UOB Infinity FAQs

About Infinity

UOB Infinity is UOB’s digital banking platform for businesses. The platform offers a comprehensive suite of cash management and trade services to help you manage your cash and trade transactions more efficiently.

The platform is available 24/7 and is accessible as long as you have internet access. However, some transactions may be subject to processing hours.

Application

Companies/Institutional entities that may Corporate account with UOB Manila branch are eligible to apply for UOB Infinity.

Please contact your relationship manager or call us at 8548-6400 from Mondays to Fridays, 9.00am to 5.00pm , excluding public holidays.

- To reset Group (Organisation) ID / User ID – please contact our UOB Manila branch at 8548-6400 during office hours and furnish us with your company’s ID and your legal ID.

- To reset Password – select “Have trouble logging in?” at the bottom of the login box and follow the on-screen instructions.

It takes the Bank up to 10 working days from the receipt of your application and all required documents to process your application. Upon successful creation of your User ID, the Bank will send an email and SMS to the email address and contact number respectively as indicated on your UOB Infinity application. Please ensure that the email address and contact number provided in the application form is correct.

If you did not receive your UOB Infinity Welcome Pack, please contact our UOB Manila branch at 8548-6400 during office hours and furnish us with your company’s ID and your legal ID.

You will receive a UOB Infinity Welcome Pack delivered to your postal contact address. The welcome pack will consist of your UOB Infinity Organisation ID and User ID. Depending on the products and services you selected in the submitted form, you may also receive a physical token separately.

Note: Physical token is required for Global View functions.

Create/add users

Your Company Administrator will be able to create/add users and assign different functional and data access privileges to different users. However, the Company Administrator cannot create/add other Company Administrators and/or Authorisers. To create/add Administrator and Authoriser access, please submit a maintenance form.

Link more accounts/subscribe for more UOB Infinity services

To link more accounts to UOB Infinity or to subscribe for more UOB Infinity services such as request for token replacement, kindly submit a maintenance form.

Login

You can activate your user ID from the UOB Infinity login page by selecting “Want to activate your new account?” and following the on-screen steps. For all users except Company Administrators and Authorisers, your Company Administrator will also be able to activate your account on your behalf.

- Organisation ID – You cannot change your Organisation ID

- User ID - You can change your User ID only during your first login to UOB Infinity. Subsequent changes are not allowed.

- Password – You may change your password at any time from the “Manage Profile” menu at the top right corner of your dashboard.

UOB Infinity has a “Remember Me” function to store the Organisation ID and User ID from the last login. You will only need to enter your password the next time you log in. However, the “Remember Me” function can only save one Organisation ID and User ID.

UOB Infinity supports Infinity Secure and physical tokens concurrently. If you do not have Infinity Secure installed, you may use your existing BIBPlus login details and OTP generated from your BIBPlus token to log in. If you already have Infinity Secure installed, you may choose to log in using Infinity Secure (via Push Notification or OTP generated in Infinity Secure “offline” mode).

To de-register Infinity Secure:

- Log in to Infinity mobile app > More Services > Remove Infinity Secure from this account.

- Alternatively, you may request for your Company Administrator (CA) to de-register Infinity Secure on your behalf.

Accounts

UOB Infinity can display account activity data for the past 12 months.

For existing UOB Infinity customers

You will be able to view/retrieve account activity data for the past 12 months in UOB Infinity. For activity data beyond 12 months, please visit your nearest UOB branch to request the data. Fees may apply.

For new UOB Infinity customers

You can only view/retrieve account activity data for the past 2 months when you access UOB Infinity for the first time.

You will be able to download/export the account statements of all your UOB accounts that are linked to UOB Infinity. Please note that the layout of the downloaded statement differs from the physical account statement.

To download/export account statements:

- From the top menu bar, go to Accounts > Account Activities.

- Select the account number and date range required.

- Click the “Export” button at the top right corner of the screen.

Note: Files are available in PDF, CSV, spreadsheet or fixed length format

Token

No.

Infinity Secure will be progressively enhanced to support all functions. In the meantime, the physical token is still required for the following services:

- All transactions using Global View service

Even if you do not use any of the above services, please keep your physical token in a secure location as a backup. In the event that you subscribe for any of the above services in the future or should you encounter any unexpected issues when using your Infinity Secure (e.g. loss of mobile phone), you will still be able to authorise transactions using your physical token.

If you require a replacement for your physical token, you need to fill up a Maintenance Form. Please contact your relationship manager to get the required form.

Web browser and mobile operating system requirements for UOB Infinity

The minimum supported versions of the different browser types required to access UOB Infinity are:

- Google Chrome - version 86 and above

- Microsoft Edge - version 98 and above

- Safari - version 12 and above

- Mozilla Firefox - version 90 and above

The minimum supported versions for iOS and Android mobile operating systems are:

- iOS - version 15 and above

- Android OS - version 11 and above

These minimum supported versions of the browsers and mobile operating systems have continued security patches and updates provided by the respective manufacturers.

Security

UOB Infinity has a system that provides a high standard of security for banking over the Internet. This security system safeguards the confidentiality of your personal account information and banking transactions by employing:

- Multiple levels of firewalls

- 2048-bit Secure Sockets Layer (SSL) encryption – currently recognised internationally to be of the highest standard in encryption technology commercially available

- A two-factor authentication that uses User ID and password (or biometric login for UOB Infinity mobile app) along with a secure token

To further protect your company's account and transaction information while banking via UOB Infinity, we recommend doing the following:

- Change your password regularly as an added security measure

- Clear the browser's cache after each session in UOB Infinity so that details of your transactions are removed

- Always log out properly after you have completed your online banking activities

For more details, you may wish to view our best privacy and security practices.

Security

This feature is necessary for enhanced security to mitigate the dangers and protect your exposure to malware scams, as it prevents scammers from taking control of your device, and compromising your banking and personal information. It also serves as an alert when a scammer is attempting to take control of your device remotely. For your security, your access to UOB’s corporate banking apps, UOB Infinity will be restricted until you stop these activities.

Note that there are differences in iOS and Android devices due to device specific behaviours. As much as possible, our stance is to prevent these activities and we strongly urge customers not to share any content from your banking app.

If you did not perform screen sharing or recording but you are prompted with an anti-malware message upon login, please switch your device to flight mode immediately, to disconnect it from the internet. This will prevent the scammers from further accessing your device remotely. Use a reputable anti-virus software to scan and remove any malware detected in your device. You are strongly encouraged to report the incident to the relevant authorities and lodge a police report. Please also contact our hotline 8548-6400 for urgent assistance. Please share your device details with our UOB Branch staff so that they can investigate and assist you further.

The screen sharing app/tool that you were using was not restricted, and hence you were able to continue to share your screen. However, in line with industry efforts to fight against the evolving scam threats, note that we are constantly updating the list of restricted app/tools and refining our anti-scam security measures to protect our customers.

We have detected that this mobile app is riskier and may compromise your banking and personal information. Hence, it is recommended that you uninstall the mentioned app shown on the error message. Your access to UOB’s corporate banking apps, UOB Infinity will be restricted until you uninstall the app.

With the latest update, we have enhanced the security check to prompt customers with an error message to uninstall the mentioned apps if we have detected apps with risky permissions. We are constantly refining and updating our security checks based on feedback from our customers, in line with industry efforts to counter evolving scam threats.

We have detected that you have installed mobile apps with risky permissions on your device. Apps downloaded from third-party sites may compromise banking and personal information. For your security, your access to UOB's corporate banking apps, UOB Infinity, will be restricted until you uninstall or turn off the accessibility permissions for the mentioned apps shown on the error message.

To mitigate the risk of malware attack from these apps, we recommended to uninstall the mentioned apps that were not downloaded from the official app stores.

However, if you are certain and trust that the mentioned app is safe (example: it is a workplace app), you may turn off its accessibility permissions.

These enhanced security features are necessary to mitigate the dangers and protect your exposure to malware scams. You will need to uninstall (recommended option) or turn off the accessibility permissions for the mentioned apps shown on the error message, to continue to use our app.

To mitigate the risk of malware attack from these apps, we recommended to uninstall the mentioned apps that were not downloaded from the official app stores.

However, if you are certain and trust that the mentioned app is safe (example: it is a workplace app), you may turn off its accessibility permissions.

We value your privacy. You can be assured that our new features do not monitor your phone activity, nor collect or store any personal data.

We apologise for any inconveniences caused. This security feature was intended to protect customers from malware scams. As the mentioned app was detected to be installed from a third-party site instead of the official app stores, there is a possibility that your banking and personal information may be compromised. If you wish to continue using UOB's corporate banking apps, UOB Infinity and your workplace app on your device, you will have to turn off the accessibility permissions of your workplace app.

Step 1: Open the “Settings” app on your device

Step 2: Scroll down and select "Accessibility" or scroll until you find the "Advanced Settings" option, then select "Accessibility”

Step 3: Tap on "Select actions" or the toggle switch to turn off the "Accessibility” feature

Please note that the above path may differ across device manufacturers and operating systems. If you encounter any difficulties, please check with your device manufacturer.

The affected app could be malicious. Please follow these steps to protect yourself from malware scams:

Step 1: Switch your device to flight mode

If you suspect your device has been infected by malware, switch your device to flight mode immediately, to disconnect from the internet. This will prevent scammers from any further remote access to your device.

Step 2: Run an anti-virus scan on your device

Scan your device with an anti-virus software to detect, identify and remove any malware.

Step 3: Report the incident

You are strongly encouraged to report the incident to the relevant authorities and lodge a police report.

Please also call our hotline at 8548-6400 for any urgent assistance.

Once the above steps are completed, you may resume usage of your device by rebooting your device in safe mode to temporarily disable any third-party apps, followed by uninstalling any suspicious apps. Finally, install mobile security software from a trusted source to scan for remaining malware.

As a further precaution, you may also consider doing a “factory reset” and changing any important passwords. Please do not port any back-up data after a factory reset of your device.

Please refer to our UOB security website for more information and tips to protect yourself from malware scams.

Overlay is a feature where an app can appear on top of other apps. These could be invisible to the user and malicious parties can phish information that you have entered on your device. Hence for your security, it is recommended that you turn off the device's overlay permission at the phone setting.

Step 1: Open the “Settings” app on your device

Step 2: Scroll down and select “Apps & Notifications”

Step 3: Tap on “Advanced” option and select “Special app access”

Step 4: Tap on “Display over other apps” / “Draw over other apps” / “Apps that can appear on top”

Step 5: Tap on the toggle switch on the app to turn off the overlaying

Please note that the above path may differ across device manufacturers and operating systems. If you encounter any difficulties, please check with your device manufacturer.

USB / wireless debugging (developer option) is a special mode on Android devices that gives you access to advanced settings and features that are not normally available to users. These settings could compromise the security of your device. Hence, the access to UOB's corporate banking apps, UOB Infinity, has been restricted for your security.

App tampering is a technique to modify an app's code from the original code to bypass or manipulate the app’s security features. Hence, the access to UOB's corporate banking apps has been restricted and it is recommended that you reinstall UOB's corporate banking apps, UOB Infinity, from the official app stores for your security.

Getting Help

You can download our user guides by logging in to UOB Infinity, click the user icon at the top menu bar and click “Need Help?”. Should you require any assistance, please contact your relationship manager or contact us directly at 8548-6400 from Mondays to Fridays, 9.00am to 5.00pm, excluding public holidays.

Infinity Secure

A shared digital token (Infinity Secure) conveniently allows a user to access more than one UOB Infinity User Profiles (login credentials) across different Organisation IDs within the same country (e.g. Singapore or Malaysia) and across countries on a single UOB Infinity mobile app.

The benefits are:

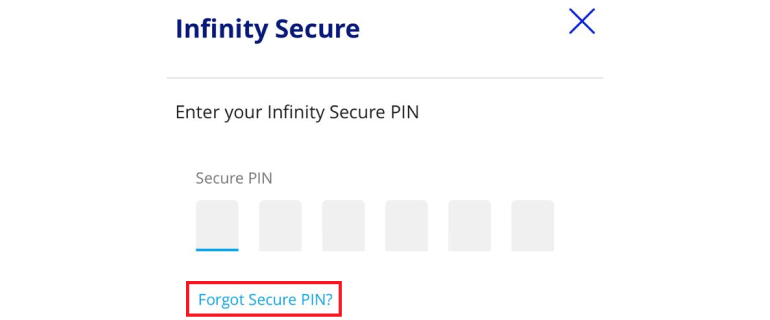

- Secure – Infinity Secure is protected by a 6-digit Secure PIN chosen by you. Multiple UOB Infinity User Profiles (across different Organisation IDs within the same country) can be linked to one Infinity Secure digital token.

- Convenient – You do not need to carry the physical token around to log in to UOB Infinity or approve cash transactions. Infinity Secure enables you to receive authentication requests through UOB Infinity’s push notifications.

You will need valid login details (UOB Infinity Organisation ID, User ID, and Password) to kick start the registration process for Infinity Secure.

- Download UOB Infinity mobile app and log in to Infinity via the mobile app

- Register for Infinity Secure

- Wait for 12 hours

- Activate Infinity Secure

For a step-by-step guide, please log in to UOB Infinity, click the user icon (![]() ) at the top menu bar and click “Need Help?”.

) at the top menu bar and click “Need Help?”.

You may refer to the "Register your digital security token" User Guide to link multiple UOB Infinity User Profiles (login credentials) across different Organisation IDs within the same country and across countries to your shared digital token (Infinity Secure) on your UOB Infinity mobile app.

This is a security feature of Infinity Secure’s registration and activation process to prevent fraudulent activation of Infinity Secure.

Should you receive the One-Time Verification Code via SMS or email for UOB Infinity Secure registration without initiating the registration, please contact UOB Manila at 8548-6400 immediately.

To update the status of your linked User Profile to "Activated", you may perform a login using the linked User Profile credentials on the UOB Infinity mobile app.

If you have a physical token, login with your physical token and click on “More Services" > "Register / Activate Infinity Secure for this Device”. Follow the on-screen instructions for the activation.

If you do not have a physical token, you will be prompted to activate your digital token after your initial login via Organisation ID and User ID. Follow the on-screen instructions for the activation.

For a step-by-step guide for the removal of linked UOB Infinity User Profiles, please log in to UOB Infinity, click the user icon at the top menu bar and click “Need Help?”.

You may refer to the "Register your digital security token" User Guide to remove your existing linked UOB Infinity User Profiles (login credentials) from your shared digital token (Infinity Secure) on your UOB Infinity mobile app.

Yes, you can subscribe for Global View service and you may still use your digital token (Infinity Secure) locally (e.g. Singapore) as well.

When you subscribe for Global View service, a physical shared token will be issued to you, where it will allow you to access more than one UOB Infinity User Profiles (login credentials) across different markets (e.g. Singapore and Malaysia).

Alternatively, you can also easily access Singapore and Malaysia UOB accounts on UOB Infinity mobile app after upgrading to Infinity Secure with Global view functionality. You will still require your physical token to authorise trade transactions or to navigate to accounts beyond Singapore and Malaysia on UOB Infinity web. However, you have the flexibility to use Infinity Secure to authorise your cash payments within and across countries, after completing linking process for Singapore and Malaysia.

No, you will not be able to register/activate Infinity Secure whilst in China. This is because Google services are currently not available in China.

Yes, please perform the following steps when you are switching to a new mobile phone:

- Download the UOB Infinity mobile app and install it on your new mobile phone

- Log in to the UOB Infinity mobile app on your new mobile phone

- Click on “Register / Update Infinity Secure” at the “Enter Token Response” screen

- Register for Infinity Secure

- Wait for 12 hours

- Activate Infinity Secure

If you are using iCloud services to migrate your iOS apps and configurations to your new iPhone, please uninstall the migrated UOB Infinity Mobile app under your new iPhone and re-install the latest version from the iOS App Store by following step 1 above.

Once Infinity Secure has been registered on a new mobile device, the Infinity Secure on your old mobile will be invalidated.

If you have exceeded the maximum number of tries (i.e. 5 times) for your Infinity Secure PIN, for security reasons, you will be required to re-register for Infinity Secure.

Please use your physical token to log in and follow the steps below to register and activate your Infinity Secure.

You will need valid login details (UOB Infinity Organisation ID, User ID, and Password) to kick start the registration process for Infinity Secure.

- Download UOB Infinity mobile app and log in to Infinity via the mobile app

- Register for Infinity Secure

- Wait for 12 hours

- Activate Infinity Secure

For a step-by-step guide, please log in to UOB Infinity, click the user icon (![]() ) at the top menu bar and click “Need Help?”.

) at the top menu bar and click “Need Help?”.

You may refer to the "Register your digital security token" User Guide to link multiple UOB Infinity User Profiles (login credentials) across different Organisation IDs within the same country to your shared digital token (Infinity Secure) on your UOB Infinity mobile app.

For security reasons, there is no reset function for your Infinity Secure PIN. If you have forgotten your 6-digit Infinity Secure PIN, you can select “Forget Secure PIN” on your UOB Infinity mobile screen. After which, you will be guided to re-register for Infinity Secure.

You may request your Company Administrator (CA) to deregister Infinity Secure that is linked to your user ID. If you are the CA and you have lost your mobile phone, please contact UOB Manila at 8548-6400 immediately.

No, Infinity Secure will not be automatically deregistered. You will need to deregister Infinity Secure from your account by following these steps:

- Log in to the UOB Infinity mobile app

- Select “More Services”

- Click “Remove Infinity Secure from this account”

You may also request your Company Administrator (CA) to deregister Infinity Secure that is linked to your user ID. If you are the CA and you have lost your mobile phone, please contact UOB Manila at 8548-6400 immediately.

Yes, both the shared physical token and the shared digital token (Infinity Secure) can co-exist. Either type of shared token may be used to log in and approve cash transactions in UOB Infinity.

No.

Infinity Secure will be progressively enhanced to support all functions. In the meantime, the physical token is still required for the following services:

- All transactions using Global View service

Even if you do not use any of the above services, please keep your physical token in a secure location as a backup. In the event that you subscribe for any of the above services in the future or should you encounter any unexpected issues when using your Infinity Secure (e.g. loss of mobile phone), you will still be able to authorise transactions using your physical token.

Note: A physical token may go out-of-sync if it is not used for more than 6 months. You should login to UOB Infinity with your physical token regularly to prevent it from going out-of-sync.

In order to link the multiple UOB Infinity User Profiles (login credentials) to your shared digital token (Infinity Secure) successfully, the Legal ID Type, Number and Country of your User Profiles (across the different Organisation IDs within the same country) will need to match.

To update the Legal ID Type, Number and Country of your UOB Infinity User Profiles, you may use the UOB Infinity - Services and User Maintenance form.

In addition, your UOB Infinity User Profiles at the different Organisation IDs are required to be activated first, before you can proceed to link them to your shared digital token (Infinity Secure) on the UOB Infinity mobile app.

Yes, if you switch to a new mobile phone:

- Please install the UOB Infinity mobile app on the new mobile phone and perform the registration and activation of Infinity Secure on your new mobile phone.

- You will be prompted to transfer existing linkages to new mobile, or you may choose to need to re-link all of the User Profiles across the different Organisation IDs under the UOB Infinity mobile app on your new mobile phone again.

Note: If you are using iCloud services to migrate your iOS apps and configurations to your new iPhone, please uninstall the migrated UOB Infinity mobile app under your new iPhone and re-install the latest version from the iOS App Store.

By registering and activating Global Digital Token, you may access, view, and transact all UOB accounts within and across locations with a single login.

There are 2 options:

- Infinity Secure only - a digital token which allows user to login to UOB Infinity with multiple user access within or across locations.

- Infinity Secure with Global View – a digital token which allows user to login to UOB Infinity with multiple user access, view consolidated accounts and perform transaction within and across different locations with a single login via primary user.

This feature is available on Singapore, Malaysia, Overseas Branches UOB Infinity mobile app currently and will be progressively made available to more countries.

You may:

- perform self linkage of user ID,

- get your company administrators to perform linkage.

Under Infinity Secure “Manage Infinity Secure’s Linked Profiles” sub-menu, the user can input to-be linked Organisation ID and User ID and choose “Infinity Secure only” or “Infinity Secure with Global View” option to link users within or across countries.

After successful linkage and upgrade of Infinity Secure, initiating user and linked user has to perform Infinity Secure activation. 12 hours cooling period is imposed before user activation process as part of enhanced security measures.

Activation of initiating user

- Initiating user can activate his own profile after 12 hours cooling period has passed.

Activation of linked user

- Activate on behalf of Linked user. To do so, initiating user can select “Manage Infinity Secure’s Linked Profiles” sub-menu, select “Profile” and choose “Activate” option to activate the profile linkage

- Alternatively, the Linked user will activate his own Infinity Secure profile by logging into the App directly after 12 hours cooling period has passed.

Please note that all existing users will be prompted to re-activate their user profile after linkage is completed.

User has to perform linking with to-be linked new user ID. Upon successful Global digital token upgrade, newly linked user has to activate user profile and will be prompted to accept Terms and Conditions if this is 1st time login.

Activation of linked user

- Activate on behalf of Linked user.

To do so, initiating user can select “Manage Infinity Secure’s Linked Profiles” sub-menu, select profile and choose “Activate” option to activate the profile linkage

Alternatively, the Linked user will activate his own profile after 12 hours cooling period has passed.

Initiating user always has to request for the linkages of the users within or across countries as 1st step.

Initiating user can perform successful linking of user IDs when following conditions are met:

- Requestor/Initiating User and Linking User to have same Legal ID and

- Selected Infinity Secure Only Linkage Type (ie without global view feature)

Company administrator of linked user has to approve the linkage when following conditions are met:

- Requestor and Linked User Legal ID are not matched, or

- Selected Linkage type is Infinity Secure with Global View

- If user (i.e. authoriser) had selected only “Infinity Secure Linkage only” and linked within same country, Push notification will be sent to the digital token registered device where authoriser can login and authorise transaction.

- If user (i.e. authoriser) had selected only “Infinity Secure Linkage only” and linked across different country, authoriser will be redirected to login to Mobile Browser to authorise the transaction. It is still 2 user profiles in different countries using 1 mobile device/Infinity Secure), hence the authoriser is always redirected to Mobile Browser.

- If user (i.e. authoriser) had selected only “Infinity Secure with Global View Linkage” and across different country, authoriser user can act on push notification and authorise the transaction seamlessly.

User can select “Remove Infinity Secure From This Account” sub-menu from UOB Infinity mobile app, and choose the profile to be de-linked.

If selected user is linked user within group, only the linked user will be delinked.

If selected user is primary user, then all the linked users will be delinked.

If the selected user is last user on Infinity App (e.g. Singapore’s user ID on Singapore UOB Infinity App), the linked users of other countries (i.e. Malaysia user ID on Singapore UOB Infinity App) will also be delinked.

You can continue to retain Global View physical token to access UOB accounts across all countries via UOB Infinity browser.

Alternatively, you can also easily access Singapore and Malaysia UOB accounts on UOB Infinity mobile after upgrading to Global Digital Token with Global view functionality.

You will still require your physical token to authorise trade transactions. However, you have the flexibility to use Infinity Secure to authorise your cash payments within and across countries, after completing linking process.

The biometric feature allows you to access the mobile app quickly and securely by using your mobile device’s fingerprint/face recognition function. With this feature, you do not need to enter your password to log in to the UOB Infinity mobile app.

Get in touch

Via UOB Coverage specialist

Please contact your Relationship Manager for all your banking needs including UOB Infinity

Contact Us

Call (632)85486400 (Mon-Fri, 9am-3 pm excluding public holidays)

Email: phinfinitymatters@UOBgroup.com