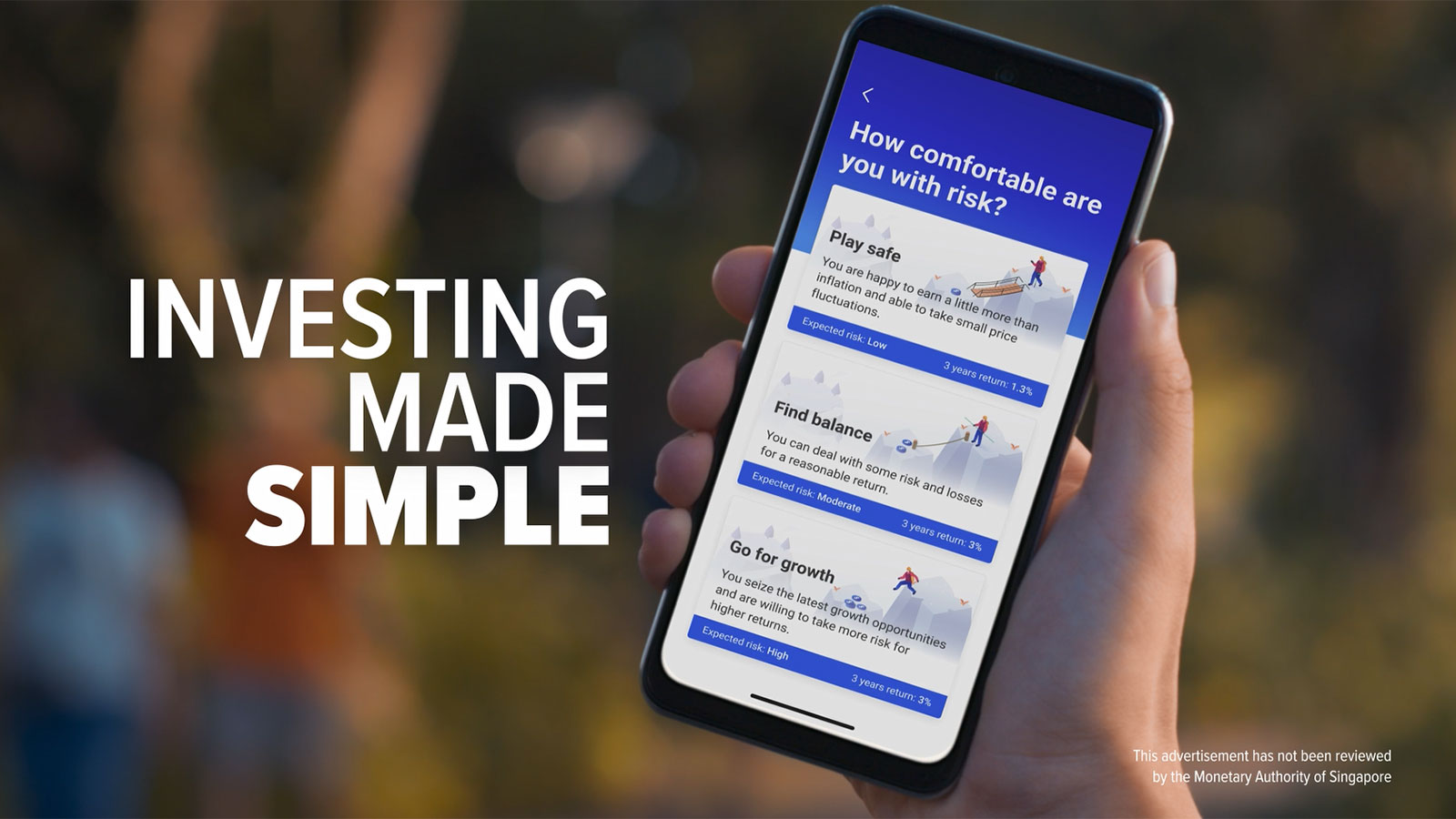

As Singapore’s best retail bank, UOB TMRW is the all-in-one banking app built around you and your needs. Bank with ease, invest from as little as S$100 with SimpleInvest and enjoy personalised rewards, cashback and deals with Rewards+. Make TMRW yours.

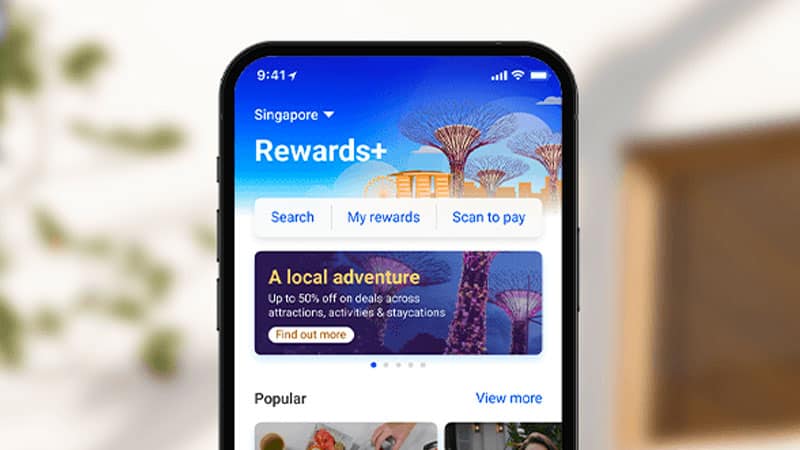

UOB Rewards+: Yours to love.

Everyone loves a great deal, especially when they are curated just for you. Shop, dine or indulge in a little luxury through UOB Rewards+, Singapore’s largest rewards programme. Access UOB Rewards+ on UOB TMRW to view and track all the cashback and rewards points you’ve earned with each transaction, as well as redeem your favourite treats.

Awards and Accolades

Best Retail Bank – South-East Asia, Singapore

TMRW also won best Digital Bank – Thailand, Outstanding Use of Advance Analytics, Best Data Analytics Initiatives – Singapore by the Digital Banker

Best Mobile Banking Application and Most Innovative Digital Bank

TMRW won in these 2 categories for Singapore, Thailand and Indonesia at the International Finance Awards

Best Digital Bank - ASEAN

TMRW won Best Digital Bank - ASEAN Award by World Economic Magazine