Blockchain and Digital Assets

Transforming the next generation of finance — from real-time interbank settlements to tokenised green bond reporting.

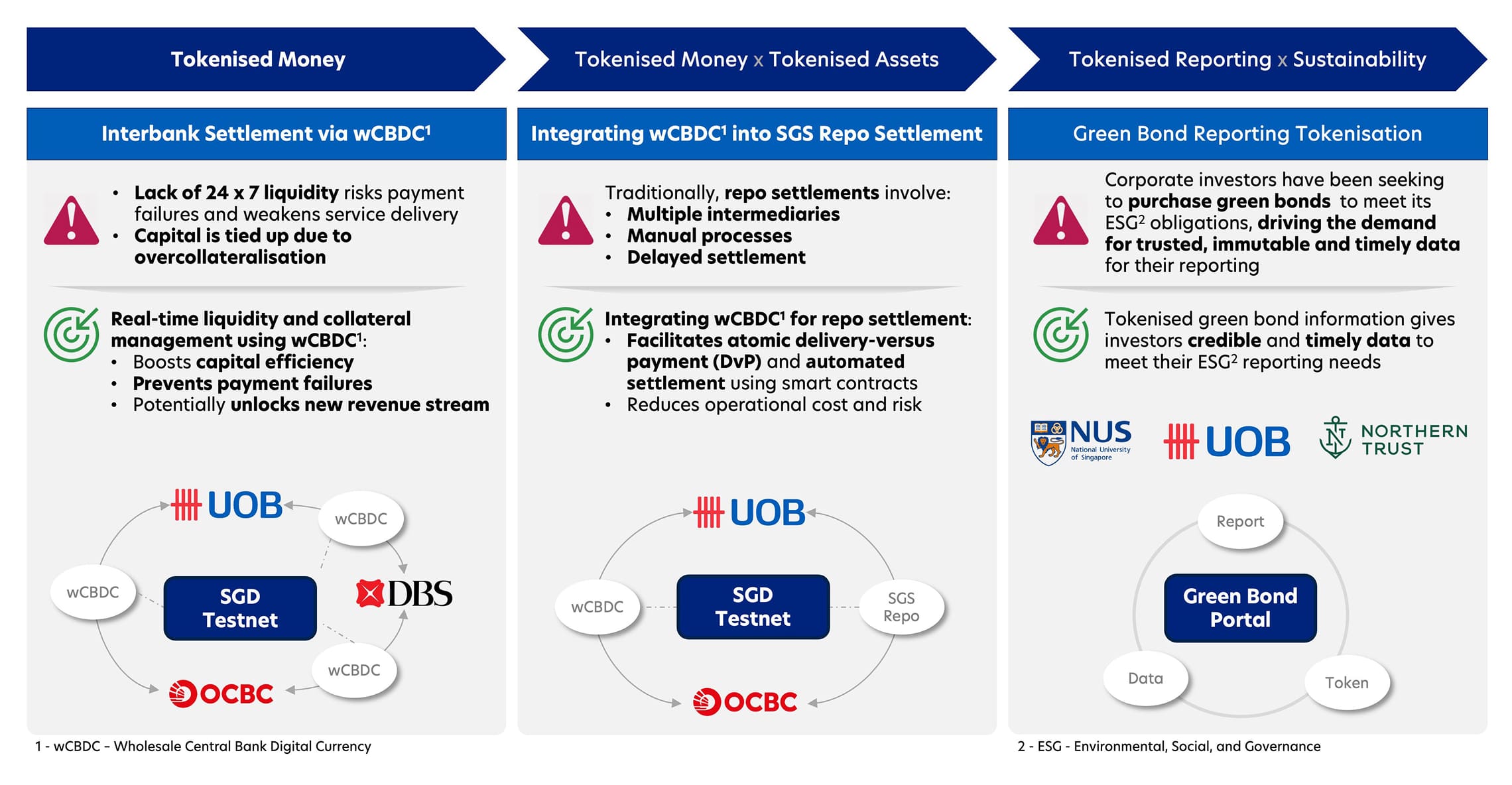

Building the next-generation financial system

Unlocking liquidity via interbank payment capabilities with wholesale CBDC: Net Debit Cap use case example

-

Problems

-

Details

| Problems | Details |

| Rejected Payments | FAST transactions that exceed Net Debit Cap (NDC1) limits outside MEPS+ operating hours are auto-rejected, risking service delays. |

| Over-Collateralisation | Banks park excess collateral during off-hours to avoid aforementioned service disruption, tying up capital. |

| No Real-Time Adjustments | Without ability to adjust collaterals to increase NDC during off-hours, banks use conservative estimates, further reducing efficiency. |

| Problems |

| Rejected Payments |

| Over-Collateralisation |

| No Real-Time Adjustments |

-

Outcomes

-

Details

| Outcomes | Details |

| 24 x 7 Collateral Management | Enables continuous payment processing, reducing payment rejections. |

| Dynamic Collateral Management | Adjusts collateral in real time, freeing up capital. |

| Boosts Efficiency & Revenue | Improves service reliability and opens doors to new financial products. |

| Outcomes |

| 24 x 7 Collateral Management |

| Dynamic Collateral Management |

| Boosts Efficiency & Revenue |

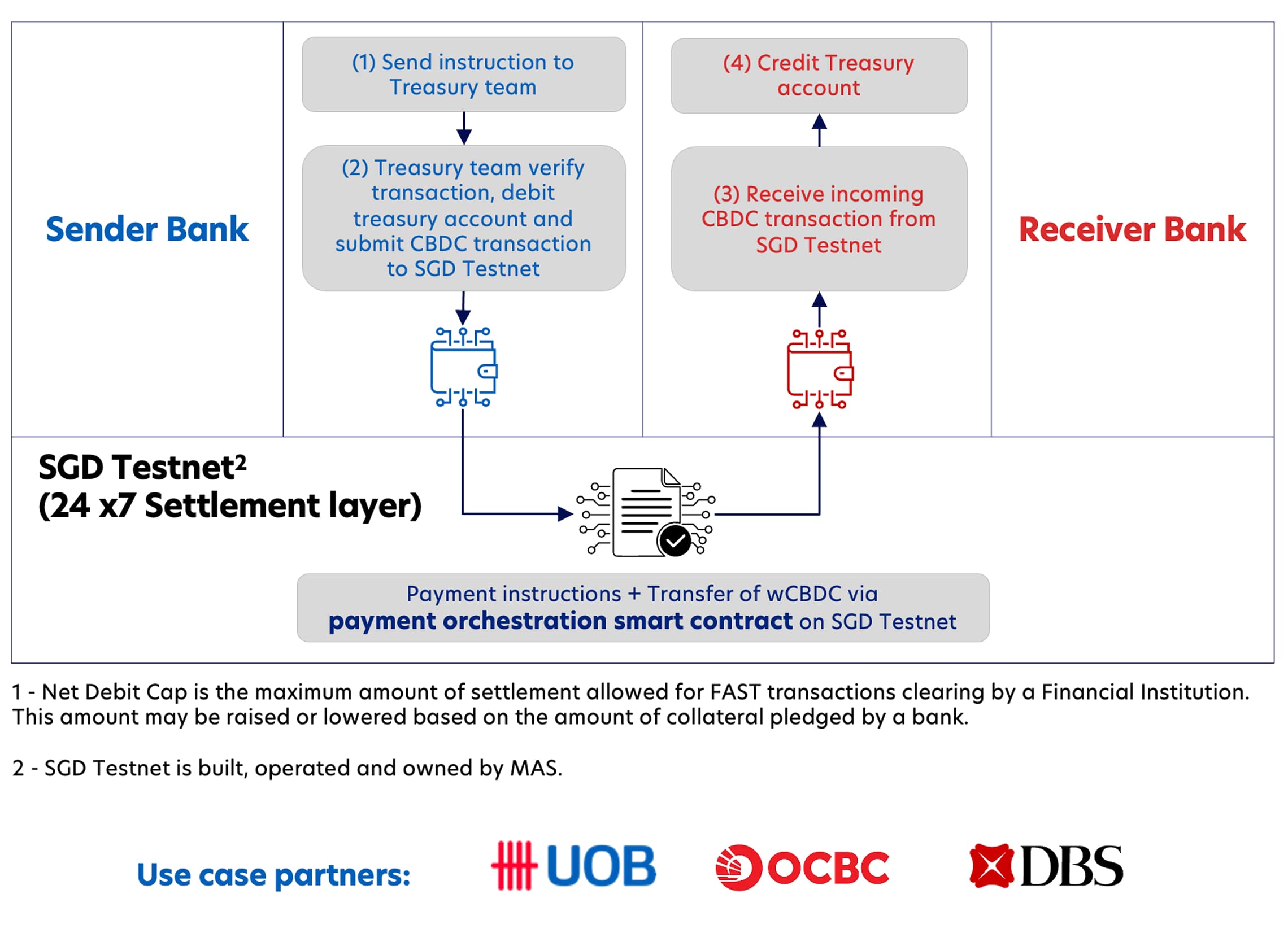

Solution Concept

FAST participants (UOB, OCBC, DBS) on the SGD Testnet successfully executed live interbank payment using wCBDC, as part of a high-level capacity-building initiative. This effort lays the groundwork for use case such as NDC top-up trials and enhances institutional readiness for broader applications.

#Net Debit Cap is the maximum amount of settlement allowed for FAST transactions clearing by a Financial Institute. This amount may be raised or lowered based on the amount collateralised by a bank.

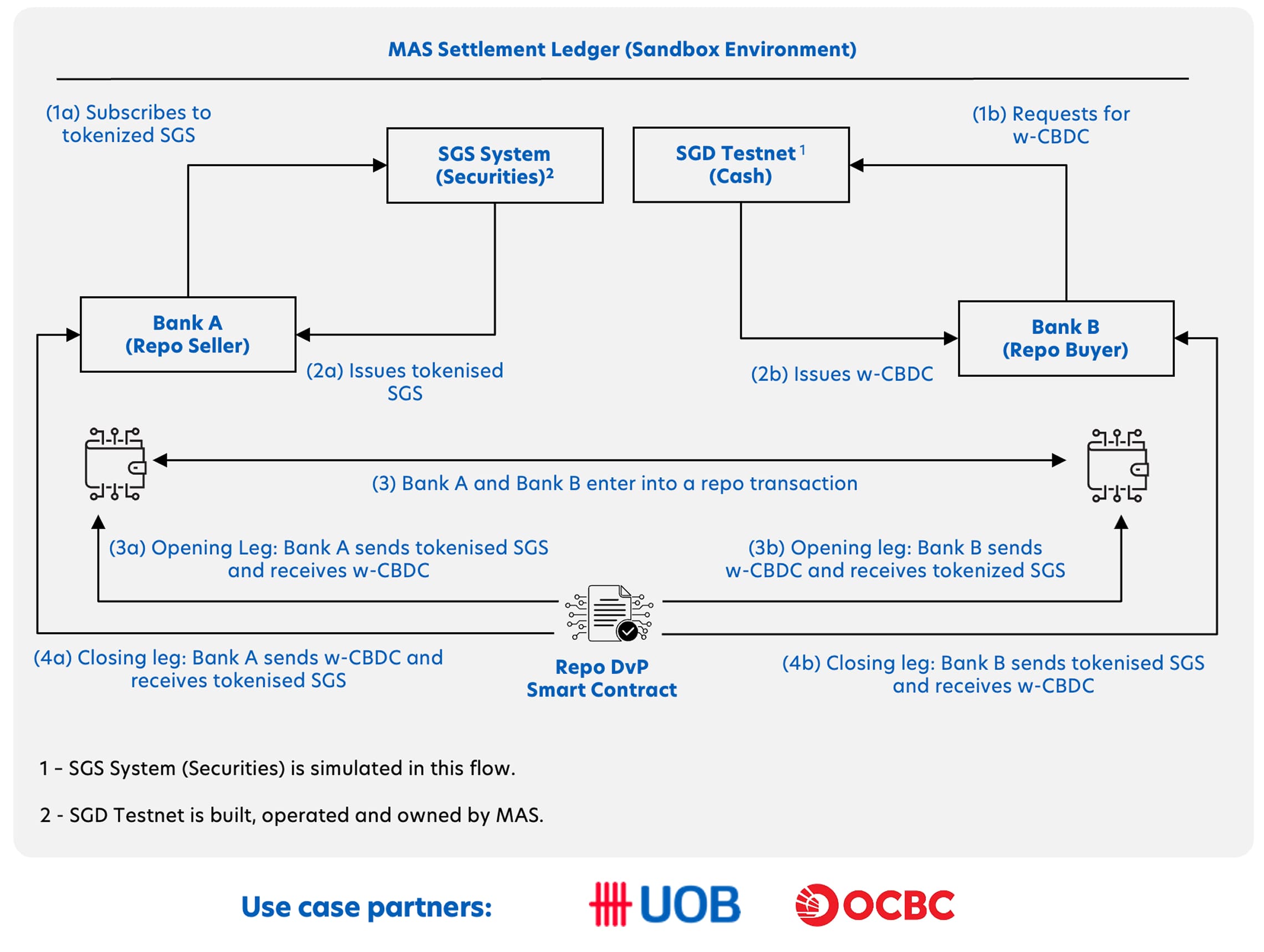

Unlocking liquidity via Singapore Government Securities repurchase settlement with Wholesale CBDC

Solution Concept

This joint project between UOB and OCBC demonstrates how tokenisation enables direct, simultaneous exchange of assets and money—supporting intraday repos, collateral management, and liquidity optimisation—powered by the MAS SGD Testnet Settlement Ledger, which supports both tokenised securities and wCBDC.

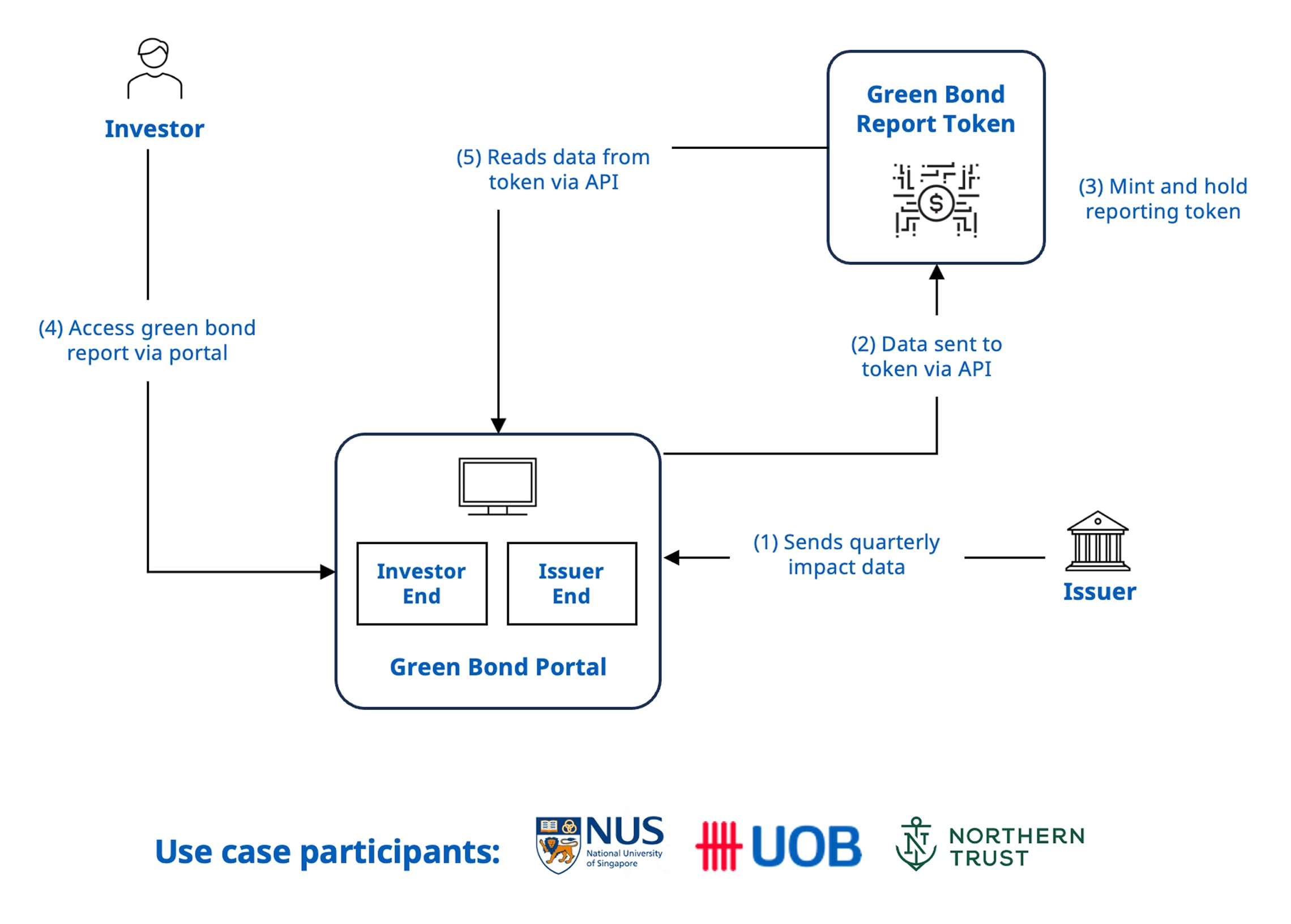

Providing credible and timely ESG report data via Green Bond Reporting tokenisation

1 - ESG - Environmental, Social, and Governance

Solution Concept

Leveraging on the blockchain technology, green reporting data is minted into reporting tokens, which investors will have access to monitor the environmental impact (i.e., Energy Savings) derived from NUS’ campus refurbishment projects.