The Auto-Save feature is a demonstration of adaptive banking, catered to each customers’ unique behaviour to help them save effortlessly

Singapore, 02 November 2022 – UOB and Personetics, today at the Singapore Fintech Festival 2022, announced the launch of Auto-Save, an AI (artificial intelligence) driven automated and self-adjustable savings feature on the TMRW mobile banking app in Indonesia. Powered by Personetics AI and advanced data analytics solutions, the Auto-Save feature is the first of its kind to be launched by a bank in Indonesia and Southeast Asia, and aims to help UOB’s customers in Indonesia to save more effortlessly. The new feature launch is also an expansion of the strategic long-term partnership between UOB and Personetics, the leading global provider of financial data-driven personalisation, customer engagement, and advanced money management capabilities for financial institutions.

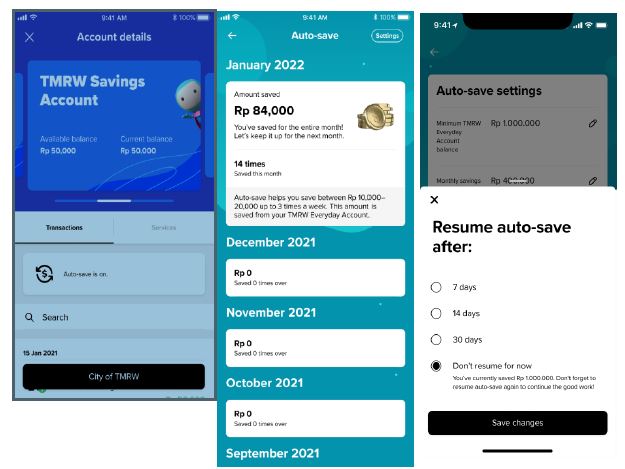

Leveraging AI and machine learning models, the Auto-Save feature on the TMRW mobile banking app is personalised to each individual. The models analyse and predict each customer’s past, current and future spending patterns, income, and everyday transactions to find safe-to-save money (i.e. excess amounts above average/typical cash outflows level). The app will then automatically move such variable amount of monies into customer’s TMRW savings account to earn higher interest while still ensuring sufficient balances in their current account for any required payments or outflows.

Kevin Lam, Head of UOB TMRW and Group Digital Banking at UOB said, “The first step to achieving one’s financial goals always starts with savings. But savings can also be a pain point for many of our customers in Indonesia. According to our recent ASEAN Consumer Sentiment Study, one in two consumers in Indonesia highlighted that their top financial concern is the ability to put money aside for saving. As a deeply-rooted bank in Indonesia, we are committed to doing right by our customers by assisting them in achieving their financial goals. We are delighted to partner with Personetics to introduce the new Auto-Save feature on our TMRW mobile banking app, to provide our customers with a simple, smart and automated way to save more for their future.”

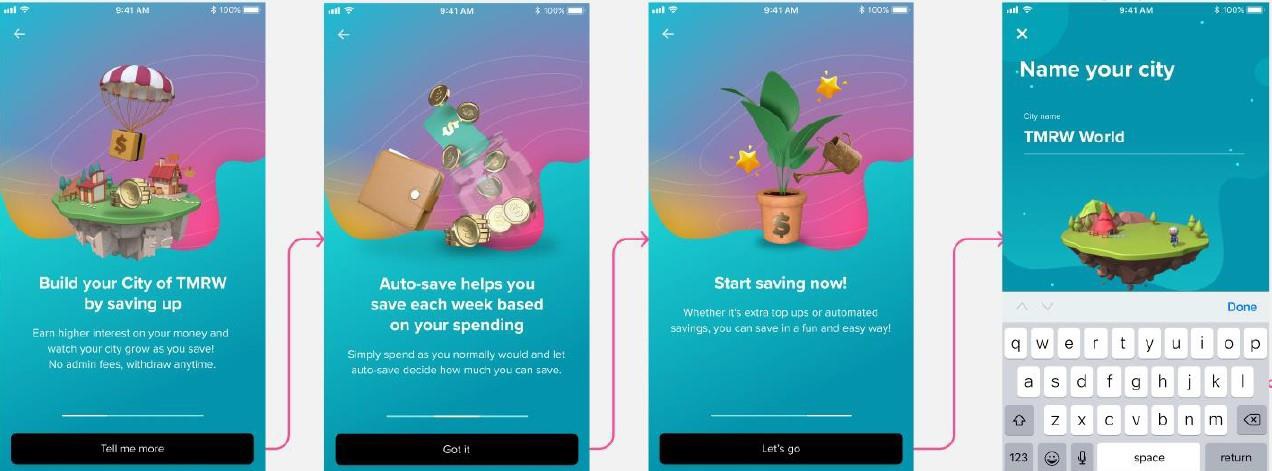

Auto-Save feature: How it Works

- Fully automated: The Auto-Save feature in TMRW constantly analyses customer financial transaction data including the monthly inflows and outflows in the customer’s Everyday bank account within the TMRW app. Powered by Personetics’ AI, the Auto-Save feature will identify small amounts of safe-to-save money to automatically transfer to a higher interest-earning Savings account up to several times a week.

- Fully controlled: Customers have the ability and flexibility to opt-in and opt-out of the Auto-Save feature at any time. With a simple click in the app, customers can easily pause or resume their auto-save participation, giving them full control to manage their savings level accordingly when there are changes to their usual lifestyle and routine which disrupt their cashflows. Customers may also withdraw funds from their accounts at any time.

The launch of Auto-Save builds upon the success and long-term partnership between UOB and Personetics in developing personalised, responsible and relevant financial data-driven solutions for tomorrow’s generation. Since the start of its partnership in 2018, UOB has already delivered over 150 million personalised insights to its customers in Indonesia, Malaysia, Singapore, and Thailand and have achieved an average year-on-year growth of mobile login users of close to 30 per cent across all four markets.

David Sosna, CEO and Co-founder of Personetics, said, “UOB for years has been one of the most forward-leaning and innovative leaders in banking in Asia, and we are proud to expand our partnership with them. They are offering customers the best combination of the tradition and stability of UOB, but with an innovative, young spirit of ‘TMRW.’ The UOB team has been an important partner to Personetics, helping create new ideas for custom insights and delivering a uniquely personalised experience for each banking customer. We believe that auto-savings will be an ideal fit for the needs of the Southeast Asian banking market, as customers in this region demand a higher level of support and involvement from their financial institutions in not just selling products, but improving their financial lives.”

UOB will also be exploring ways to further expand the use of the TMRW Auto-Save feature across its key markets in ASEAN including Singapore in the near future.