Hedging Instruments to Weather Volatile Global Markets

As clients expand globally, they must bear the risks of exchange rate fluctuations which either enhance or reduce their returns. UOB Indonesia offers solutions to manage currency risks, protecting our customers’ capital investments.

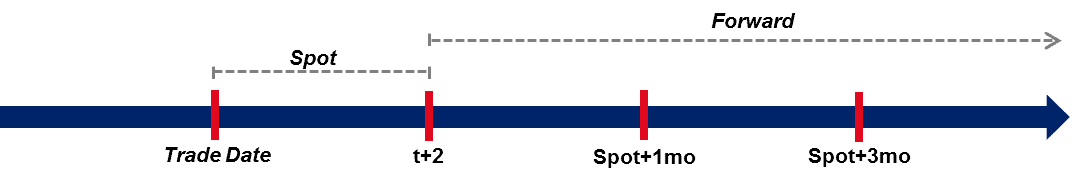

Forward Agreement

A Forward Currency Contract is a private agreement between two parties giving the buyer an obligation to purchase or sell a specific currency (and the seller an obligation to sell or purchase another specific currency) at a set price at a future point in time.

The maximum tenor for forward transactions is over 12 months. Clients might consider entering an agreement to sell USD forwards due to decreasing interest rate differentials causing the IDR to strengthen against the USD.

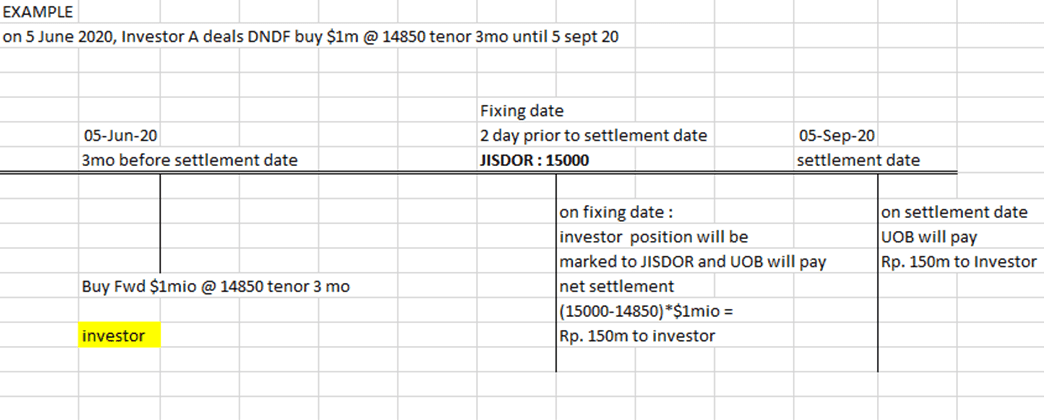

Domestic Non Deliverable Forward (DNDF)

DNDFs are FX Forward transactions with a domestic market fixing mechanism. The DNDF will be net settled in IDR using the Jakarta Interbank Spot Dollar Rate (JISDOR) on the fixing date for USD/IDR transactions. Non-USD transactions will refer to the Bank Indonesia (BI) middle rate on the fixing date.

DNDF transactions can only be unwound and the transactions between the bank and the client must be supported by documentation of underlying import/export transactions. The full criteria are stated in the BI regulations. DNDFs in MYR and THB are prohibited due to regulations in Malaysia and Thailand.

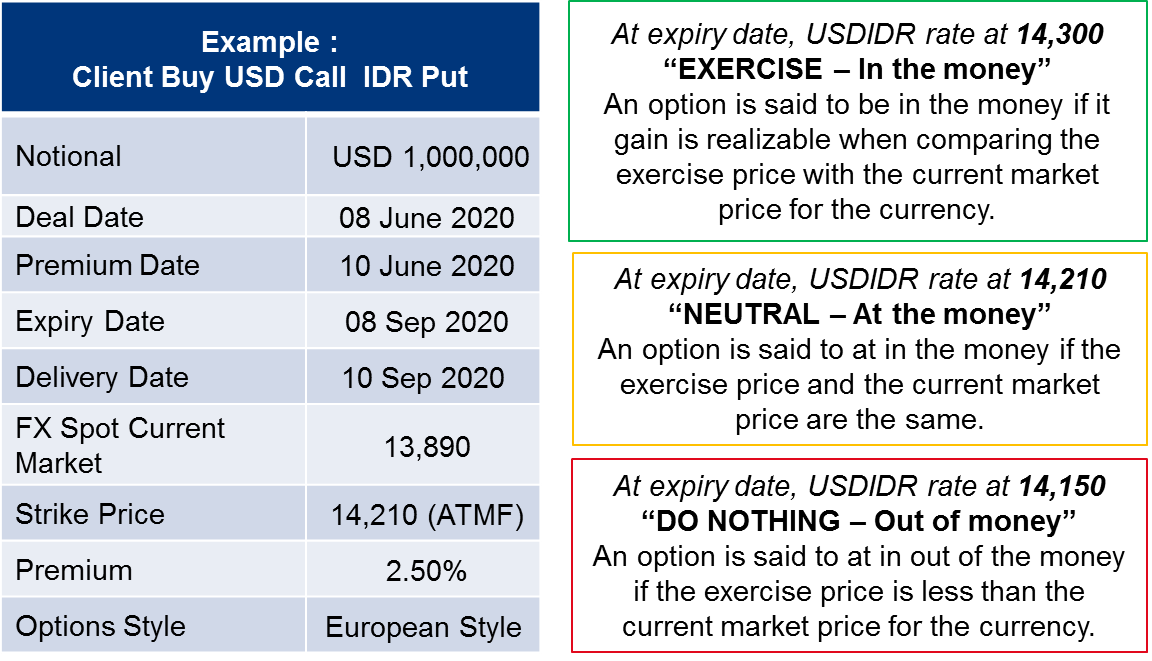

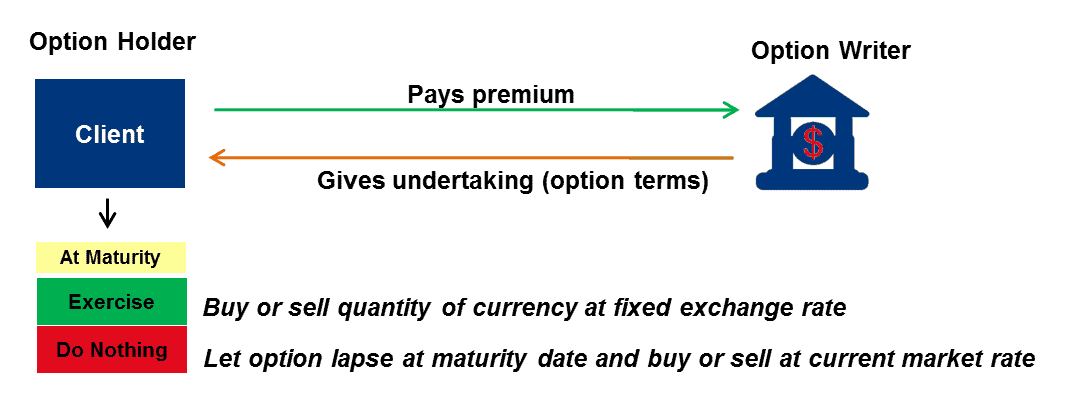

Call option

An FX Option is a contract between two parties that gives the buyer (who pays a premium to the seller) the right but not the obligation to execute an underlying foreign exchange contract to purchase a specific amount of one currency against the sale of specific amount of another currency at a predetermined exchange rate (called Strike Price) and at an agreed time line depending on the option’s style. It is an opportunity (a “right”) for the client to exercise the option rather than an obligation. Options are usually settled two days later (at the spot price on the expiry date), if exercised. Clients are to comply with BI regulations regarding foreign borrowings by Indonesian companies.