Investors

UOB’s focus on building a sustainable business with steady returns is aligned with the long-term interests of our investors. Active engagement with our investors plays a key role in ensuring we understand their concerns and address them in a timely and effective manner. Hence, we provide our investors with relevant information on the Group’s corporate strategy, operational performance and business outlook to help them make well-informed investment decisions.

2016 Highlights

Maiden Covered Bond Issuance

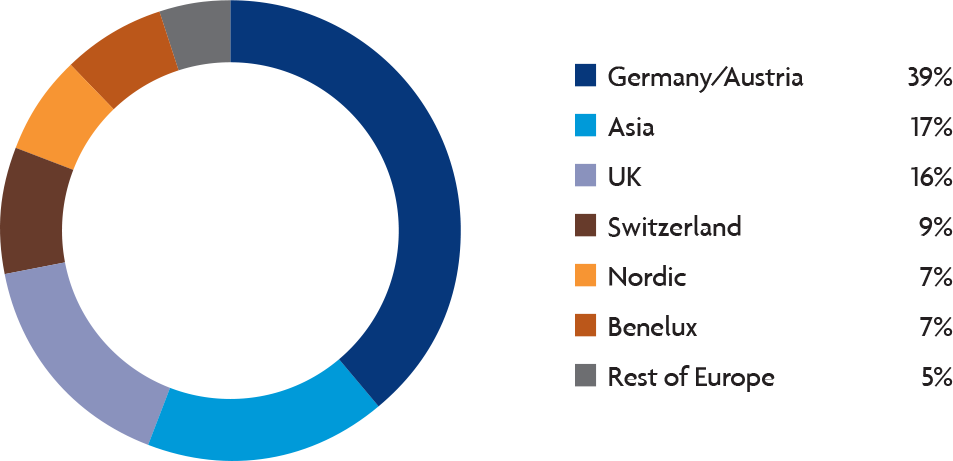

In March 2016, we launched our inaugural €500 million five-year covered bond offering1. With this, UOB became the first Asian issuer to access the euro covered bond market and the first to list euro-denominated covered bond on the Singapore Exchange. The covered bond issue broadened our list of issuances, beyond our traditional capital and unsecured debt. The strong participation from European investors also enabled us to expand and to diversify our investor base, in terms of investor type, names and geographical distribution.

The offering was 2.6 times subscribed, with a highly granular order book of 76 accounts including both repeat and new investors. The strong support was the result of proactive investor education and engagement in the two years leading up to this debut issuance. The covered bond issue was also named the “Best Securitisation” deal for Singapore by The Asset Triple A Country Awards 2016 and the 2016 Singapore Capital Markets Deal of the Year by IFR Asia.

1. This was an issuance under UOB’s US$8 billion Global Covered Bond Programme, which was launched in November 2015.

Distribution of Investors by Geography

“The first euro covered transaction from an Asian lender ex-Australasia will also serve as a template for subsequent deals.”

“UOB prices debut euro covered in line with markets.”

IFR Asia, 2 March 2016

“And as usual it is difficult to highlight one particular deal which stands out from the crowd, although it would be hard to look beyond the pioneering debut covered bond from United Overseas Bank...”

“UOB leads by example.”

Informa Global Markets, 2 March 2016

Upgrade of UOB’s Standalone Rating by S&P Global Ratings

In June 2016, S&P Global Ratings upgraded our standalone credit profile to ‘a’, while affirming the ‘AA-’ long-term issuer credit ratings with Stable Outlook. This rating action reflects S&P’s recognition of the Bank’s steady profitability across economic cycles, underpinned by our core commercial banking business model that focuses on generating recurring lending revenue through prudent strategies and conservative management style.

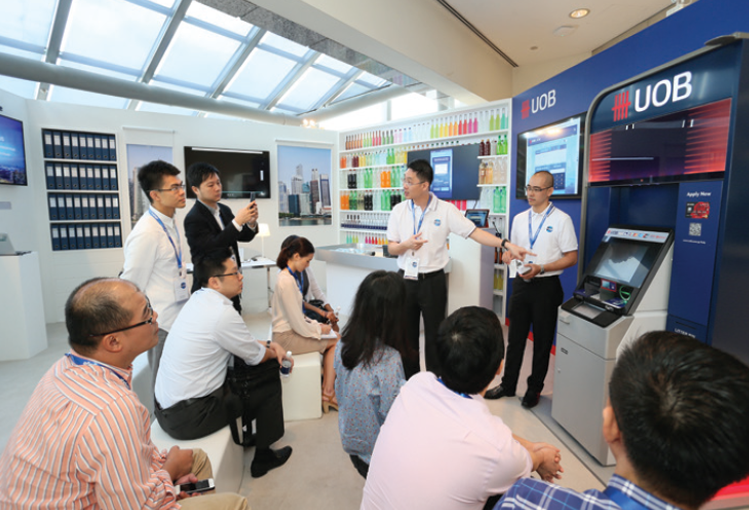

Corporate Day 2016 – UOB Engage: Improving Customers’ Lives in a Digital World

Since 2011, UOB has been organising annual Corporate Days for the investment community, during which our Senior Management shares the Group’s strategies across business lines and geographies. In 2016, the three-day event in Singapore saw the highest number of attendees for the annual series. It drew more than 700 customers, banking analysts and investors, and was also attended by our directors and employees. All materials presented during the Corporate Day were published on SGXNet and the UOB website in a timely manner.

During the Corporate Day event, Senior Management updated attendees on the Group’s strategy and approach to banking in the digital world. This was followed by a demonstration of our progress through four experiential zones, namely Connectivity, Innovation, Analytics and Ecosystem. There was a visit to BASH, a facility that houses more than 500 startups, and where UOB’s joint venture, The FinLab, mentors startups under its acceleration programme. We also hosted a panel discussion during which industry practitioners, including experts from the Monetary Authority of Singapore and UOB’s Senior Management, shared their insights into the FinTech startup landscape in Asia.

“This Corporate Day is very good and educational in terms of teaching us about what UOB does. The perception has been that UOB has been late in the game in technology, but what this event has shown is that UOB has done a lot at the back-end and is driving ahead for the future. This event is important in showcasing the Bank’s digital strategy for the next couple of years and how it will stay relevant in the business of banking. It is very refreshing. I do not think many analysts had expected that UOB would bring out so many new initiatives.”

Melissa Kuang,

Analyst, Goldman Sachs

“Banking in the digital world was the focus of UOB’s annual corporate access event. UOB is not standing still; the bank is positioning its IT infrastructure for the future and Management believes investment and experimentation in digital are necessary to be relevant.”

Asheefa Sarangi,

Analyst, CLSA

Attendees learnt more about our initiatives in the digital world at four experiential zones at UOB’s Corporate Day 2016.

Connectivity Zone: How UOB brings convenience to individual and business customers.

Innovation Zone: How UOB promotes a bank-wide culture of innovation, ideas and improvements.

Analytics Zone: How UOB uses analytics to gain insights into customers’ needs and preferences.

Ecosystem Zone: How UOB builds an ecosystem of strategic partners to connect the dots for our customers through the value chain.

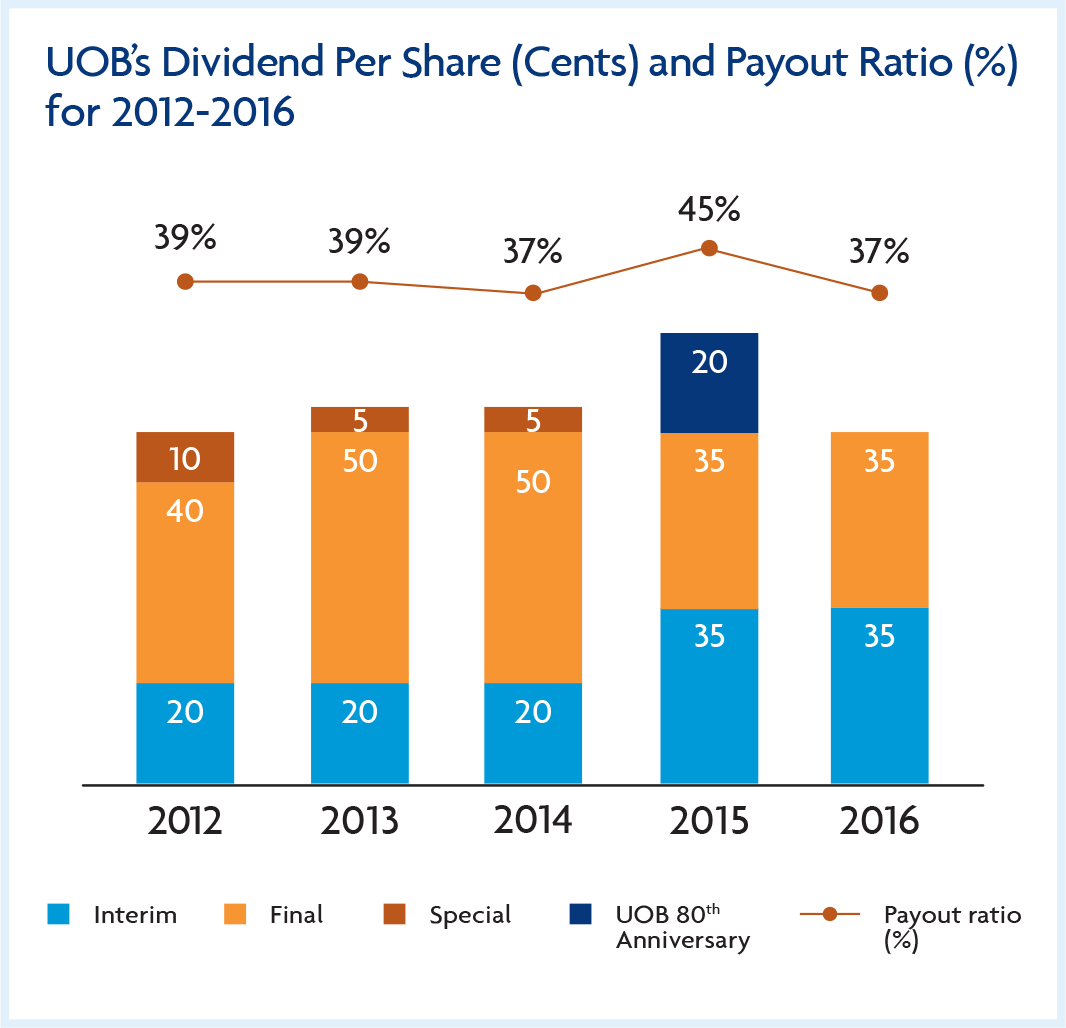

Delivering Long-Term and Sustainable Returns

Under the stewardship of a stable and experienced leadership team, UOB has developed into one of the leading banks of Asia. We focus on the fundamentals of banking and keep our balance sheet strong. Our approach is to stay customer-centric as we enhance our capabilities to remain relevant to the needs of our customers in this ever-changing world.

We are mindful of our investors’ interests. Being an established commercial bank anchored in Asia, we strive to provide steady long-term returns, sustained by our disciplined growth strategy and prudent balance sheet management.

Since our public listing in 1970 and through all business cycles, we have consistently paid dividends to our shareholders. Dividends are usually payable on a half-yearly basis. In 2016, despite slower economic growth and a softer credit cycle, we were able to maintain the total core dividend for the year at $0.70 per share. The scrip dividend scheme was applied to both the interim and final dividends, giving our shareholders the option to receive the dividend in cash and/or new UOB shares. Backed by our steady financial performance, we achieved a total annualised shareholder return of 9.7 per cent from 2012 to 2016, compared with Singapore’s stock market average of 5.0 per cent2.

2. Sources: UOB, Bloomberg

Selected Investment Metrics on UOB |

2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|

| Share price ($) | |||||

| Highest | 20.23 | 22.10 | 24.72 | 25.05 | 21.35 |

| Lowest | 15.15 | 18.63 | 19.40 | 18.10 | 16.80 |

| Average | 18.52 | 20.51 | 22.27 | 21.85 | 18.61 |

| Last Done | 19.81 | 21.24 | 24.53 | 19.65 | 20.40 |

| Price-to-earnings ratio (x)a | 10.77 | 11.15 | 11.25 | 11.26 | 10.01 |

| Price-to-book ratio (x)a | 1.27 | 1.34 | 1.30 | 1.22 | 0.99 |

| Net dividend yield (%)a | 3.78 | 3.66 | 3.37 | 4.12 | 3.76 |

| Return on average ordinary shareholders’ equity (%) | 12.4 | 12.3 | 12.3 | 11.0 | 10.2 |

| Total annualised shareholder return from 2012 to 2016 (%) | 9.7 |

a The daily-average share prices are used in computing these three ratios.

We have relied consistently on our internal capital generation ability to support our expansion plans; our last major equity capital raising exercise was in 2001 during the merger with Overseas Union Bank. In 2016, we did not buy back any shares (which are normally held in treasury) although we used 1.0 million treasury shares3 to meet our obligations under our employee long-term incentive plans.

UOB’s credit ratings constitute an important component of our risk and capital management strategies. To help rating agencies better understand our business and strategies, we maintain regular dialogues with them, updating them on the Bank’s financial performance and balance sheet standing. We are among the few highly-rated banks globally, with strong investment-grade credit ratings of ‘Aa1’ by Moody’s Investors Services and ‘AA-’ by both S&P Global Ratings and Fitch Ratings.

3. Treasury shares are ordinary shares repurchased by the Bank and are shown as a deduction against share capital. These may be sold, cancelled, distributed as bonus shares, or used to meet the obligations under employee long-term incentive plans.

“The Aa1 credit ratings are one of the highest in the world and are underpinned by UOB’s traditional and well- established banking presence in Singapore, Malaysia and other markets, and strong credit fundamentals. The bank’s capital position is good by global standards, with a large capacity to absorb unforeseen losses. The bank also has a deposit-funded asset base and a liquid balance sheet.”

Moody’s report dated 20 December 2016

“Our ratings on UOB reflect the bank’s well-established market position, particularly in the SME segments, strong funding profile, and prudent management track record.”

S&P’s report dated 12 July 2016

In 2016, UOB successfully issued the €500 million five-year covered bonds and US$700 million Tier 2 subordinated notes in March, S$750 million Additional Tier 1 perpetual capital securities in May, and the US$600 million Tier 2 subordinated notes in September. All four issuances were well-received by investors, due largely to the strong confidence they have in the Bank’s credit standing.

Regular and Transparent Communications with Investors

Our engagement with the investment community, including our shareholders, investors, shareholder proxy voting agencies, equity and fixed-income analysts and credit rating agencies, is governed by our investor relations policy. We are committed to maintaining regular and transparent communications with them and we also ensure that disclosure of information is conducted on a clear, fair and timely basis.

UOB is covered by the research teams from more than 20 brokerage firms globally. Through constant dialogue with our investment community, our Senior Management keeps investors abreast of UOB’s financials, milestones and other material developments. This is especially important during times of economic uncertainty and market volatility. For example, we proactively addressed the concerns that the investment community had about the commodities sector and geographies such as China and Europe by making additional disclosures on the asset quality of our portfolios.

In 2016, we conducted more than 400 meetings with analysts and investors and shared with them UOB’s corporate strategy, operational performance and business outlook through the following events:

- Quarterly results briefings, fronted by our Senior Management, with conference call facilities arranged for overseas analysts and investors. Analysts and investors in Singapore were also invited to post-results luncheons every quarter;

- Investor meetings, conferences and roadshows held in Europe, the US, Hong Kong, Taiwan, Malaysia, Australia, Korea, Japan and Singapore;

- UOB’s Corporate Day in Singapore;

- Meetings with credit rating agencies; and

- Annual general meeting (AGM).

General information on UOB, including annual reports, quarterly results, recorded webcasts of results briefings, news releases and presentation slides, including the CEO’s AGM presentation slides, as well as our investor relations calendar of events are available on our corporate website www.UOBGroup.com. All financial results, news releases, dividends recommended or declared for payment, and other ad-hoc announcements are also available on the SGX website.

The UOB website also contains contact details of our Investor Relations Officer, so that investors may contact the team directly to clarify any queries or to provide feedback.

In recognition of our investor relations efforts, we were named runner-up for the Most Transparent Company Award, Financial Category at the Securities Investors Association (Singapore) Investors’ Choice Awards 2016.

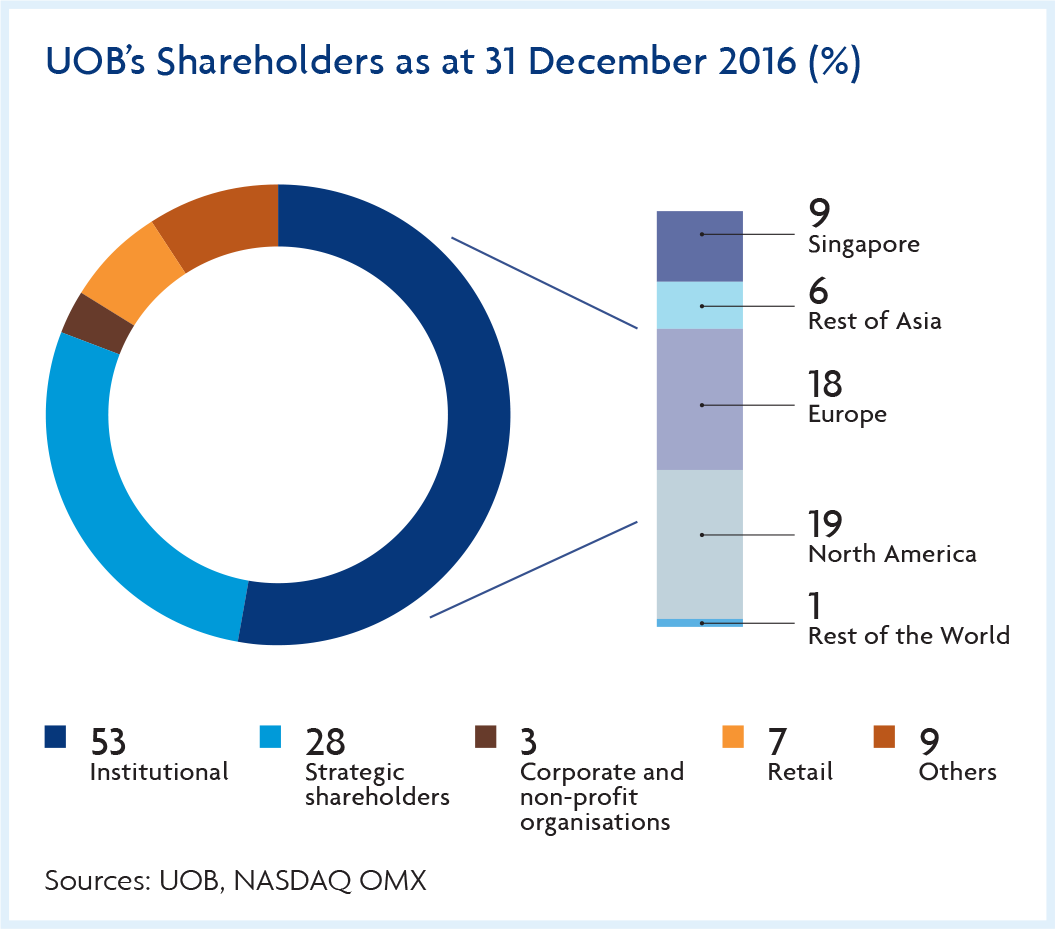

Our Diversified Shareholder Base

Our shareholder base is well-diversified, spanning institutions, strategic shareholders, retail investors and other corporate and non-profit organisations. Institutional investors constitute the largest shareholder group, holding more than half of UOB’s shares, followed by strategic shareholders among whom are members of the Wee family, including UOB’s Chairman Emeritus, Dr Wee Cho Yaw, and Deputy Chairman and CEO, Mr Wee Ee Cheong. Aimed at creating long-term value across the UOB franchise, the strategic shareholders’ steadfast focus on balancing quality growth with stability is aligned with the long-term interests of other shareholders and investors seeking stable returns from a sustainable investment.

Investor Relations Contact Information

If you have any enquiries or would like to find out more about UOB, please contact:

Mr Stephen Lin / Mr Alfred Chan

Investor Relations 80 Raffles Place #05-00 UOB Plaza 2 Singapore 048624 Tel: (65) 6539 2523 / 6539 3933 Fax: (65) 6538 0270 Email: InvestorRelations@UOBgroup.com

Share RegistrarBoardroom Corporate & Advisory Services Pte. Ltd.50 Raffles Place

#32-01 Singapore Land Tower Singapore 048623 Tel: +65 6536 5355 Fax: +65 6438 8710 Website: www.boardroomlimited.com